Valued at a market cap of $15.8 billion, Mid-America Apartment Communities, Inc. (MAA) is a real estate investment trust (REIT) that owns, acquires, develops, manages and redevelops multifamily apartment communities. Headquartered in Germantown, Tennessee, the company focuses on high-growth metropolitan areas in the Southeast, Southwest, and Mid-Atlantic, targeting middle- to upper-income renters.

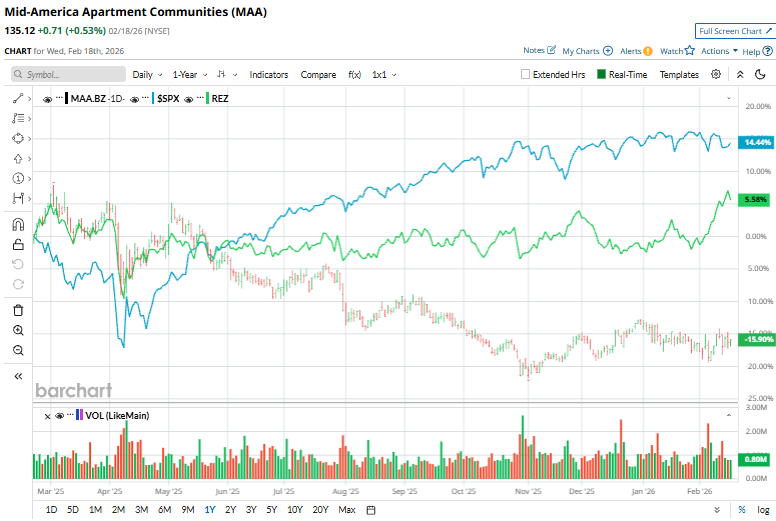

This residential REIT has considerably underperformed the broader market over the past 52 weeks. Shares of MAA have declined 14.2% over this time frame, while the broader S&P 500 Index ($SPX) has gained 12.3%. Moreover, on a YTD basis, the stock is down 2.7%, compared to SPX’s marginal uptick.

Narrowing the focus, MAA has also lagged behind the iShares Residential and Multisector Real Estate ETF’s (REZ) 5.4% rise over the past 52 weeks and 7.6% YTD rally.

On Feb. 4, MAA reported fourth-quarter earnings, with core FFO of $2.23 per share slightly beating estimates and flat year over year, while revenue of $555.6 million narrowly missed expectations. As of Dec. 31, 2025, resident turnover remained historically low at 40.2%, with just 11.1% of move-outs tied to single-family home purchases for the year, highlighting stable resident retention despite a soft leasing environment. Its shares rose 2.2% following the announcement.

For the current fiscal year, ending in December, analysts expect MAA’s FFO to decline 1.1% year over year to $8.64. The company’s FFO surprise history is mixed. It exceeded the consensus estimates in three of the last four quarters, while missing on another occasions.

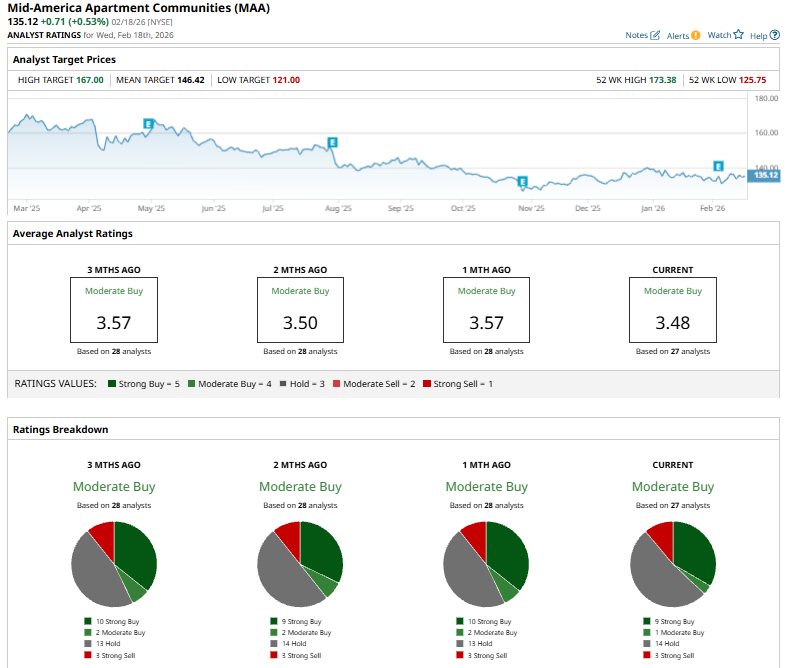

Among the 27 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on nine “Strong Buy,” one "Moderate Buy,” 14 "Hold,” and three “Strong Sell” ratings.

This configuration is slightly bearish than a month ago, with ten analysts suggesting a “Strong Buy” rating.

On Feb. 13, Citigroup lowered its price target on Mid-America Apartment Communities to $148 from $155 while maintaining a “Neutral” rating.

The mean price target of $146.42 represents an 8.4% premium from MAA’s current price levels, while the Street-high price target of $167 suggests a 23.6% potential upside from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart