Over the past six months, RE/MAX’s stock price fell to $7.60. Shareholders have lost 10.9% of their capital, which is disappointing considering the S&P 500 has climbed by 13.3%. This may have investors wondering how to approach the situation.

Is there a buying opportunity in RE/MAX, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Do We Think RE/MAX Will Underperform?

Despite the more favorable entry price, we're cautious about RE/MAX. Here are three reasons why RMAX doesn't excite us and a stock we'd rather own.

1. Inability to Grow Agents Points to Weak Demand

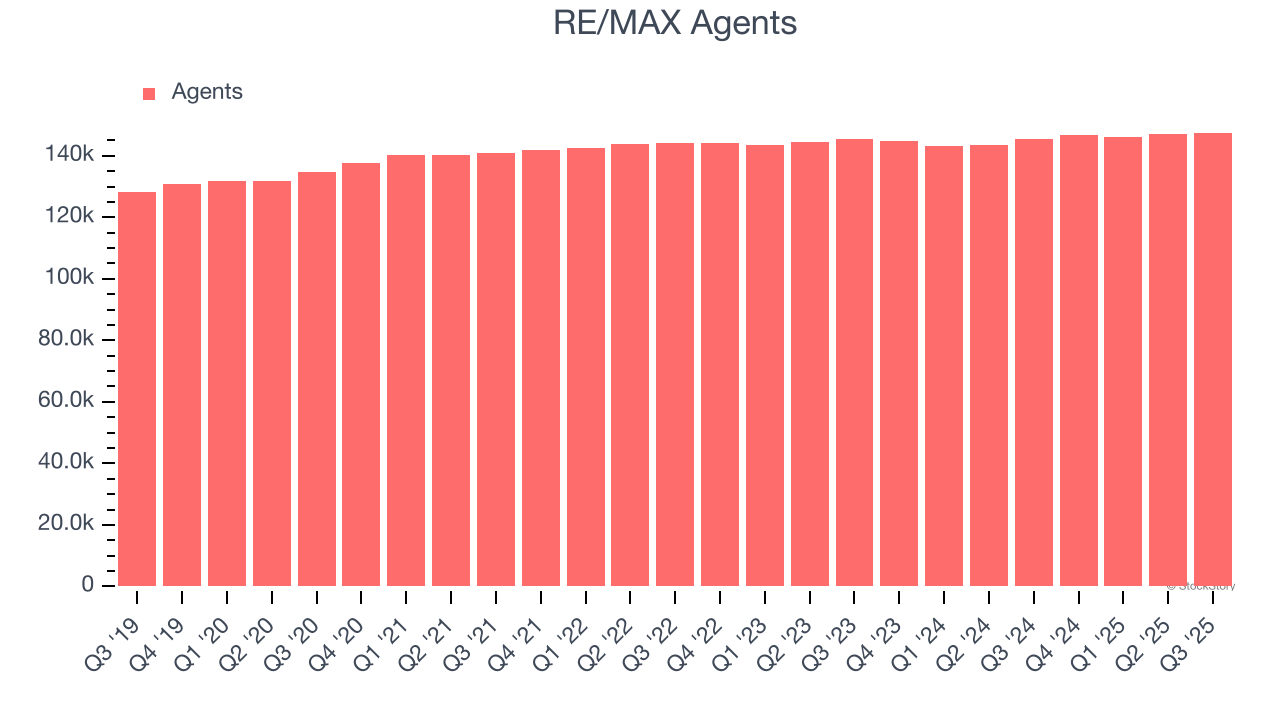

Revenue growth can be broken down into changes in price and volume (for companies like RE/MAX, our preferred volume metric is agents). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Over the last two years, RE/MAX failed to grow its agents, which came in at 147,547 in the latest quarter. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests RE/MAX might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. EPS Trending Down

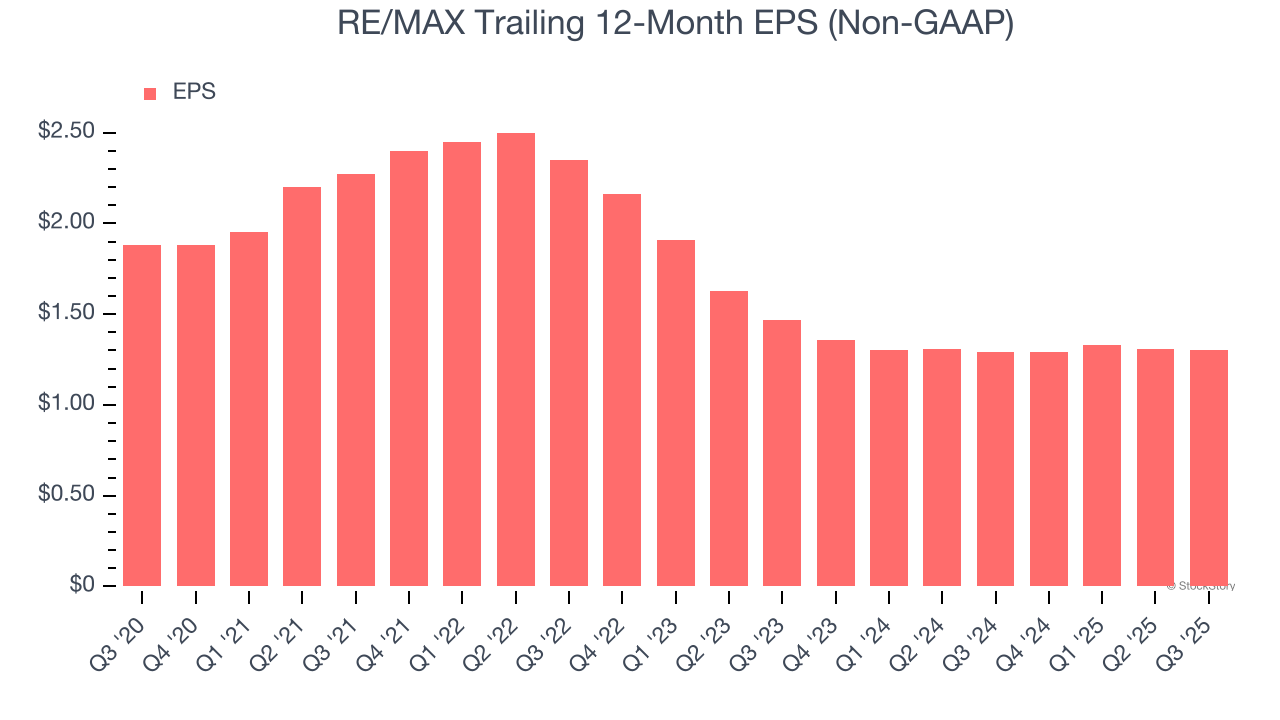

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for RE/MAX, its EPS declined by 7.1% annually over the last five years while its revenue grew by 2.3%. This tells us the company became less profitable on a per-share basis as it expanded.

3. Cash Flow Margin Set to Decline

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Over the next year, analysts predict RE/MAX’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 11.7% for the last 12 months will decrease to 4.2%.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of RE/MAX, we’ll be cheering from the sidelines. After the recent drawdown, the stock trades at 5.9× forward P/E (or $7.60 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now. We’d suggest looking at the most entrenched endpoint security platform on the market.

High-Quality Stocks for All Market Conditions

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.