Senior living provider Brookdale Senior Living (NYSE: BKD) missed Wall Street’s revenue expectations in Q4 CY2025, with sales falling 3.4% year on year to $754.1 million. Its GAAP loss of $0.17 per share was in line with analysts’ consensus estimates.

Is now the time to buy Brookdale? Find out by accessing our full research report, it’s free.

Brookdale (BKD) Q4 CY2025 Highlights:

- Revenue: $754.1 million vs analyst estimates of $767 million (3.4% year-on-year decline, 1.7% miss)

- EPS (GAAP): -$0.17 vs analyst estimates of -$0.17 (in line)

- Adjusted EBITDA: $105.6 million vs analyst estimates of $105.5 million (14% margin, in line)

- EBITDA guidance for the upcoming financial year 2026 is $509 million at the midpoint, in line with analyst expectations

- Operating Margin: 3%, up from 0.5% in the same quarter last year

- Free Cash Flow was -$7.78 million compared to -$5.11 million in the same quarter last year

- Market Capitalization: $3.95 billion

"Brookdale's fourth quarter results continued the positive momentum displayed throughout 2025, as we position Brookdale to capitalize on increasing industry demand in a suppressed supply growth environment," said Nick Stengle, Brookdale's Chief Executive Officer.

Company Overview

With a network of over 650 communities serving approximately 59,000 residents across 41 states, Brookdale Senior Living (NYSE: BKD) operates senior living communities across the United States, offering independent living, assisted living, memory care, and continuing care retirement communities.

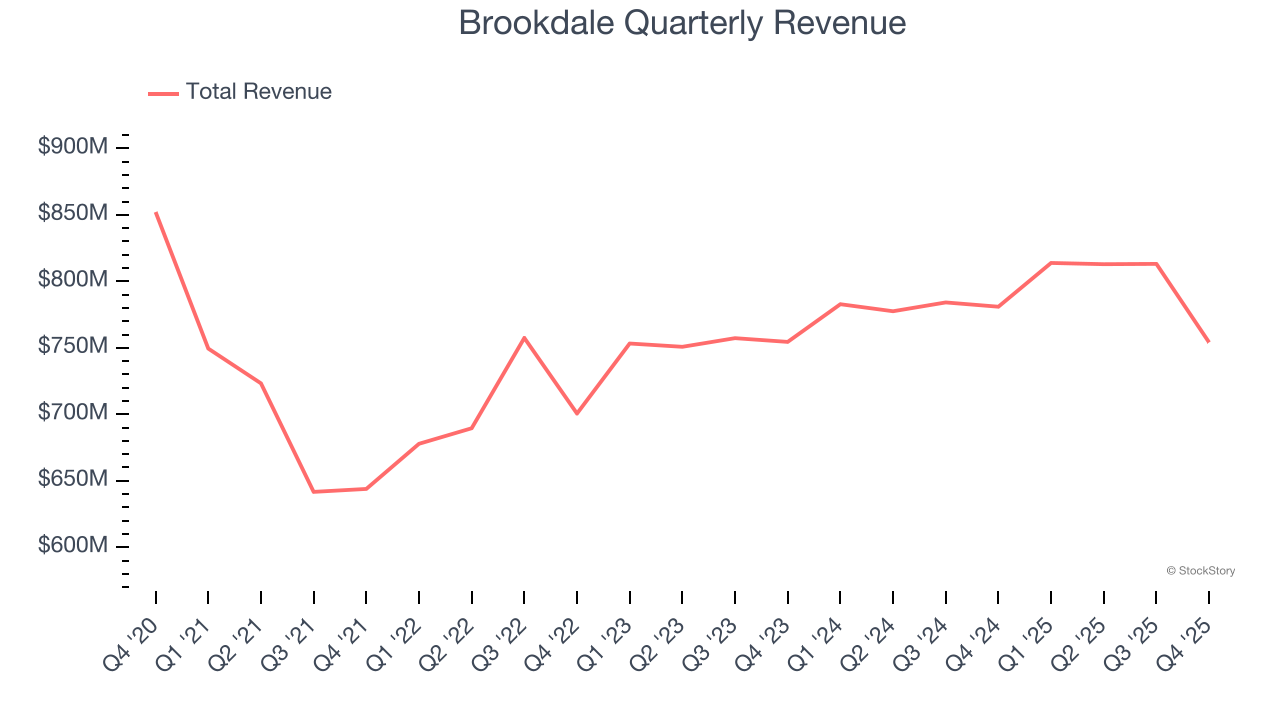

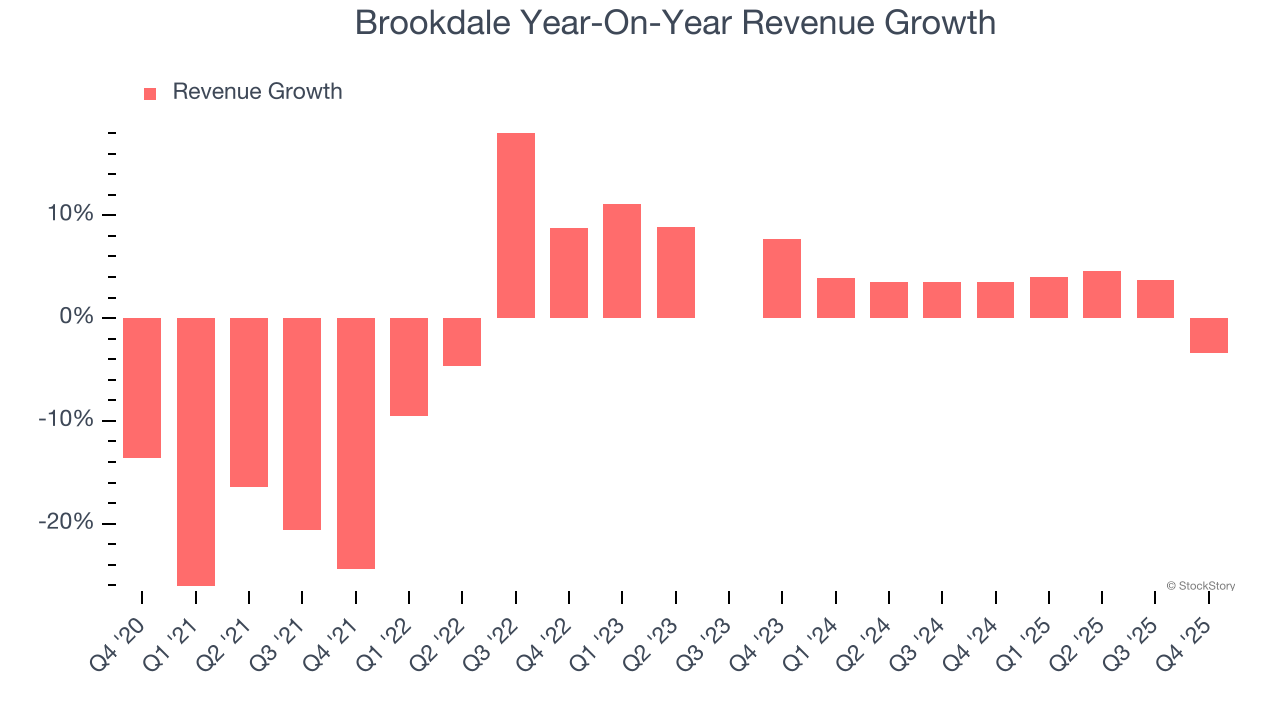

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Brookdale struggled to consistently generate demand over the last five years as its sales dropped at a 2% annual rate. This was below our standards and is a sign of lacking business quality.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Brookdale’s annualized revenue growth of 2.9% over the last two years is above its five-year trend, which is encouraging.

This quarter, Brookdale missed Wall Street’s estimates and reported a rather uninspiring 3.4% year-on-year revenue decline, generating $754.1 million of revenue.

Looking ahead, sell-side analysts expect revenue to decline by 4.1% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will see some demand headwinds.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

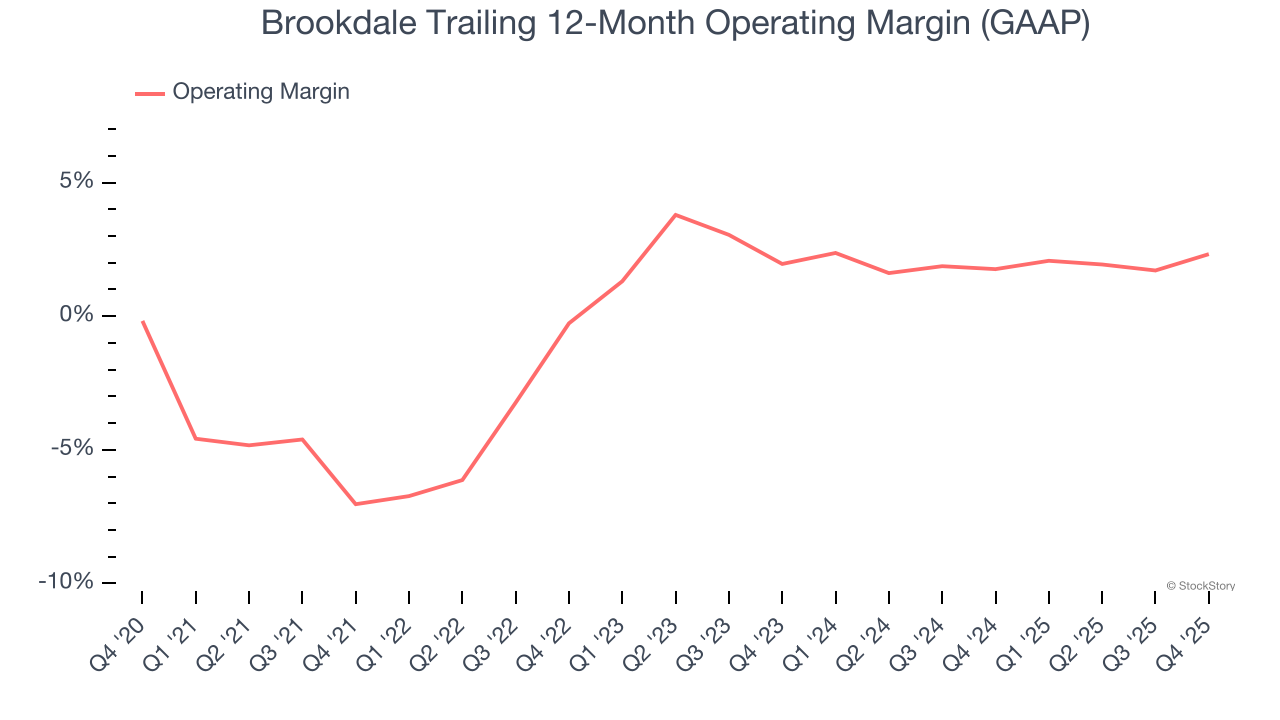

Operating Margin

Brookdale was roughly breakeven when averaging the last five years of quarterly operating profits, lousy for a healthcare business.

On the plus side, Brookdale’s operating margin rose by 9.4 percentage points over the last five years.

In Q4, Brookdale generated an operating margin profit margin of 3%, up 2.5 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

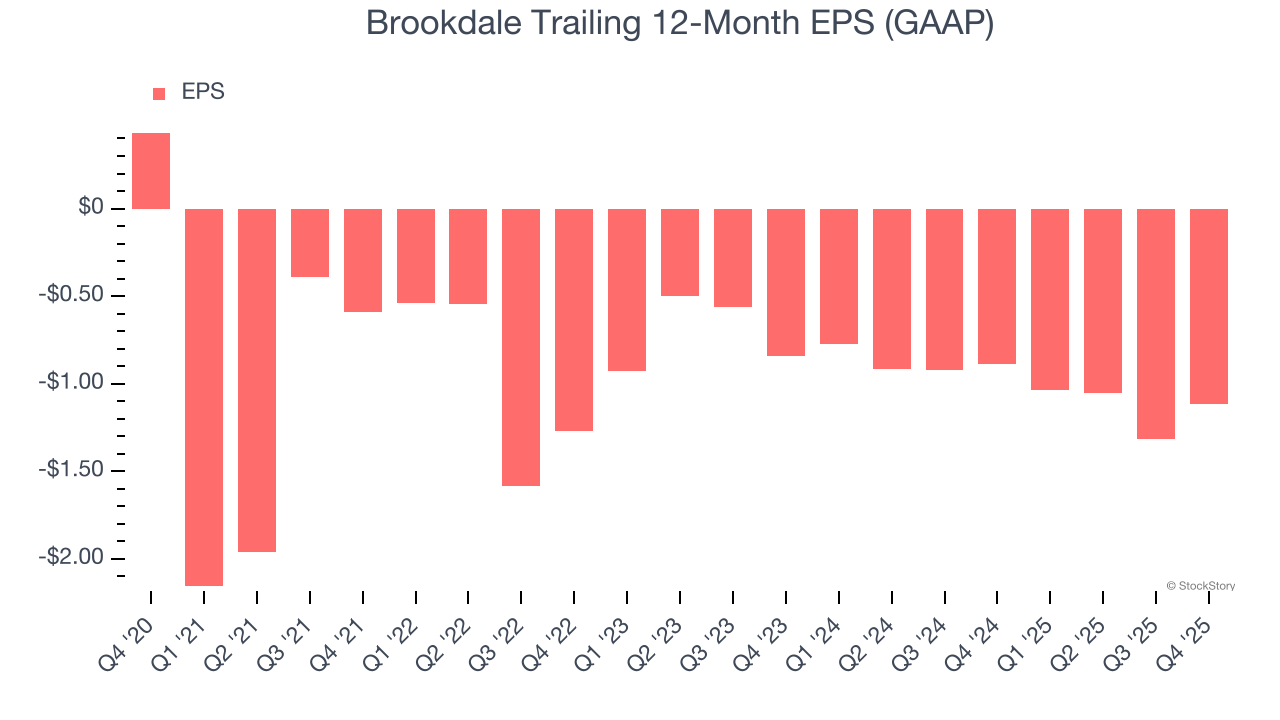

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Brookdale, its EPS declined by 35.6% annually over the last five years, more than its revenue. However, its operating margin actually improved during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

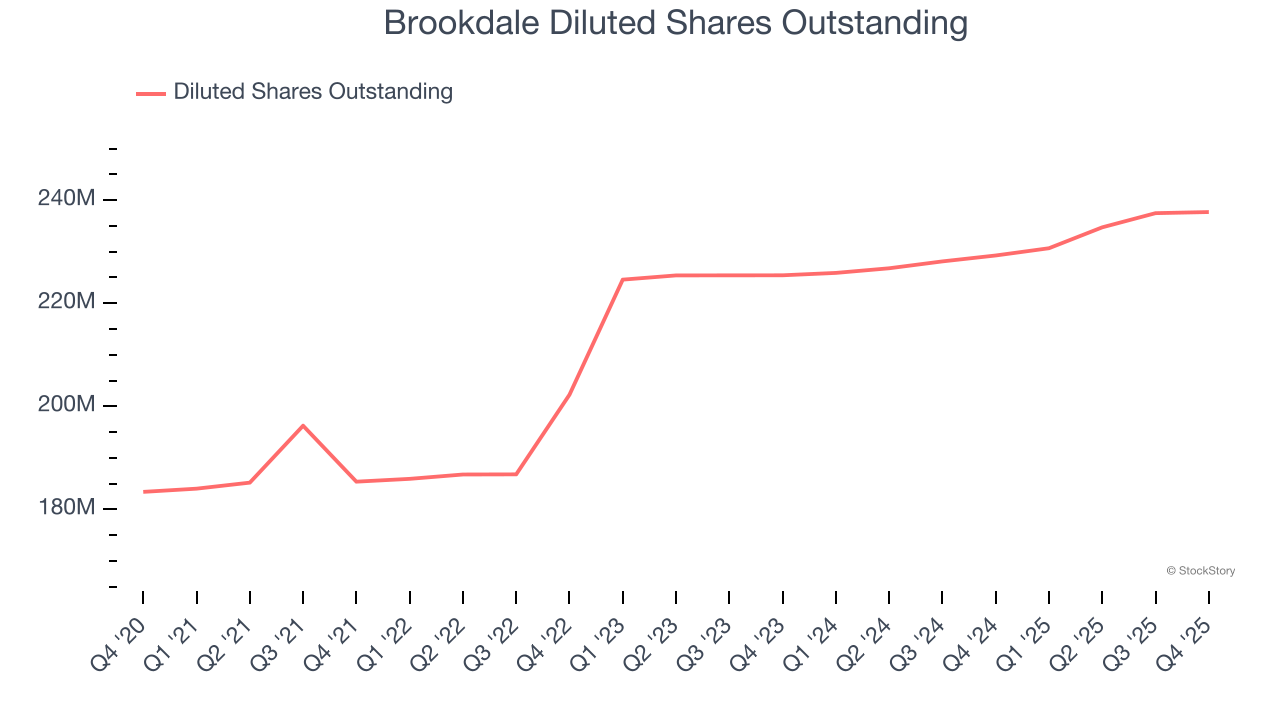

Diving into the nuances of Brookdale’s earnings can give us a better understanding of its performance. A five-year view shows Brookdale has diluted its shareholders, growing its share count by 29.6%. This dilution overshadowed its increased operational efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Brookdale reported EPS of negative $0.17, up from negative $0.37 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Brookdale to improve its earnings losses. Analysts forecast its full-year EPS of negative $1.12 will advance to negative $0.37.

Key Takeaways from Brookdale’s Q4 Results

We struggled to find many positives in these results. Overall, this was a softer quarter. The stock traded down 3.4% to $15.99 immediately after reporting.

Brookdale didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).