Retirement solutions provider Jackson Financial (NYSE: JXN) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 711% year on year to $1.99 billion. Its non-GAAP profit of $6.61 per share was 12.8% above analysts’ consensus estimates.

Is now the time to buy Jackson Financial? Find out by accessing our full research report, it’s free.

Jackson Financial (JXN) Q4 CY2025 Highlights:

- Net Premiums Earned: $2.03 billion (2.6% year-on-year decline)

- Revenue: $1.99 billion vs analyst estimates of $1.92 billion (711% year-on-year growth, 3.5% beat)

- Pre-tax Profit: -$358 million (-18% margin)

- Adjusted EPS: $6.61 vs analyst estimates of $5.86 (12.8% beat)

- Market Capitalization: $8.42 billion

Company Overview

Spun off from British insurer Prudential plc in 2021 after more than 60 years as its U.S. subsidiary, Jackson Financial (NYSE: JXN) offers annuity products and retirement solutions that help Americans grow and protect their retirement savings and income.

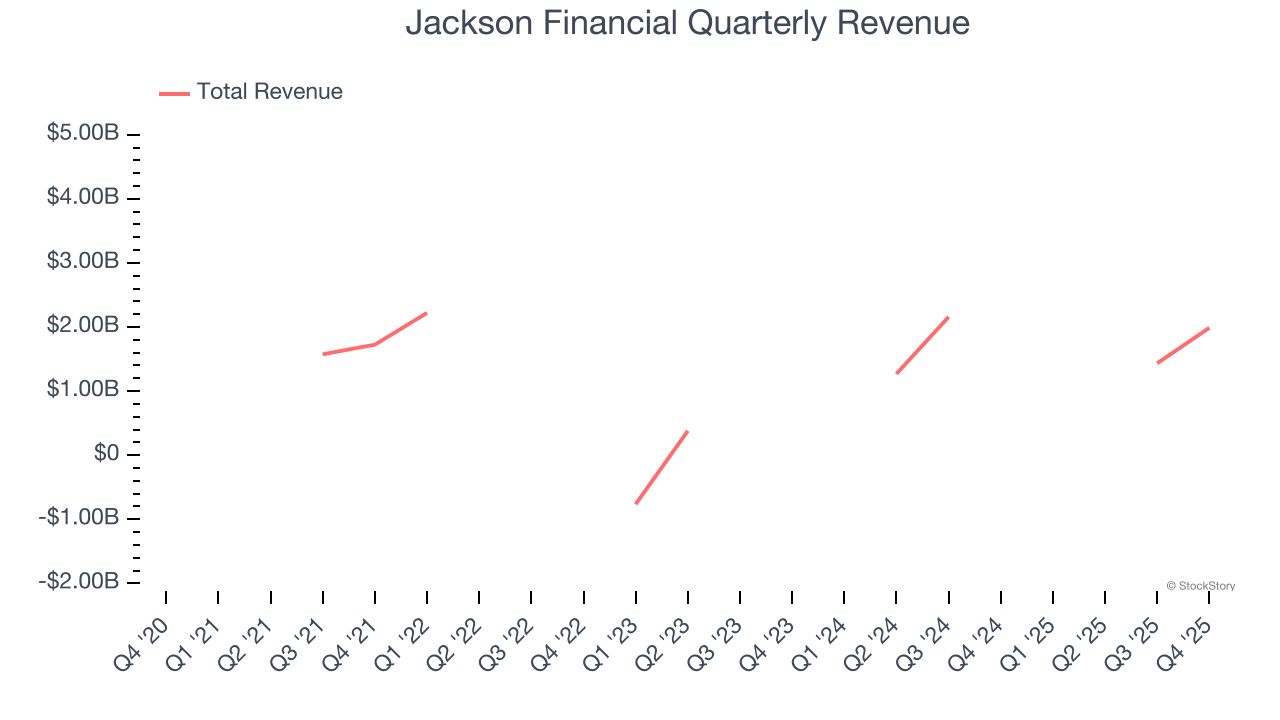

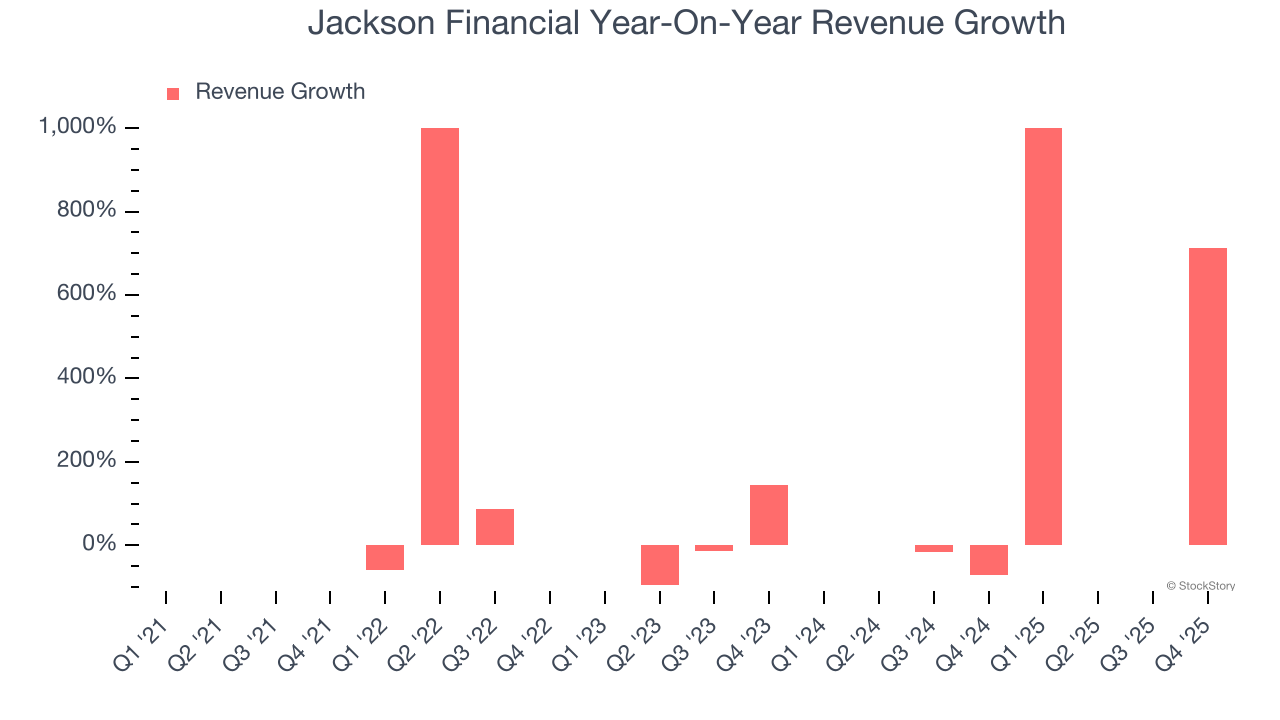

Revenue Growth

In general, insurance companies earn revenue from three primary sources. The first is the core insurance business itself, often called underwriting and represented in the income statement as premiums earned. The second source is investment income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities. The third is fees from various sources such as policy administration, annuities, or other value-added services. Over the last five years, Jackson Financial grew its revenue at an incredible 30.9% compounded annual growth rate. Its growth beat the average insurance company and shows its offerings resonate with customers.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Jackson Financial’s annualized revenue growth of 11% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Jackson Financial reported magnificent year-on-year revenue growth of 711%, and its $1.99 billion of revenue beat Wall Street’s estimates by 3.5%.

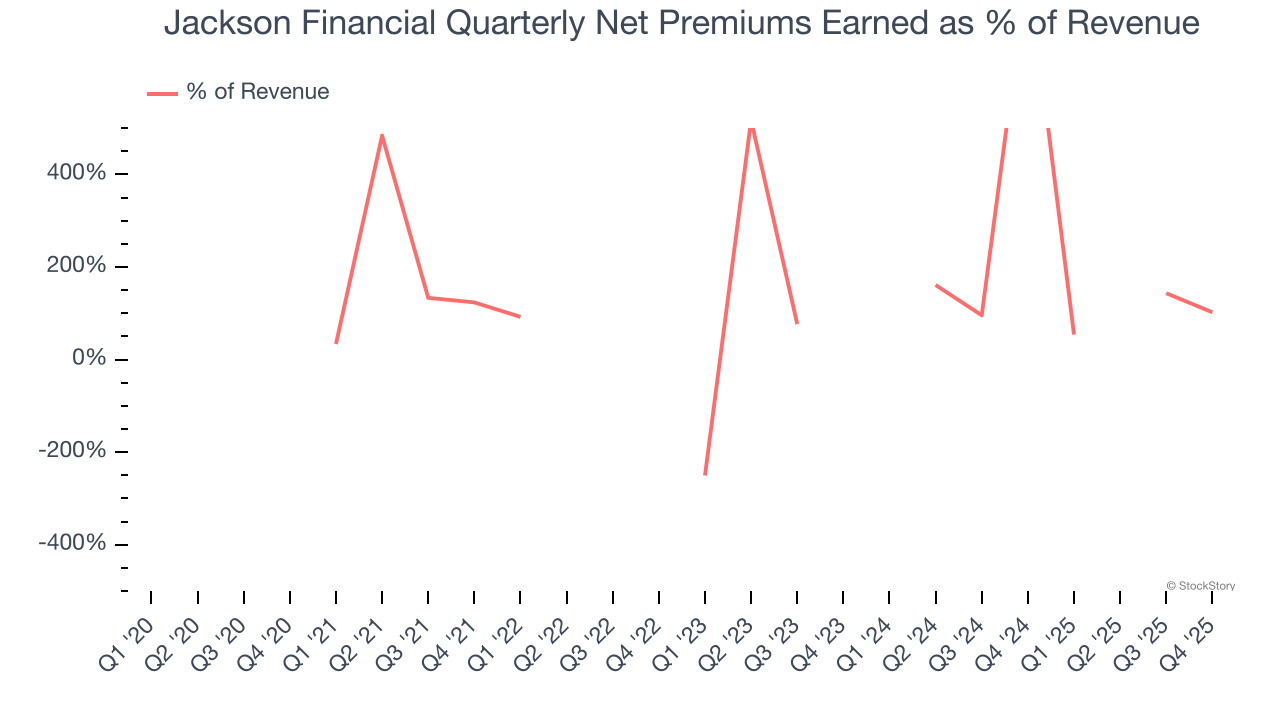

Since the company recorded losses on certain securities, it generated more net premiums earned than revenue (a 1.2x multiple of its revenue to be exact) during the last five years, meaning Jackson Financial lives and dies by its underwriting activities because non-insurance operations barely move the needle.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.Markets consistently prioritize net premiums earned growth over investment and fee income, recognizing its superior quality as a core indicator of the company’s underwriting success and market penetration.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Net Premiums Earned

Insurers sell policies then use reinsurance (insurance for insurance companies) to protect themselves from large losses. Net premiums earned are therefore what's collected from selling policies less what’s paid to reinsurers as a risk mitigation tool.

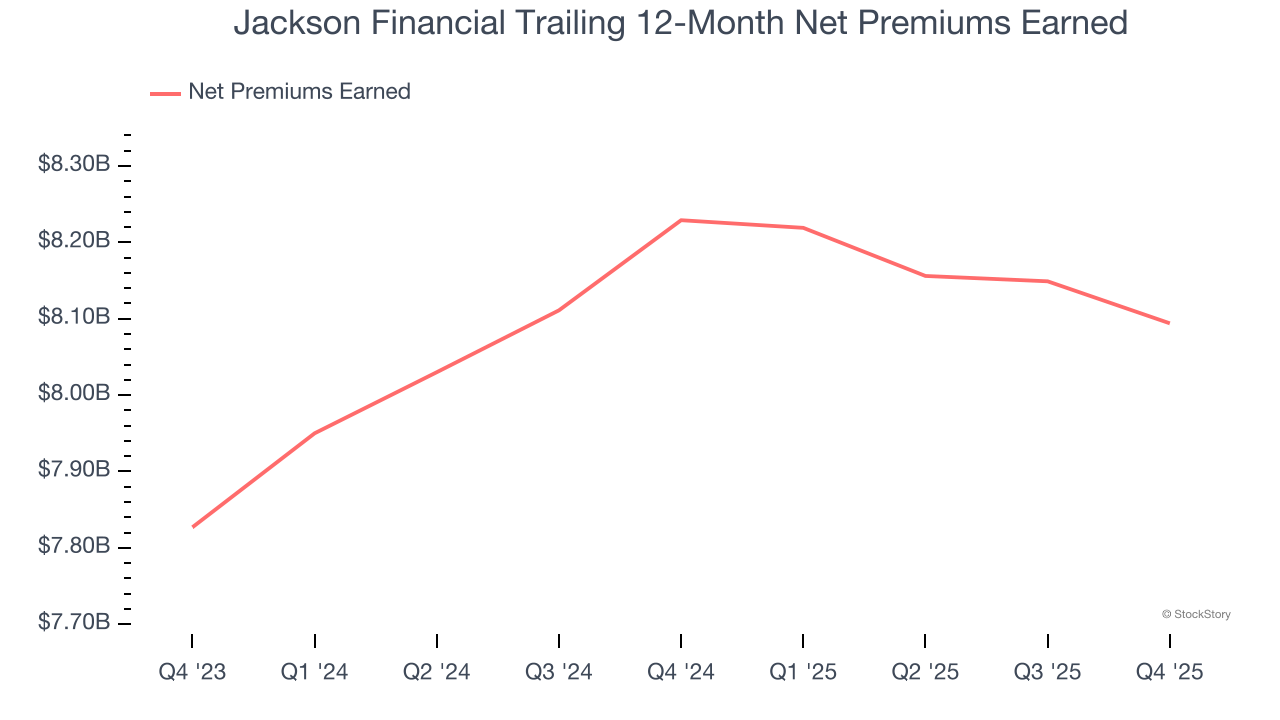

Jackson Financial’s net premiums earned has grown at a 3.7% annualized rate over the last five years, worse than the broader insurance industry and slower than its total revenue.

When analyzing Jackson Financial’s net premiums earned over the last two years, we can see that growth decelerated to 1.7% annually. Since two-year net premiums earned grew slower than total revenue over this period, it’s implied that other line items such as investment income grew at a faster rate. These additional streams do play a key role in the bottom line, but their impact can vary. While some firms have excelled in consistently investing their float, sudden shifts in the fixed income and equity markets can heavily sway short-term performance.

Jackson Financial’s net premiums earned came in at $2.03 billion this quarter, down 2.6% year on year.

Key Takeaways from Jackson Financial’s Q4 Results

We enjoyed seeing Jackson Financial beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 2.2% to $119.46 immediately after reporting.

Sure, Jackson Financial had a solid quarter, but if we look at the bigger picture, is this stock a buy? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here (it’s free).