Over the last six months, Zimmer Biomet’s shares have sunk to $98.28, producing a disappointing 5.8% loss - a stark contrast to the S&P 500’s 6.7% gain. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Zimmer Biomet, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Zimmer Biomet Not Exciting?

Despite the more favorable entry price, we're cautious about Zimmer Biomet. Here are three reasons why ZBH doesn't excite us and a stock we'd rather own.

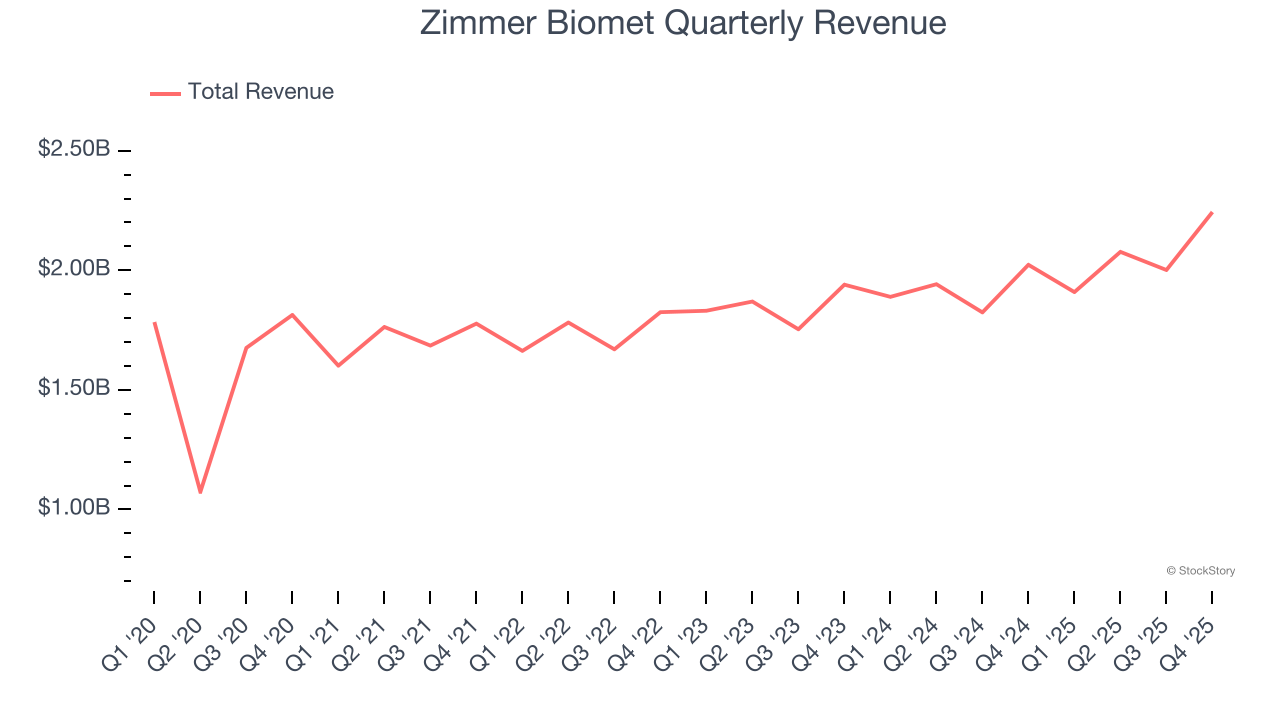

1. Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Zimmer Biomet grew its sales at a mediocre 5.3% compounded annual growth rate. This was below our standard for the healthcare sector.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Zimmer Biomet’s revenue to rise by 3.8%, a slight deceleration versus its 5.3% annualized growth for the past five years. This projection is underwhelming and suggests its products and services will face some demand challenges.

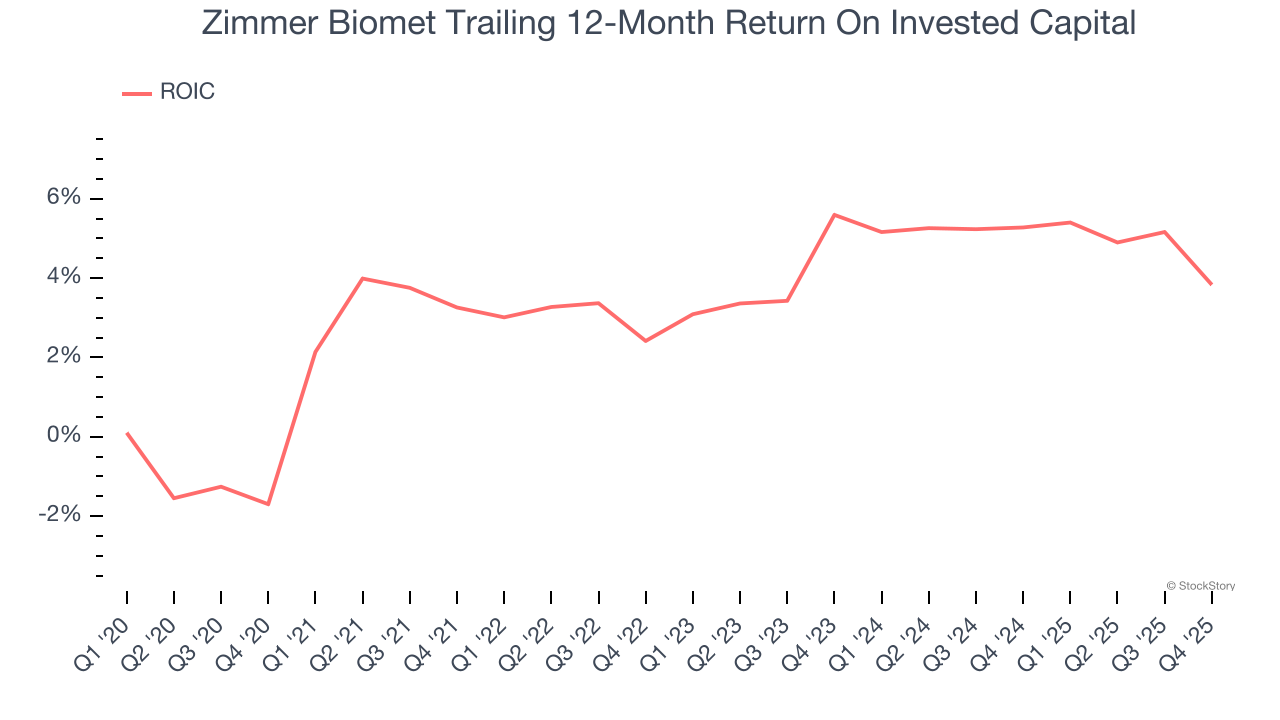

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Zimmer Biomet historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 4.1%, lower than the typical cost of capital (how much it costs to raise money) for healthcare companies.

Final Judgment

Zimmer Biomet isn’t a terrible business, but it doesn’t pass our bar. Following the recent decline, the stock trades at 11.6× forward P/E (or $98.28 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are more exciting stocks to buy at the moment. We’d recommend looking at the most entrenched endpoint security platform on the market.

High-Quality Stocks for All Market Conditions

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.