Water analytics and treatment company Veralto (NYSE: VLTO) missed Wall Street’s revenue expectations in Q4 CY2025 as sales rose 3.8% year on year to $1.40 billion. Its non-GAAP profit of $1.04 per share was 6% above analysts’ consensus estimates.

Is now the time to buy Veralto? Find out by accessing our full research report, it’s free.

Veralto (VLTO) Q4 CY2025 Highlights:

- Revenue: $1.40 billion vs analyst estimates of $1.40 billion (3.8% year-on-year growth, 0.5% miss)

- Adjusted EPS: $1.04 vs analyst estimates of $0.98 (6% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $4.15 at the midpoint, missing analyst estimates by 0.7%

- Operating Margin: 22.6%, in line with the same quarter last year

- Free Cash Flow Margin: 20.8%, up from 19.6% in the same quarter last year

- Market Capitalization: $25.2 billion

Company Overview

Spun off from Danaher in 2023, Veralto (NYSE: VLTO) provides water analytics and treatment solutions.

Revenue Growth

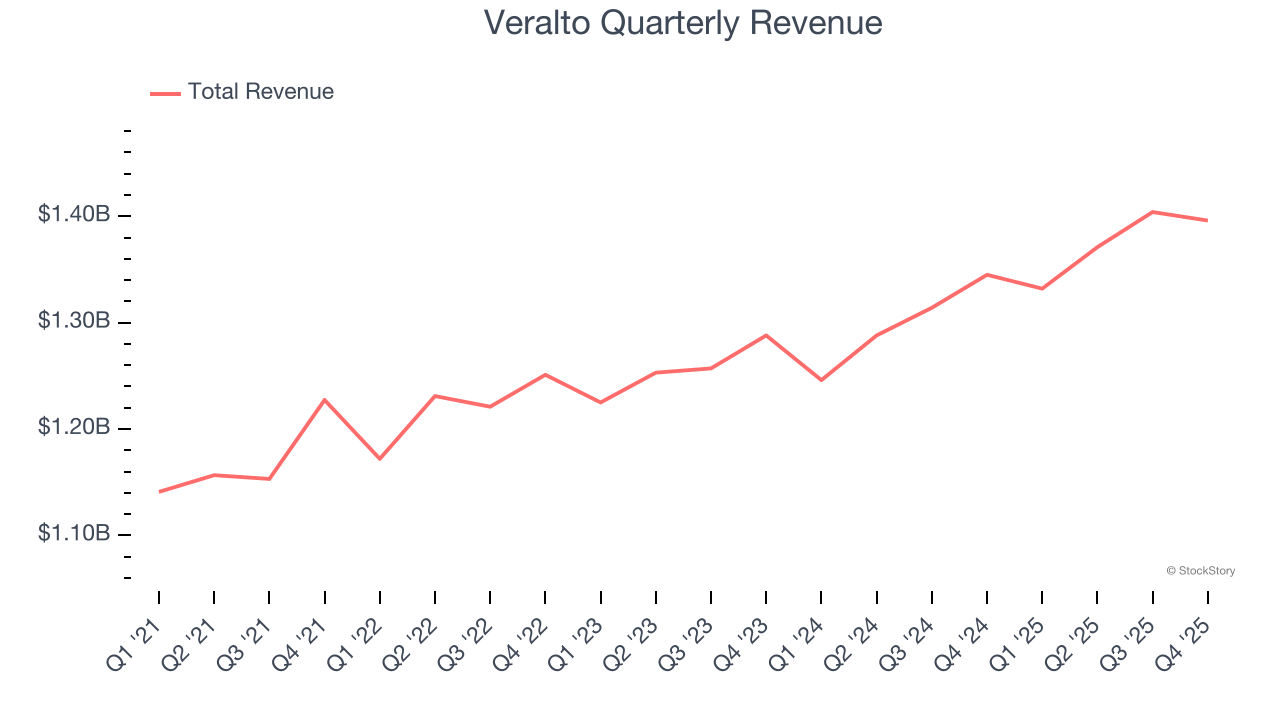

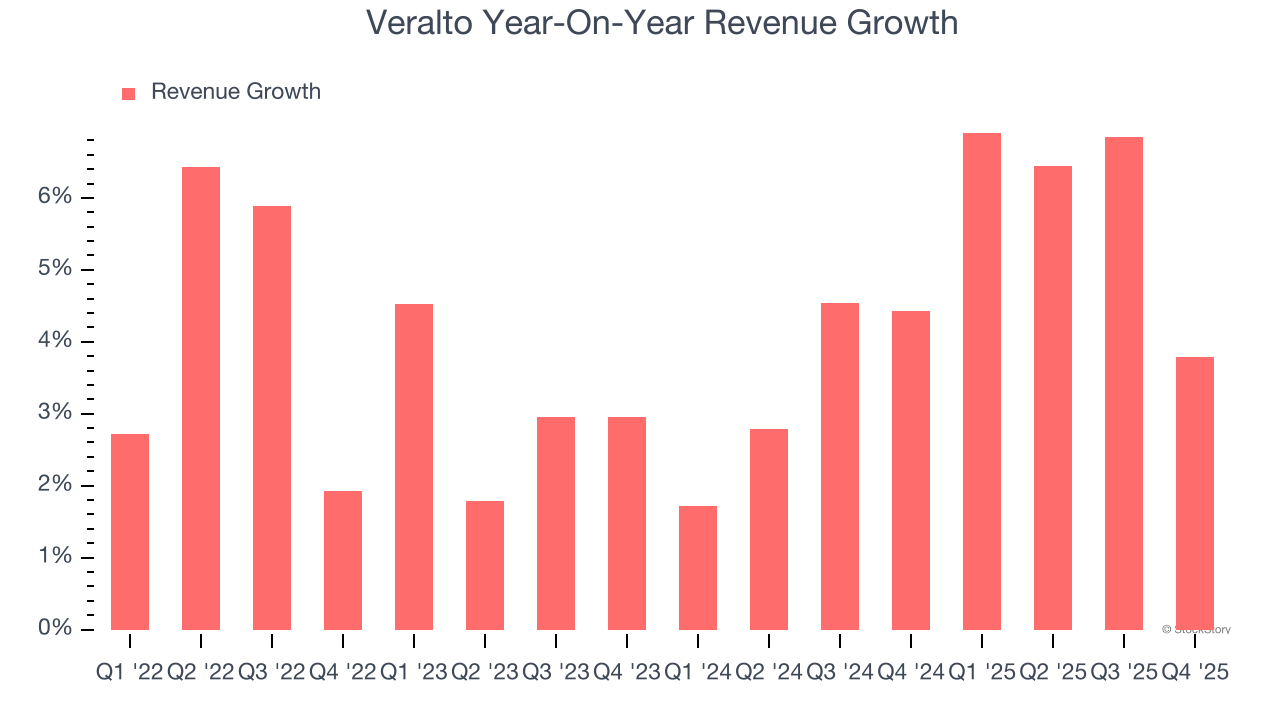

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Veralto’s 4.1% annualized revenue growth over the last four years was sluggish. This was below our standard for the industrials sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. Veralto’s annualized revenue growth of 4.7% over the last two years aligns with its four-year trend, suggesting its demand was consistently weak.

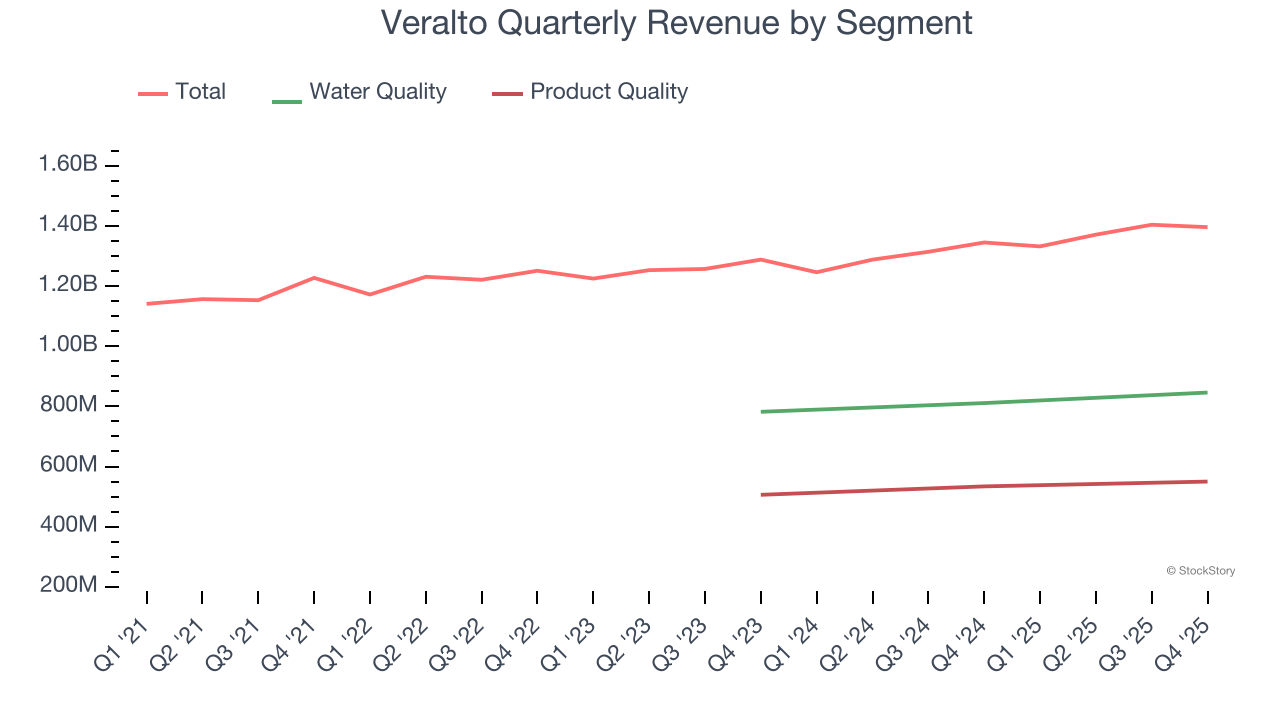

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Water Quality

and Product Quality, which are 60.6% and 39.4% of revenue. Over the last two years, Veralto’s Water Quality

revenue (measurement and analysis equipment) averaged 4% year-on-year growth while its Product Quality revenue (marking and coding for packages) averaged 4.3% growth.

This quarter, Veralto’s revenue grew by 3.8% year on year to $1.40 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.2% over the next 12 months. While this projection implies its newer products and services will spur better top-line performance, it is still below the sector average.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

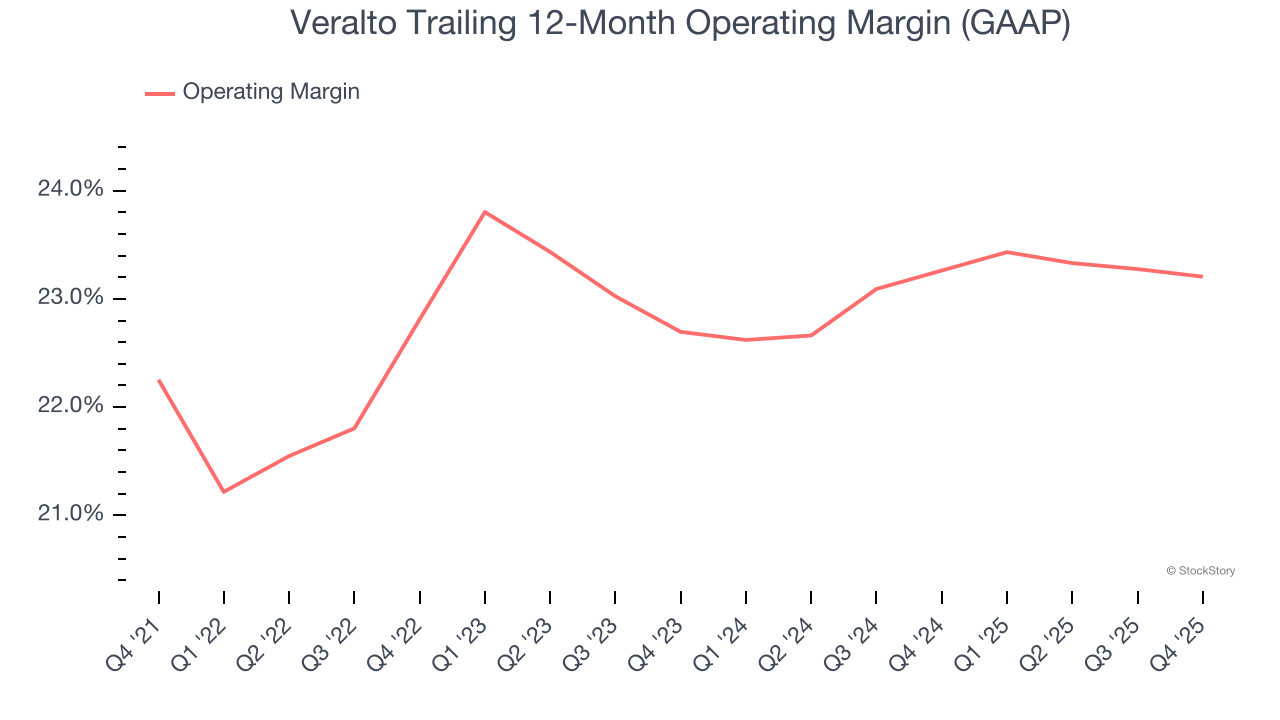

Veralto’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 22.9% over the last five years. This profitability was elite for an industrials business thanks to its efficient cost structure and economies of scale. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Veralto’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. We like to see margin expansion, but we’re still happy with Veralto’s performance considering most Air and Water Services companies saw their margins plummet.

In Q4, Veralto generated an operating margin profit margin of 22.6%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

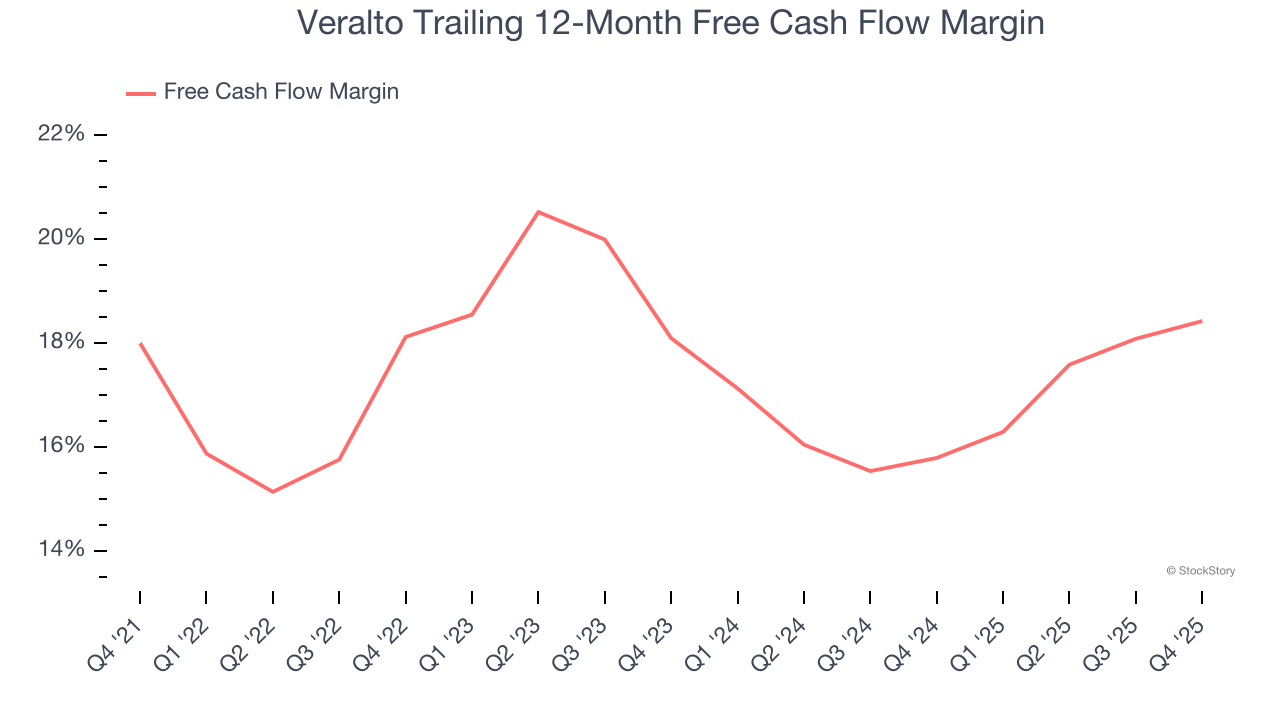

Veralto has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 17.7% over the last five years.

Veralto’s free cash flow clocked in at $291 million in Q4, equivalent to a 20.8% margin. This result was good as its margin was 1.3 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

Key Takeaways from Veralto’s Q4 Results

It was good to see Veralto beat analysts’ EPS expectations this quarter. On the other hand, its EPS guidance for next quarter missed and its revenue fell slightly short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 1.5% to $95.91 immediately following the results.

Veralto’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here (it’s free).