Applied Materials (AMAT) shares pushed higher to a record price of about $331 this week after peer Taiwan Semiconductor’s (TSM) record earnings sparked a sector-wide rally.

TSMC now sees its capital expenditures hitting a whopping $54 billion this year at the midpoint, which is notably positive for AMAT given it’s a critical supplier of semiconductor manufacturing equipment.

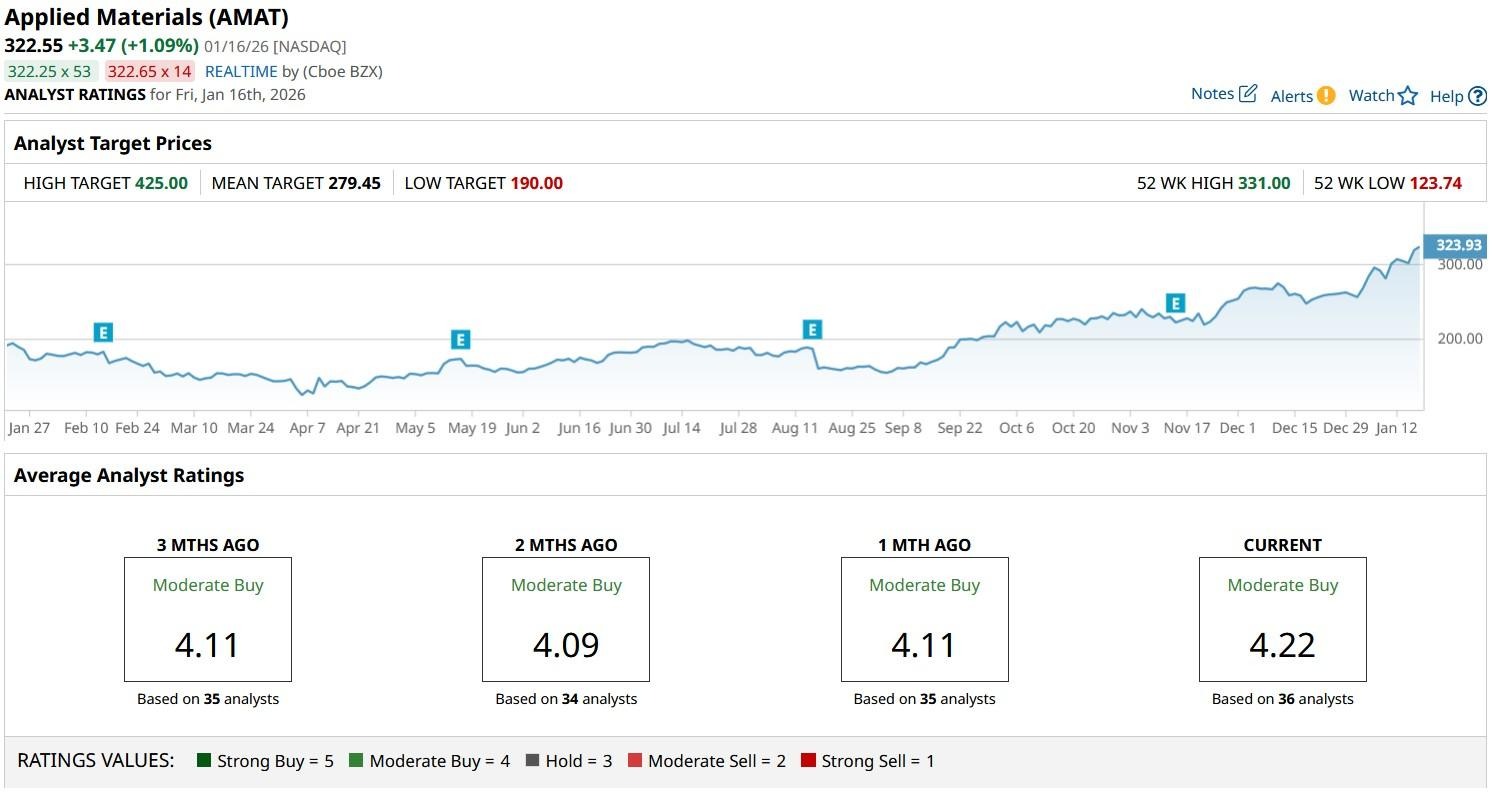

Including recent gains, Applied Materials stock is up a remarkable 165% versus its 52-week low.

KeyBanc Recommends Sticking With Applied Materials Stock

Despite its cosmic run since last April, KeyBanc analysts led by Steve Barger believe AMAT stock will push meaningfully higher from here in 2026.

Barger is particularly bullish on the company’s exposure to conventional DRAM, which he dubbed “arguably the artificial intelligence (AI) related device facing the most scarcity.”

According to him, this scarcity will make companies commit to capacity expansion, catalyzing a sustainable long-term rally in Applied Materials.

KeyBanc raised his price target on the Nasdaq-listed firm this week to $380, indicating potential upside of another 15% from current levels.

AMAT Shares Are Cheaper to Own Than Industry Peers

Beyond memory, Applied Materials’ exposure to logic chips positions it strongly to benefit from AI buildout as well in 2026.

Despite this balanced, diversified exposure to the semiconductor space, AMAT is more attractively priced currently than its peers, including KLA (KLAC) and Lam Research (LRCX).

At the time of writing, the California-based company is trading at a forward price-earnings (P/E) multiple of just over 30x, significantly lower than KLAC and LRCX at north of 40x each.

What’s also worth mentioning is that historically (over the past 16 years), AMAT has rallied about 5.76% on average in February, which makes up for another exciting reasons to stick with it in the near-term.

Note that Applied Materials shares do also pay a dividend yield of 0.58%.

What’s the Consensus Rating on Applied Materials?

Other Wall Street analysts seem to agree with KeyBanc’s bullish view on Applied Materials stock.

According to Barchart, the consensus rating on AMAT shares sits at “Moderate Buy” currently with price targets going as high as $425 indicating potential upside of another 23% from here.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Morningstar’s New Generative AI Index Could Unlock Opportunities in OpenAI and Anthropic for Everyday ETF Investors

- SoFi CEO Anthony Noto Says His Company Is Poised to Win if Trump Caps Credit Card Rates: Why Personal Loans Could Come Out on Top

- Hedge Funds Are Shorting This Classic Warren Buffett Stock. Should You Sell Shares Now?

- This Under-the-Radar Pet Stock Could Be the Biggest Meme Buy in January 2026