In early 2026, the Magnificent 7 are no longer moving together. And they’re not moving the market. While smaller companies try to make a dent in their historic lagging trend versus tech stocks, the biggest of the big have become a drag on the broader market rather than its leading group.

Based on Friday’s close, there’s a notable performance gap between Alphabet (GOOG) (GOOGL) and Amazon (AMZN) and the rest of the pack. Especially when we consider that this is over just two weeks’ time.

Here is the scoreboard for the Mag 7 through Friday, Jan. 16, 2026:

| Stock | Ticker | 2026 YTD Performance |

| Alphabet | GOOGL | +7.14% |

| Amazon | AMZN | +2.49% |

| Nvidia | NVDA | -2.18% |

| Tesla | TSLA | -2.73% |

| Apple | AAPL | -4.62% |

| Microsoft | MSFT | -5.30% |

| Meta Platforms | META | -6.67% |

Alphabet and Amazon Earn an ‘A’ Grade

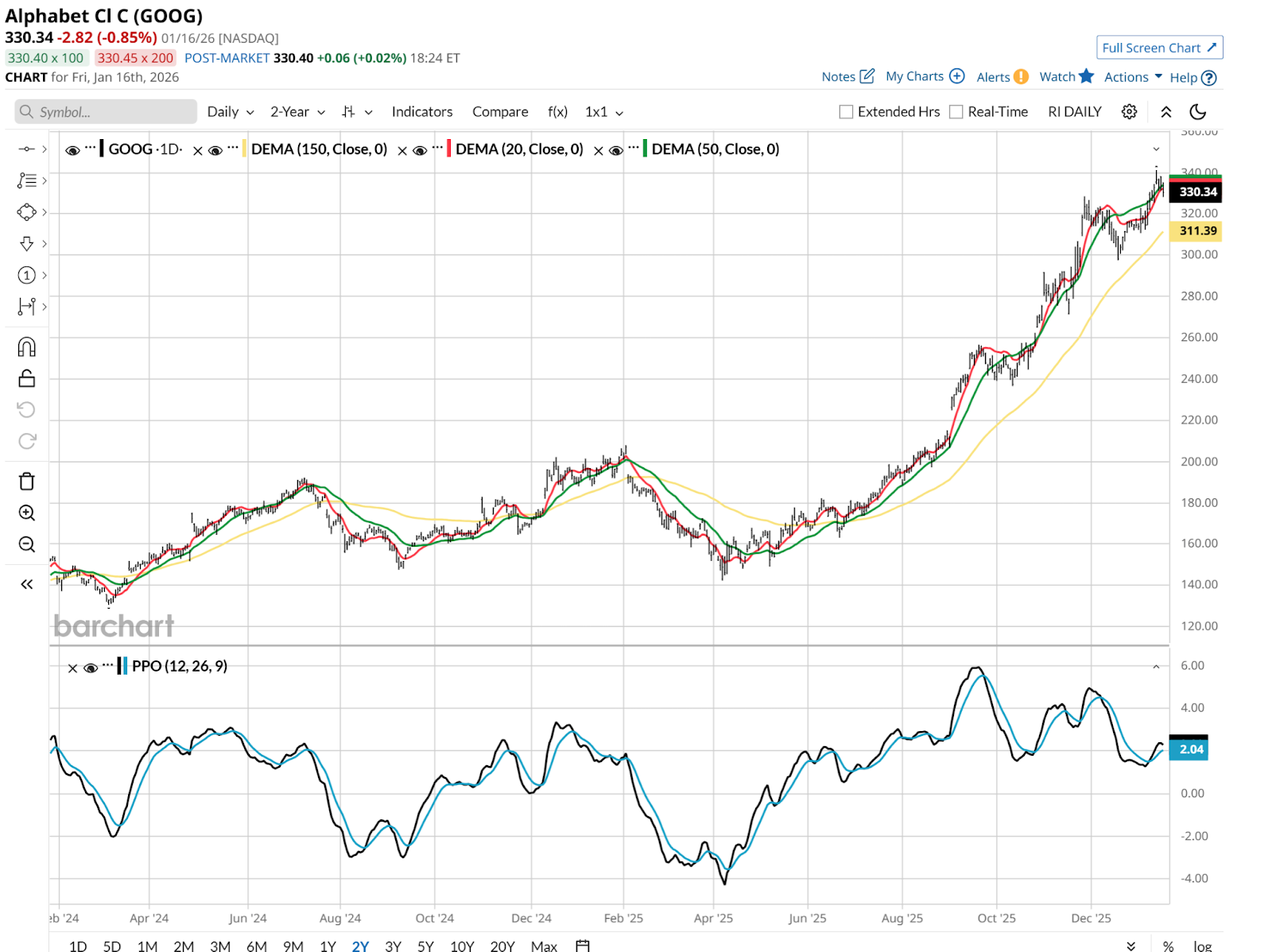

Alphabet is the clear standout, riding a fourth-quarter surge in optimism over its in-house TPU chips and artificial intelligence (AI) tools, namely Gemini. It recently hit a $4 trillion market cap.

Amazon is also bucking the trend, finally catching up after underperforming the group for much of 2025.

Apple Weaker To Start the Year

The rest of the elite group is currently in the red to start 2026. However, there’s taking a pause and then there's being on a downward trajectory. And that’s why I’ll focus here on Apple (AAPL). Yes, it's the third “A” in the group, but its stock looks more like a “C-” at best.

Not only is it down, its 20-day moving average is now off more than 10% from its all-time high set in early December, and the PPO indicator at the bottom of the above chart looks like it just dipped further down. That’s not a good sign at all and could put $200 in play later this year if the broader market starts to suffer.

Meta Platforms Down in 2026

Despite being a Wall Street favorite for 2026, Meta is the worst performer so far this year. High capex spending — reportedly crossing the $100 billion mark — has investors laying low until the company’s next earnings report. That chart below does not look as threatening as that of AAPL, but there’s been a lot of selling pressure that has to be worked through before META can build a sustainable rally.

The Takeaway

These rough starts to the new year for several Mag 7 names is not the end of the tech trade per se. But valuations are likely to be much more under the radar this year. After three years of bliss, tech has moved into the next phase. And that might involve yet another brief market flirtation with the so-called S&P 493.

The key: See if these dips are bought. When? Perhaps the next 2-3 weeks. If not, we might revisit this as cycle change, not a case of a quick timeout.

Rob Isbitts is a semi-retired fiduciary investment advisor and fund manager. Find his investment research at ETFYourself.com. To copy-trade Rob’s portfolios, check out the new PiTrade app. His new blog on racehorse ownership as an alternative asset is at HorseClaiming.com.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Is Amazon Too Cheap Ahead of Earnings? Put Yields are High, Implying AMZN Stock Could Rally

- Cathie Wood May Be Trimming Her Tesla Stake, But She Still Thinks the Company Is on Track for 70%-80% Gross Margins

- Lockheed Martin Stock Hits New 52-Week High as the Greenland Crisis Heats Up

- Trump Bought CoreWeave’s Debt. What Does That Mean for CRWV Stock?