According to a White House disclosure last week, U.S. President Donald Trump purchased at least $50 million in corporate and municipal bonds through December. This includes debt from the AI infrastructure company CoreWeave (CRWV). The filing also revealed bond purchases between Nov. 14 and Dec. 29, 2025, for companies such as Netflix (NFLX), General Motors (GM), Boeing (BA), Occidental Petroleum (OXY), and others.

CoreWeave specializes in GPU infrastructure for generative AI workloads and provides compute acceleration services for enterprises building AI models and applications. Let’s see if you should buy CoreWeave stock right now.

Is CoreWeave Stock a Good Buy Right Now?

CoreWeave has experienced explosive growth in the AI cloud computing market. The company reported revenue of $1.4 billion in its third quarter, up 134% year-over-year (YoY). Notably, the firm added over $25 billion in revenue backlog in Q3, increasing the total backlog to $55 billion. That's nearly four times what it had at the start of the year.

CoreWeave operates a specialized cloud platform that provides the infrastructure supporting AI workloads for enterprises. It builds and manages data centers equipped with advanced Nvidia (NVDA) GPUs, which are essential for training and running AI models. Major customers include Meta (META), OpenAI, and various frontier AI labs.

However, CoreWeave faces challenges typical of the rapidly expanding AI infrastructure space. The company recently lowered its 2025 revenue guidance to between $5.05 billion and $5.15 billion due to construction delays from a third-party data center provider. The delays pushed some capacity from the fourth quarter into the first quarter of 2026.

Despite the setback, demand for CoreWeave's services remains strong. The company expanded its active power footprint to approximately 590 megawatts and has contracted for 2.9 gigawatts of total capacity. Management expects the vast majority of this capacity to come online within 12 to 24 months.

CoreWeave has also been aggressive in securing financing for its expansion. In the first nine months of 2025, it has raised $14 billion via debt and equity capital. It also expects capital expenditures to more than double in 2026, which indicates rapid expansion amid supply chain headwinds.

A Focus on Growth and Expansion

Investors need to analyze whether CoreWeave’s business model can sustain its growth trajectory. The company’s proprietary software orchestration layer is called Mission Control. This technology allows CoreWeave to autonomously manage AI cloud operations and deliver maximum performance while extending the longevity of expensive GPU chips.

Third-party analysts like SemiAnalysis have awarded CoreWeave the highest Platinum ClusterMAX ranking twice, a distinction no other cloud provider has achieved. Customer retention tells a compelling story. When CoreWeave's first major contract for 10,000 H100 GPUs approached expiration, the customer proactively renewed two quarters early at nearly the same price, 5% below the original rate.

Customers are using GPU clusters for inference workloads that generate revenue, and the return on investment remains attractive enough to justify continued spending.

CoreWeave has reduced its customer concentration risk. At the start of 2025, one customer accounted for 85% of the revenue backlog. By the third quarter, no single customer accounted for more than 35% of backlog. The company has also shifted toward higher-quality customers, with over 60% of revenue backlog now originating from investment-grade entities.

CoreWeave only spends on capital expenditures after signing customer contracts. These contracts are structured as take-or-pay agreements spanning five years, with cash flows designed to cover both infrastructure costs and debt payments.

This approach has allowed it to reduce financing costs by hundreds of basis points. It recently secured funding at SOFR plus 400 basis points compared to much higher rates previously.

Unlike the dot-com era, when companies built capacity speculatively, CoreWeave builds only what customers have already committed to purchasing through long-term contracts. The company is struggling to keep up with demand rather than chasing it.

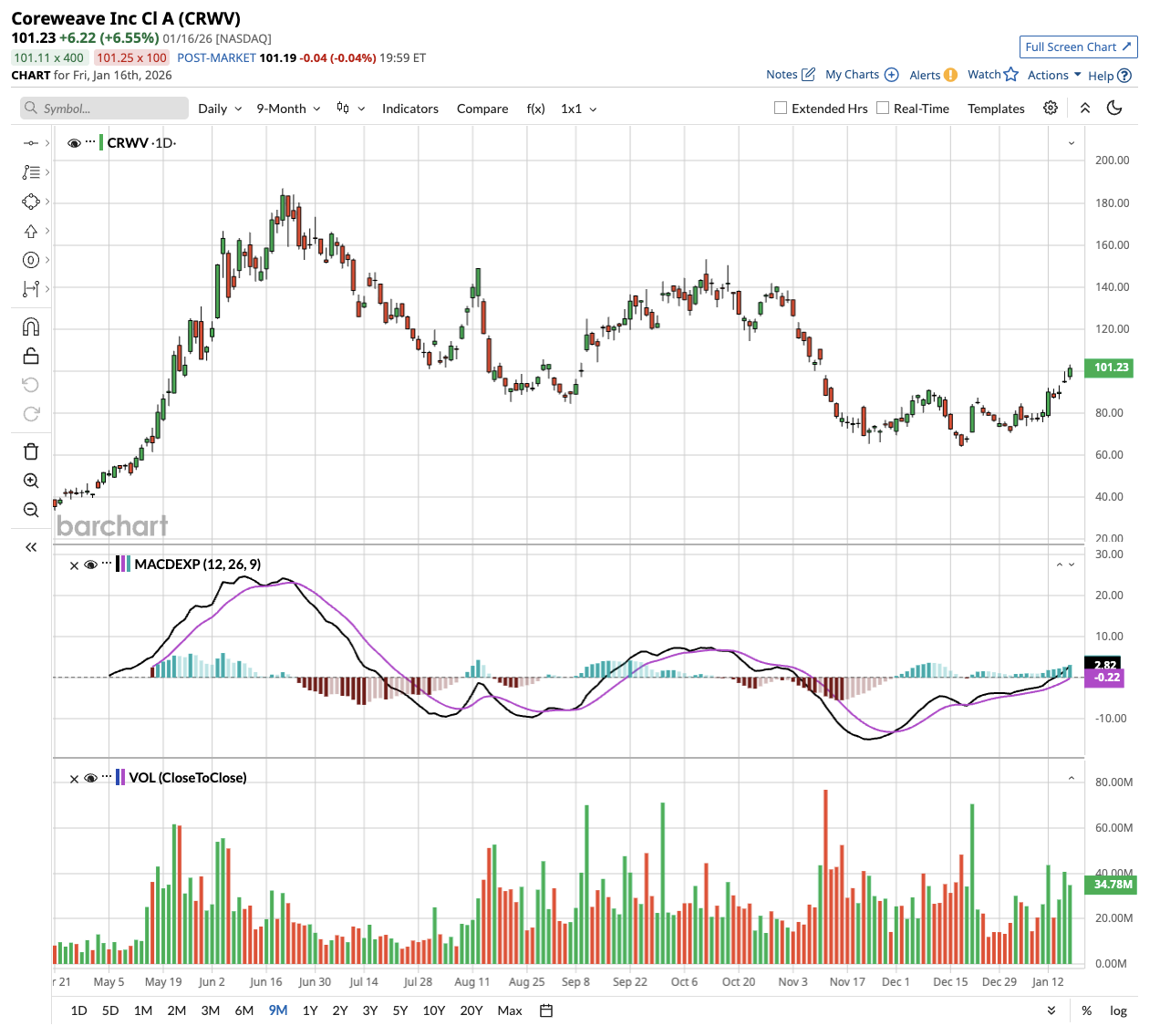

What Is the CRWV Stock Price Target?

Analysts tracking CRWV stock forecast revenue to increase from $5.12 billion in 2025 to $29 billion in 2028. Moreover, it is projected to end 2028 with an adjusted earnings per share of $4.51, compared to a loss of $1.31 per share in 2025. If CRWV stock is priced at 35x forward earnings, which is reasonable given its growth estimates, it could gain over 55% over the next two years.

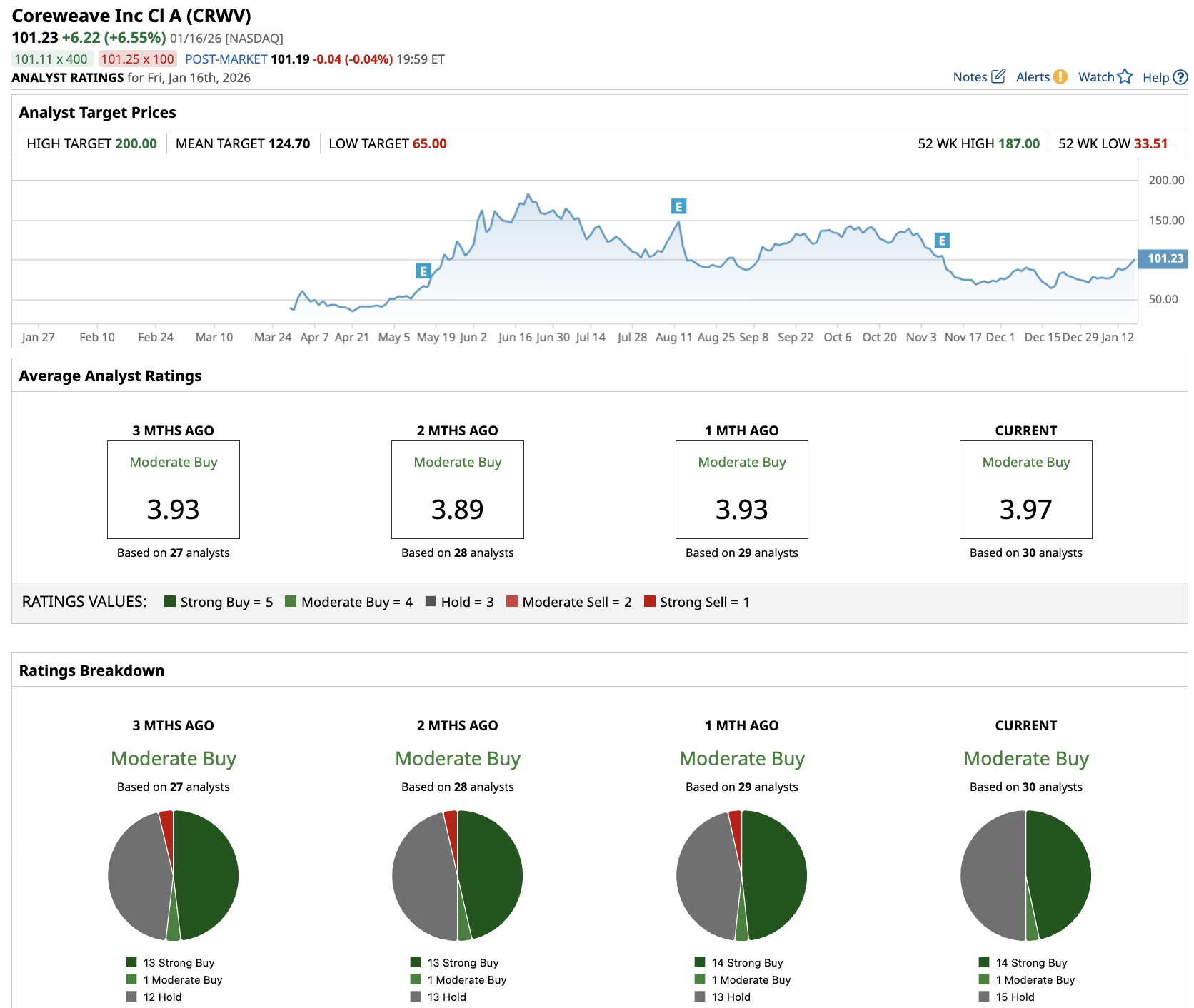

Out of the 30 analysts covering CRWV stock, 14 recommend “Strong Buy,” one recommends “Moderate Buy,” and 15 recommend “Hold.” The average CRWV stock price target is $124.70, above the current price of $101.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Is Amazon Too Cheap Ahead of Earnings? Put Yields are High, Implying AMZN Stock Could Rally

- Cathie Wood May Be Trimming Her Tesla Stake, But She Still Thinks the Company Is on Track for 70%-80% Gross Margins

- Lockheed Martin Stock Hits New 52-Week High as the Greenland Crisis Heats Up

- Trump Bought CoreWeave’s Debt. What Does That Mean for CRWV Stock?