Amazon (AMZN) stepped up its restructuring efforts on Jan. 28 when it announced cutting 16,000 corporate jobs at the company. Roughly 4.6% of its corporate workforce. This has reminded people of the late 2022 and early 2023 period, when the firm laid off about 27,000 people.

Beth Galetti, who is the senior vice president of people experience and technology at Amazon, has stated that these layoffs were a part of efforts to reduce bureaucracy and layers within the organization, which is quite bloated at an employee count of over 1.5 million, though a vast majority of these are warehouse workers.

In parallel to these layoffs, Amazon continues to add staff in other areas of the business. Some have speculated that these layoffs are a result of AI integration. This could be true to an extent, as many functions can now be seamlessly performed with AI. However, others are arguing that the lack of ROI on AI investments is what’s forcing the company to become leaner. Either way, it is quite possible that these layoffs continue in the coming months as Amazon reevaluates its corporate workforce.

About Amazon Stock

Amazon is a global tech company, known primarily for its Amazon.com platform. It was founded by Jeff Bezos and is headquartered in Seattle, Washington. The company offers cloud services through Amazon Web Services (AWS), which has become a crucial growth engine. It is also among a small group of companies that have invested billions into AI infrastructure.

The company’s 2025 returns were just above 5%. Quite disappointing for the company, considering the S&P 500 ($SPX) delivered 18% returns in the same period. Some of this was due to the fear that companies that were investing more than a hundred billion dollars in AI per year may not see a great return on investment. Amazon was in the same boat, though the company management claims it is still in the very early stages of setting up new projects within the organization. The future is certainly interesting, but short-term traders are paying the price.

As with many other tech stocks that have underperformed in the last year, Amazon is also trading at a significant discount to its own five-year average valuation. For instance, on a forward P/E basis, the company’s current 34.14x multiple is a massive 79% below its five-year average of 165.07x! This is a colossal discount, which can also be seen in other metrics, though to a much lesser extent. The forward EV/EBIT is trading at a 34.6% discount, whereas the forward price-to-book is also 16.8% below the five-year average.

Some of this discount may be due to slower growth. Amazon has grown its EPS at a compound annual growth rate of 37% in the last five years. From 2026 to 2028, it is expected to grow at 11%, 22%, and 24%, respectively. The growth is slowing down, but it is by no means small. The valuation metrics have shrunk accordingly, but with the company focusing on a lean corporate structure and AI projects yet to bear fruit, this could be an interesting entry point for investors.

Amazon Posts Strong Cloud Growth in Q3

Amazon announced its Q3 earnings report on Oct. 30 and reported an EPS of $1.95 against expectations of $1.57. This massive beat caused the stock to go up over 10% in post-market trading. AWS revenue was $33 billion, while $17.7 billion came from advertising. Both segments beat Wall Street expectations comfortably.

While Amazon’s future EPS expectations are modest according to Wall Street, the CEO is calling the growth “a pace we haven’t seen since 2022.” He is confident that the robust AI demand will impact the bottom line soon. The company has added 3.8 gigawatts of capacity in the last 12 months. The market has criticized Amazon’s AI progress in the past, but things can change quickly, as we witness in the market every week. Amazon opened its $11 billion AI data center called Project Rainer in October 2025. Projects like these are expected to continue in the near term as the company has no plans of slowing down on its AI investments.

The company’s Q4 earnings report is set to be delivered on Feb. 5, and here’s what you can expect from the company.

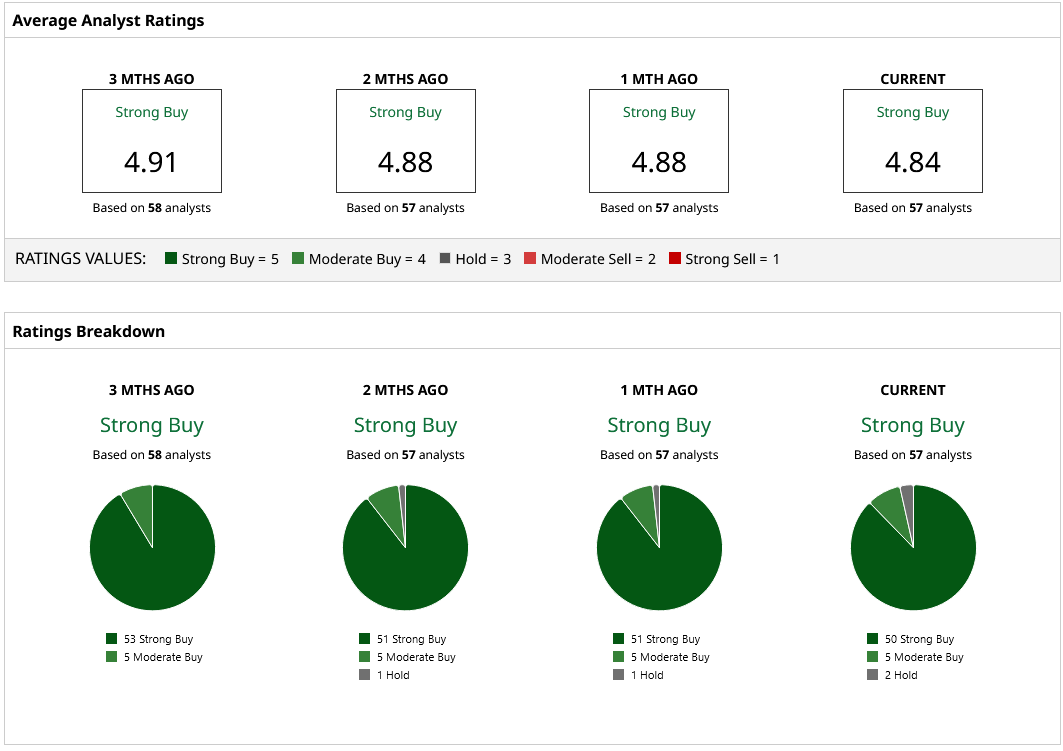

What Are Analysts Saying About AMZN Stock?

A consensus “Strong Buy” rating is not a surprise, especially considering such a strong company is just coming out of underperformance from the previous year. Amazon has a mean target price of $297.67, which is more than 22.5% above the current share price. The firm is expected to invest $50 billion in OpenAI, a development that could see analysts revise their price targets soon. For now, the highest price target on Wall Street is $360, which offers just under 50% upside from here on.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Here’s How One Trader Screens Stocks to Find Better Covered Call Options Trade Ideas in Minutes

- This AI Chip Stock Could Power the Next Decade. Is It a Buy Ahead of Its Next Earnings Report?

- Dear Western Digital Stock Fans, Mark Your Calendars for February 3

- Cathie Wood Just Bet $26 Million on Broadcom Stock. Should You Buy AVGO Too?