Piper Sandler analyst Jessica Tassan remains bullish on UnitedHealth (UNH) stock, although she lowered her price target on shares. This comes after news that the Centers for Medicare and Medicaid Services (CMS) indicated that it would not meaningfully increase health insurers' Medicare Advantage reimbursement rates in 2027.

However, with health insurers obviously in President Donald Trump's administration's crosshairs and UnitedHealth's Medicare and Retirement unit generating 25% of its revenue in fiscal 2025, the risk-reward ratio of UNH stock seems quite negative at this point. Therefore, investors may want to sell UNH stock.

Let's take a closer look.

About UNH Stock and the CMS Decision

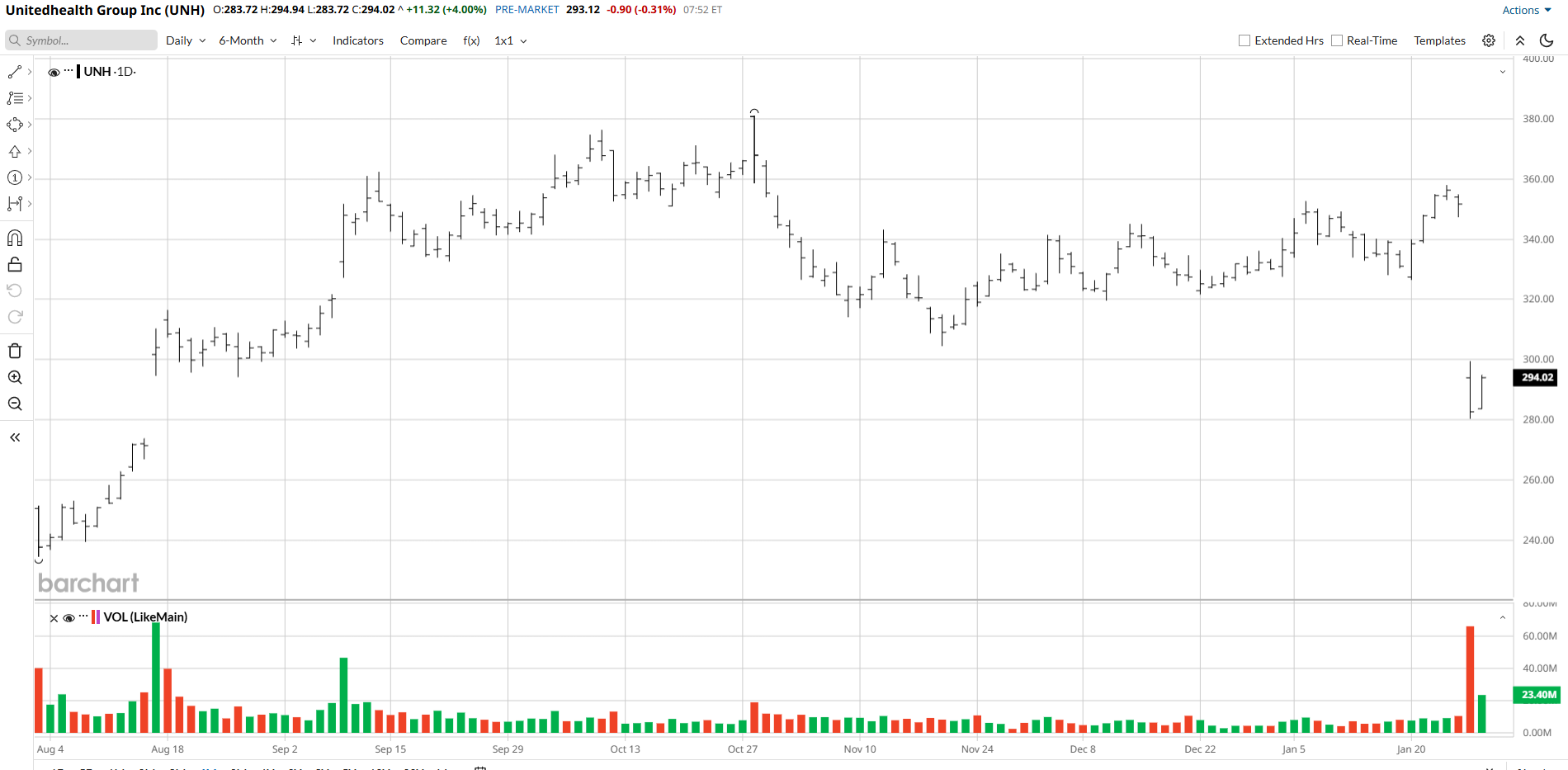

The largest U.S. health insurer, UnitedHealth has a market capitalization of $264 billion and a forward price-to-earnings (P/E) ratio of 16.5 times.

In the third quarter, sales rose 12% versus the same period a year earlier to $113.2 billion. However, net income retreated to $2.35 billion while operating cash flow came to $5.9 billion. On the balance sheet, UnitedHealth had $27.2 billion of cash and cash equivalents and $72.4 billion of long-term debt as of the end of Q3.

On Jan. 26, CMS disclosed that it would only increase its payments to private insurers providing Medicare Advantage plans by a net amount of 0.09% in 2027. The agency is expected to publish the final reimbursement data in April. However, with health spending having risen by 7.2% in 2024, an increase of 0.09% will not come close to covering the increased costs that UnitedHealth will have to pay on behalf of its Medicare Advantage customers.

Piper Sandler analyst Jessica Tassan responded to the news by trimming her price target on UNH stock to $396 from $417 while keeping an “Overweight" rating. Although the analyst is worried about the company's "persistent funding headwinds" and noted that the rates would be insufficient to cover rising cost trends, Tassan expects UnitedHealth to cope with the situation by reducing its benefits and leaving some geographic markets. Still, the analyst admitted that CMS' decision represents “a risk to the entire industry.”

How Should Investors Approach UNH Stock?

While UNH may be the best Medicare Advantage insurer, the entire sector is facing a great deal of risk. Further, Medicare Advantage insurers do face significant competition. On average, Medicare beneficiaries "have access to plans offered by 8 firms, a slight increase from 2018,” health policy research firm KFF reported this past July. Given the competition, UnitedHealth may not be able to cut benefits without losing consequential market share, putting further downward pressure on its top and bottom lines.

Also worth considering is the fact that CMS' 2027 Medicare Advantage rate decision may very well not be the final salvo that the Trump administration fires at health insurers. That's because Trump's past statements strongly indicate that he generally believes health insurers' premiums are excessive. In December, Trump said, “I want to meet with [health insurers], and I want to say, ‘I want you to cut your rates way down.'" Because CMS does have the ability to tremendously impact a large percentage of UnitedHealth's Medicare revenue and Trump is seeking lower rates, there's a good chance that more adverse rate decisions could meaningfully harm the company's performance.

History suggests that it's generally not a good idea to invest in companies whose sectors are being targeted by the incumbent administration. During President Barack Obama's presidency, his administration vigorously sought to curb the tuition charged by for-profit colleges. In those years, stocks of for-profit colleges generally struggled. For example, Lincoln Educational Services (LINC) tumbled from the $25 level in February 2010 to 43 cents in August 2015 while American Public Education (APEI) sank from around $46 in March 2010 to $15 in January 2016.

The Bottom Line on UNH Stock

The forward P/E ratio of UNH stock is not low, and shares seem quite risky at this point. As long as Trump is in office, UNH is unlikely to rally a great deal due to his attitude toward the health insurance sector. Given the situation, despite Piper Sandler's rating, I would suggest avoiding UnitedHealth stock for now.

On the date of publication, Larry Ramer did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Up 77% in the Past Year, This Analyst Says More Upside Is Still in Store for Applied Materials Stock

- This Trump Stock Just Announced a $100 Million Catalyst. Should You Buy Its Shares Now?

- Apple Is Reportedly Looking to Partner with Intel Foundry. Does That Make INTC Stock a Buy Here?

- Dear Disney Stock Fans, Mark Your Calendars for February 2