Grain and lean hog (HEG26) futures markets entered 2006 with a weaker tone, while the live (LEG26) and feeder cattle (GFH26) futures markets hit the accelerator.

Technical selling pressure was featured in the corn (ZCH26) and soybean (ZSH26) markets, while the winter wheat (ZWH26) (KEH26) futures bulls worked to stabilize their markets. Meantime, live and feeder cattle futures prices jumped on reports that a case of New World Screwworm had been detected in Mexico late last week, the second case in two days. The discovery of new cases likely further pushes back any opening of the U.S. southern border to feeder cattle imports from Mexico.

Grain Market Bears Gaining Momentum

March corn futures fell 12 1/2 cents last week. March soybeans on Friday saw the lowest close since Oct. 16 for a 26 3/4-cent loss on the week. March soft red winter wheat on Friday scored a new contract low and for the week wheat fell 12 1/2 cents. The technically bearish weekly low closes in corn, soybean, and SRW wheat futures markets set the table for follow-through technical selling pressure early this week.

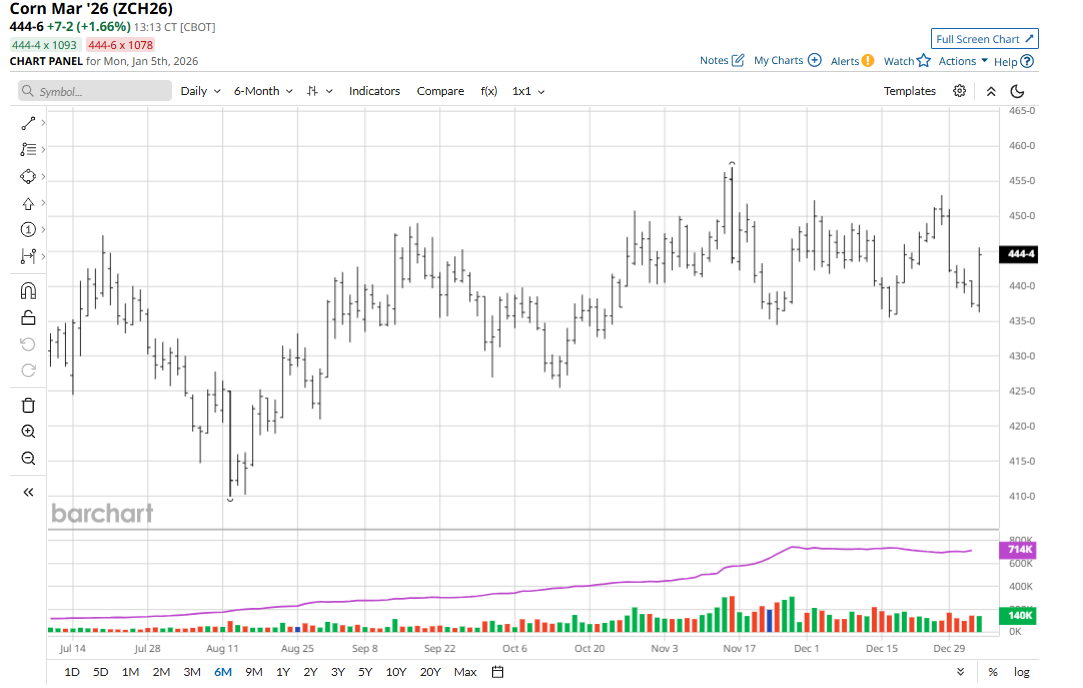

Corn Still Trapped in a Trading Range

March corn futures remain in a choppy and sideways trading range but have seen prices now drift to the bottom of that range, which is defined by the November high of $4.57 and the November low of $4.34 1/2. Corn bulls are thinking good export demand for U.S. corn in recent months will keep a floor just under present futures price levels.

Corn and soybean traders will continue to closely monitor growing conditions for South American crops. In Brazil, a late-planted soybean crop will bring a particular focus on second-crop (safrinha) corn plantings. So far this growing season, Brazilian and Argentine corn and soybean crops and their production potential have not seen major problems.

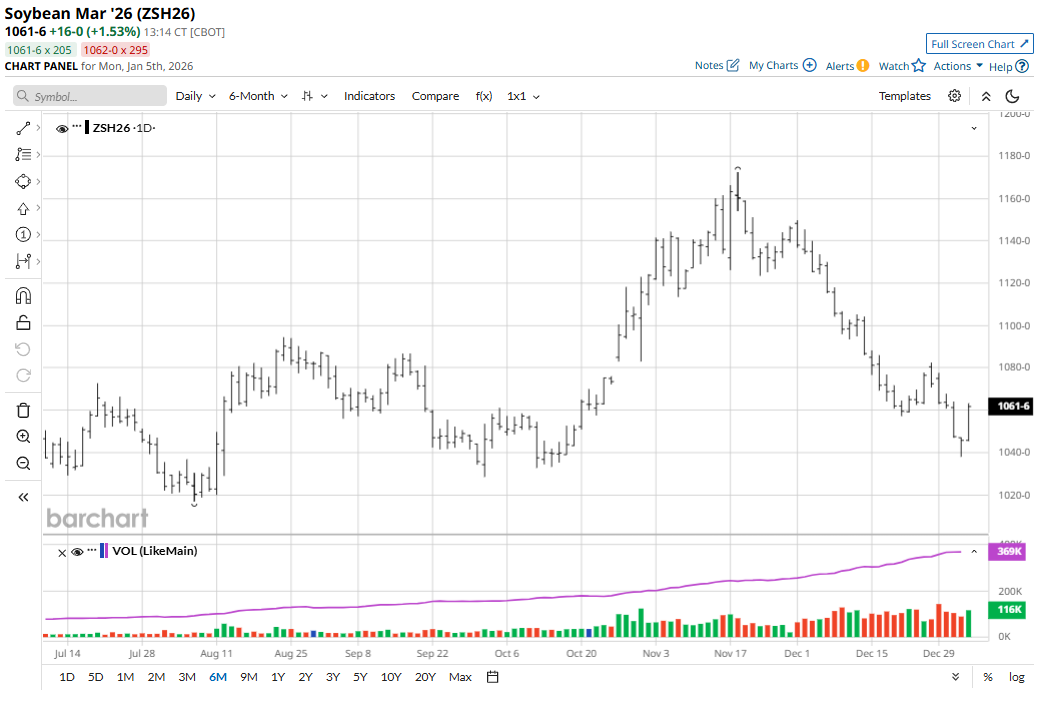

Soybean Bulls Not Getting Traction from China Purchases of U.S. Beans

A steady stream of China purchases of U.S. soybeans, with the trade estimating around 10 million metric tons the past several weeks, has not provided much, if any, price support to the soybean complex futures markets. In fact, since the U.S.-China trade truce announcement in late October, soybean futures prices have dropped by over $1.00 a bushel from mid-November highs. U.S. trade relations with China will continue to be near the front burner of the soy complex futures markets. China is so far meeting its pledge to the U.S. regarding the amount of U.S. soybeans purchased. However, recent big U.S. arms sales to Taiwan did not please China, and the negative rhetoric between the two largest economies in the world seems to be rising a bit.

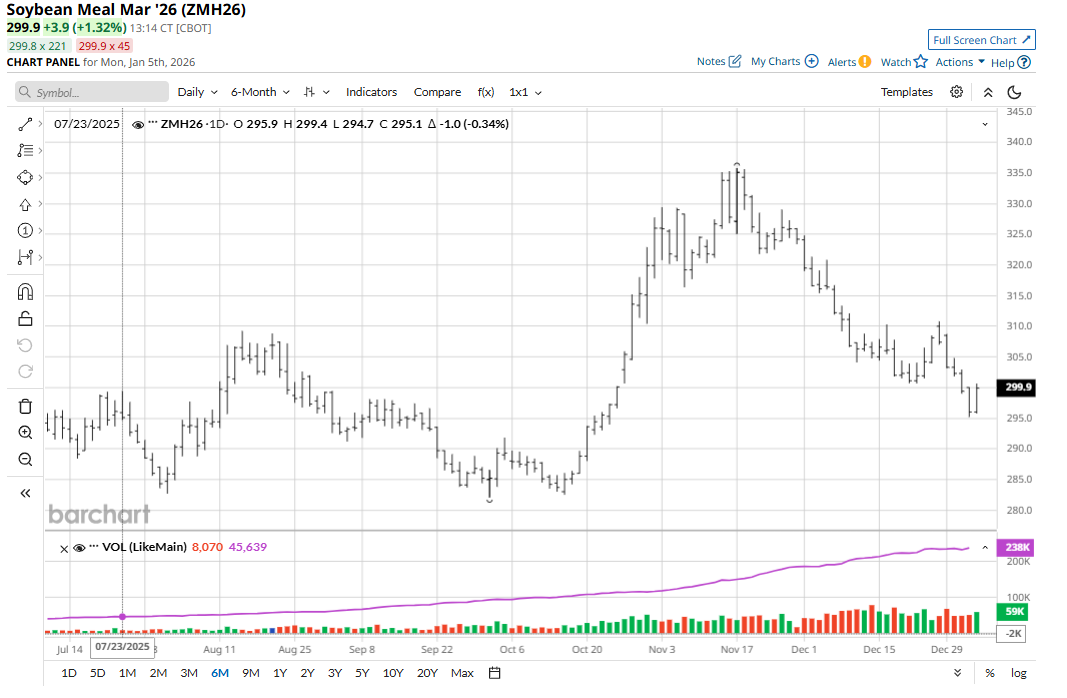

Soybean traders will continue to closely watch the soybean meal futures market. Meal will need to start performing better for the bean bulls to get any upside traction.

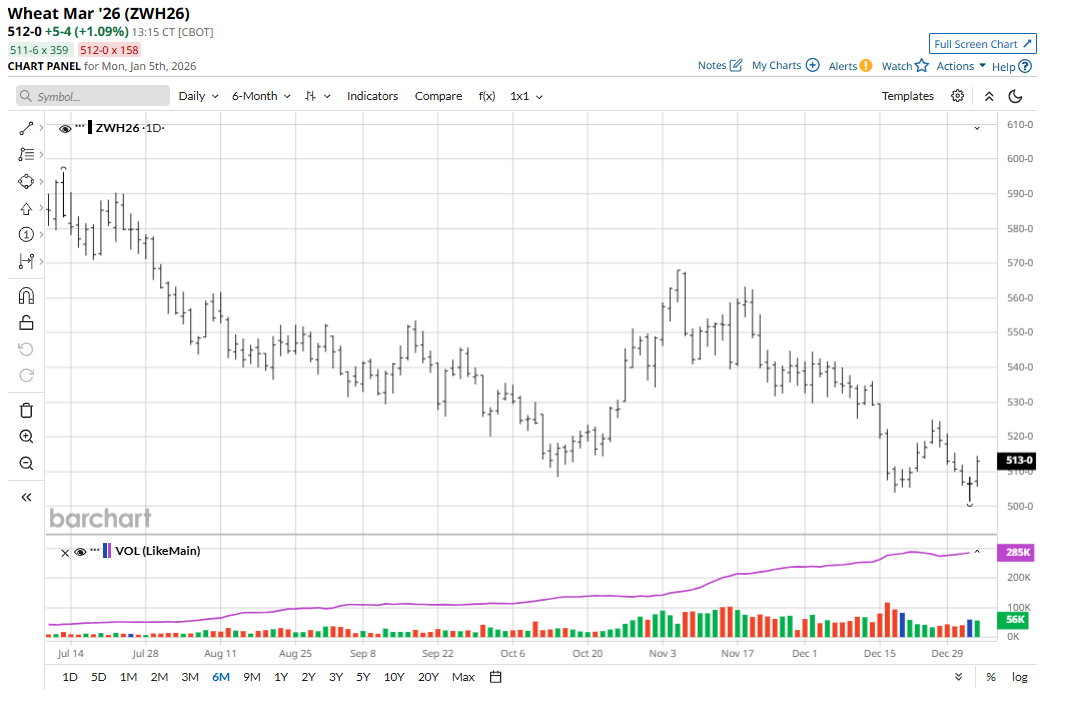

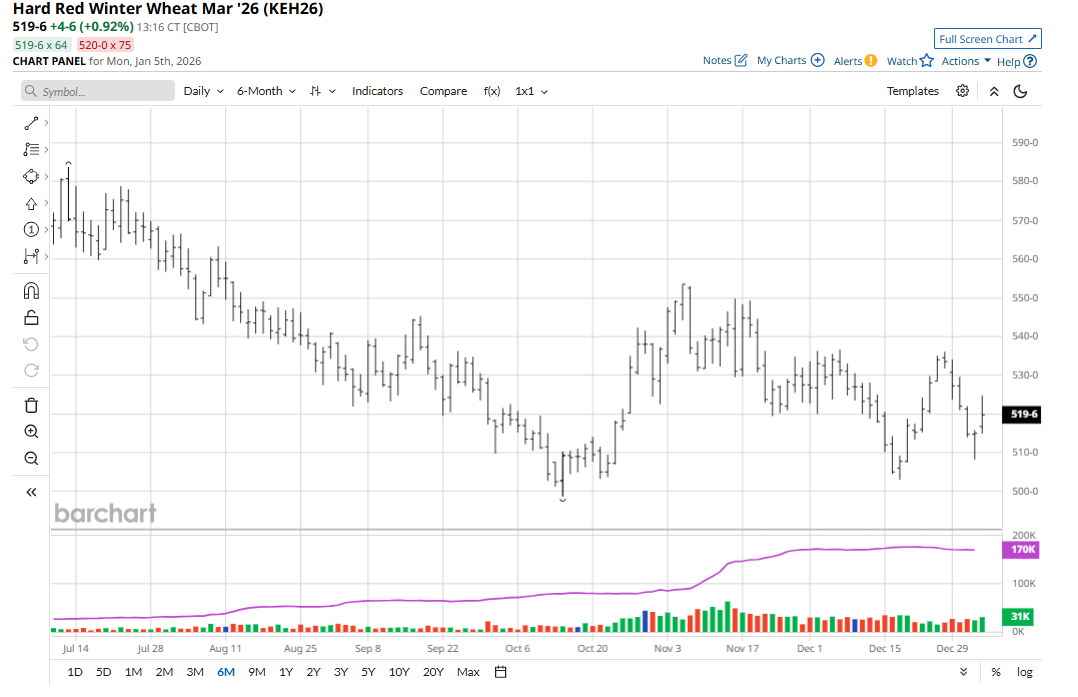

Winter Wheat Markets Languish at Lower Price Levels

Hefty global wheat supplies and mostly favorable weather conditions around the world have kept wheat futures bulls at bay the past few months. However, there is lingering uncertainty over U.S. planted acres and whether it will be harvested or grazed. The all-important late-March USDA U.S. planting intentions report will provide grain traders more definitive crop acreage numbers. One veteran wheat market watcher said recent price action in winter wheat futures “suggests the wheat market is presently well supplied.”

The ongoing Russia-Ukraine peace talks have been a focus for wheat traders. Any peace deal would likely mean more wheat from Russia and Ukraine being shipped out of the Black Sea region from both sides. Recent rhetoric from the U.S., which is brokering the deal, has been somewhat upbeat and that may be limiting buying interest in the wheat futures markets. However, there is a notable contingent of market watchers that believes a Russia-Ukraine peace deal still has big hurdles to clear before both sides lay down their arms.

It’s likely that any winter wheat futures markets rally potential will have to get some help from gains in corn and soybean prices in the coming weeks.

Live and Feeder Cattle Futures Rally to Nine-Week Highs

February live cattle futures on Friday gained $4.40 to close at $236, logging their highest close since Oct. 23. Live cattle rose $6.35 on the week. March feeders jumped $7.625 to $352.95, also hitting a nine-week high, for a weekly gain of $12.525. The cattle futures markets bulls flexed their muscles last Friday by producing new for-the-move highs and technically bullish weekly and monthly high closes. Firmer cash cattle prices in trade last week and improved boxed beef values should keep selling interest in cattle futures limited in the near term.

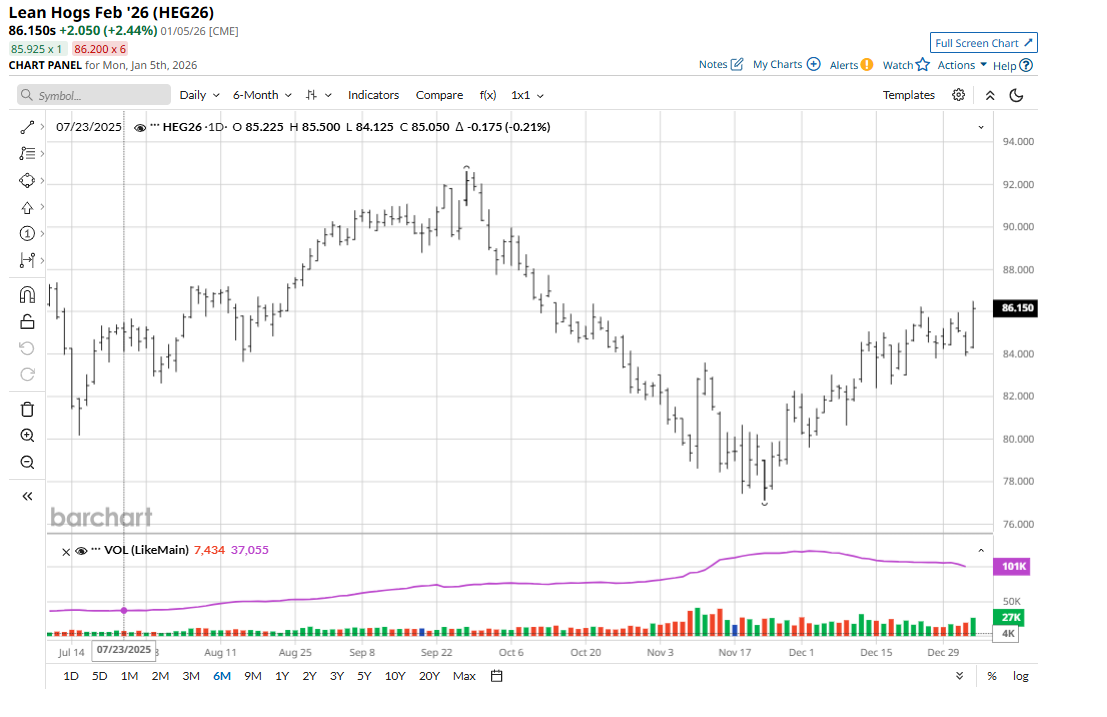

Hog Futures See Some Profit-Taking and are Fading a Bit

February lean hog futures on Friday lost $1 to $84.10, falling 42.5 cents on the week. Cash hog market weakness has been a weight on the hog futures market recently. Still, the overall near-term technical posture for the lean hog futures market leans price-bullish. Seasonal factors suggest hog slaughter levels will decline into spring, which will also be price-friendly for the cash hog and lean hog futures markets for the next few months. However, the hog futures bulls need to step up and show some fresh power this week, or else the speculative, chart-based bears will start to press their case more aggressively.

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart