Applied Materials (AMAT) will release its fiscal first-quarter 2026 earnings on Thursday, Feb. 12. AMAT stock has gained significantly, rising about 30% year-to-date (YTD) and over 81% in 12 months. The rally in AMAT stock is supported by artificial intelligence (AI)-driven demand.

The broader semiconductor equipment market is currently enjoying a strong upcycle, driven largely by massive investments in AI data centers. As hyperscalers and chipmakers race to build capacity for more powerful and energy-intensive workloads, demand for advanced manufacturing tools has surged. Applied Materials, as one of the world’s leading suppliers of wafer fabrication equipment, is benefiting from this trend.

Its tools are essential for producing cutting-edge chips used in AI accelerators and data center servers. Moreover, Applied Materials’ equipment is used to produce chips for automobiles, consumer electronics, and a wide range of industrial applications.

Heading into the earnings report, sustained customer demand and favorable industry conditions could continue to support its top line. However, margin pressure could dampen near-term enthusiasm for the stock.

Valuation and technical signals also suggest caution may be warranted. Applied Materials’ 14-period Relative Strength Index currently sits near 80.9, well above the 70 threshold typically associated with overbought conditions. This indicates that much of the optimism may already be priced into the shares.

Adding to the uncertainty is the stock’s recent post-earnings behavior. Applied Materials shares have declined following earnings releases in each of the past four quarters, including a 3.3% drop after the most recent fourth-quarter report.

Q1 Forecast: Solid Revenue, Softer Profitability

Applied Materials’ first-quarter financials will continue to benefit from the increased demand for AI compute capacity. Over the past year, the company has expanded its technological capabilities, refined its product lineup, and streamlined operations, positioning itself well to capture rising investment in advanced chips.

Management expects first-quarter revenue of about $6.85 billion, with the bulk, about $5.03 billion, coming from its Semiconductor Systems segment. Applied Global Services (AGS) revenue is projected to contribute around $1.52 billion. Strong capital spending by AI-focused data centers is supporting demand for the company’s advanced tools.

That said, a decline in wafer fab equipment spending in China could weigh on results, especially as trade restrictions have reduced Applied Materials’ addressable market.

Margins are another area to watch. Management expects an adjusted gross margin of about 48.4% for the quarter, slightly below the 48.9% reported a year ago. Adjusted earnings per share (EPS) are projected at $2.18, down from $2.38 in the prior-year period. Further, the current analysts’ consensus EPS estimate of $2.19 implies an 8% year-over-year (YoY) decline.

According to management, margin pressure is likely to persist until higher production volumes allow fixed costs to be absorbed more efficiently, improving overall profitability.

Despite these near-term challenges, Applied Materials has a track record of solid execution, having beaten analysts’ earnings expectations in each of the past four quarters.

Bottom Line: Strong AI Tailwinds, But Expectations Are High

Applied Materials’ first quarter will benefit from robust AI-driven demand. However, elevated valuation metrics, overbought technical conditions, and ongoing margin pressure suggest that expectations are already high.

The recent rally suggests that much of this optimism is already reflected in AMAT’s stock price. Applied Materials is trading at a forward price-to-earnings multiple of about 31.6, a level that looks high relative to its expected earnings trajectory. While its EPS growth is projected to reaccelerate in the longer term, near-term expectations remain modest. Analysts forecast earnings growth of 2.1% in fiscal 2026, followed by about 22% growth in fiscal 2027.

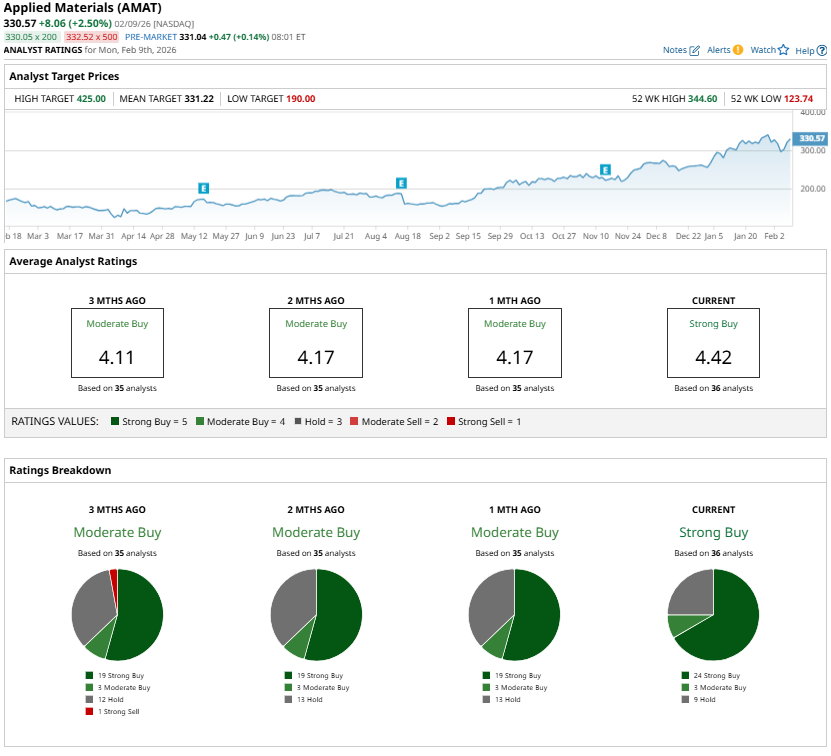

Wall Street analysts’ sentiment remains optimistic on AMAT ahead of Q1 earnings. Analysts have maintained a “Strong Buy” consensus rating on AMAT stock.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Short Sellers Are Making Bank on Oracle Stock. Should You Bet Against ORCL Too?

- What Options Traders Expect from SHOP Stock When Shopify Reports Earnings on February 11

- I Created My Own Prediction Market. What It’s Telling Me About the S&P 500 Now, and What Comes Next.

- As Datadog Soars Higher, Should You Chase the Rally in DDOG Stock?