Oakland, California-based The Clorox Company (CLX) manufactures and markets consumer and professional products. Valued at a market cap of $14.5 billion, the company owns iconic brands such as Clorox, Pine-Sol, Glad, Burt’s Bees, and Hidden Valley.

This household and personal products company has lagged behind the broader market over the past 52 weeks. Shares of CLX have declined 18.1% over this time frame, while the broader S&P 500 Index ($SPX) has soared 15.6%. However, on a YTD basis, the stock is up 19.5%, outpacing SPX’s 1.7% return.

Narrowing the focus, CLX has also underperformed the State Street Consumer Staples Select Sector SPDR ETF’s (XLP) 9.1% rise over the past 52 weeks. Nonetheless, it has outpaced XLP’s 12.2% YTD uptick.

On Feb. 3, CLX shares rose 1.5% following its mixed Q2 earnings release. Due to lower consumption, the company’s revenue decreased marginally year-over-year to $1.7 billion, but surpassed Wall Street expectations by 2.5%. Meanwhile, its adjusted EPS also declined 10.3% from the year-ago quarter to $1.39, missing analyst expectations of $1.43.

For the current fiscal year, ending in June, analysts expect CLX’s EPS to decline 23.3% year over year to $5.92. The company’s earnings surprise history is mixed. It exceeded the consensus estimates in two of the last four quarters, while missing on two other occasions.

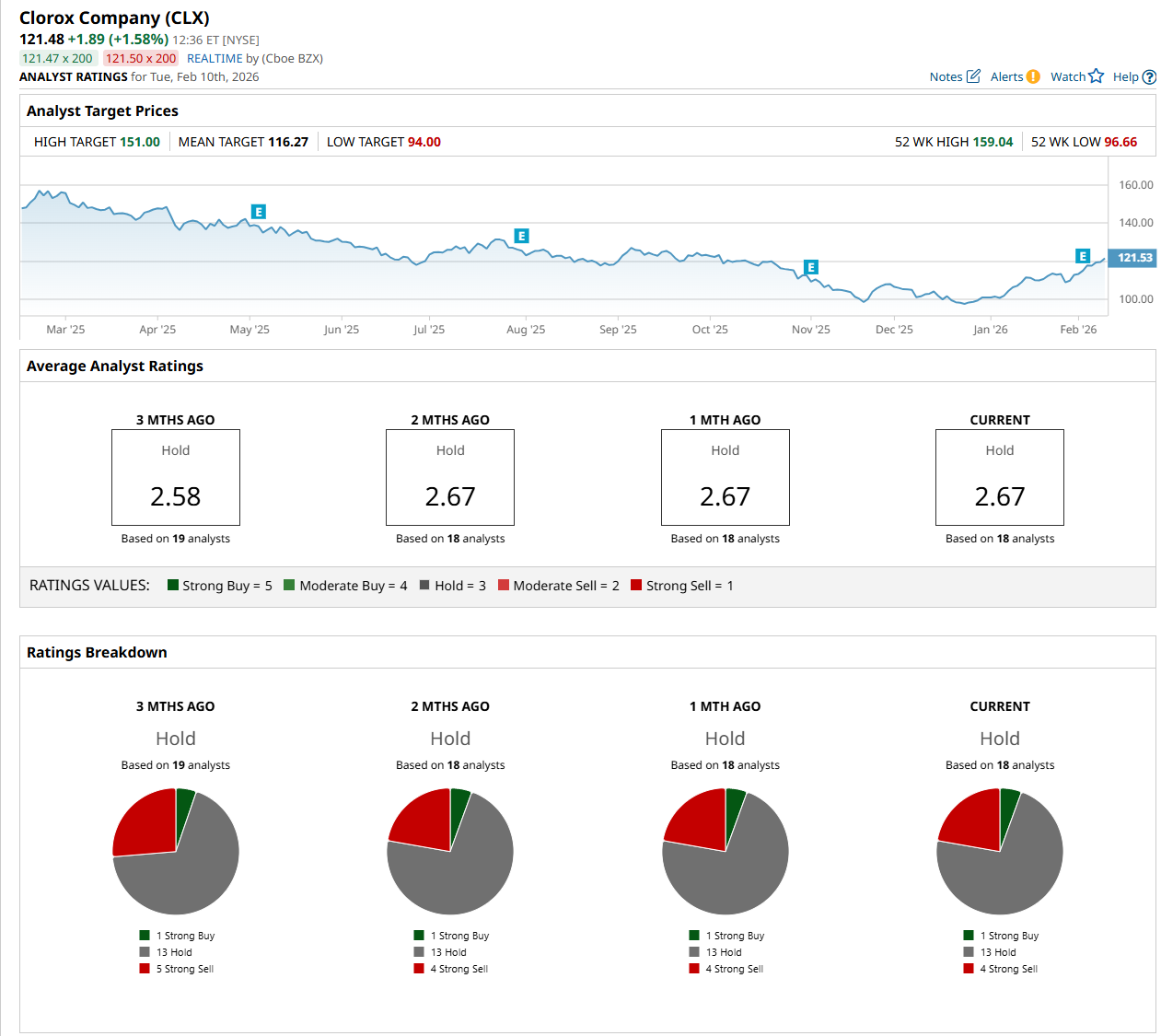

Among the 18 analysts covering the stock, the consensus rating is a "Hold,” which is based on one “Strong Buy,” 13 “Hold,” and four “Strong Sell” ratings.

The configuration is less bearish than three months ago, with five analysts suggesting a “Strong Sell” rating.

On Feb. 5, Morgan Stanley (MS) analyst Dara Mohsenian maintained a “Hold" rating on CLX and set a price target of $136, indicating a 12% potential upside from the current levels.

While the company is trading above its mean price target of $116.27, its Street-high price target of $151 suggests a 24.3% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The Super Bowl Is Over, And Cathie Woods Is Ditching This Key Sports Betting Stock

- Should You Buy BOBS Stock After the Bob’s Discount Furniture IPO?

- Airbnb’s (ABNB) Upcoming Earnings Present a ‘Binary’ Opportunity

- Nasdaq, Inc. Stock Is Off Its Highs, Despite Strong Results - Short Put Plays Work Here