With a market cap of $110.8 billion, CME Group Inc. (CME) is a global operator of contract markets, offering futures and options across asset classes such as interest rates, equity indexes, foreign exchange, commodities, energy, and metals. It also provides clearing, risk management, and market data services to a broad range of institutional and individual market participants worldwide.

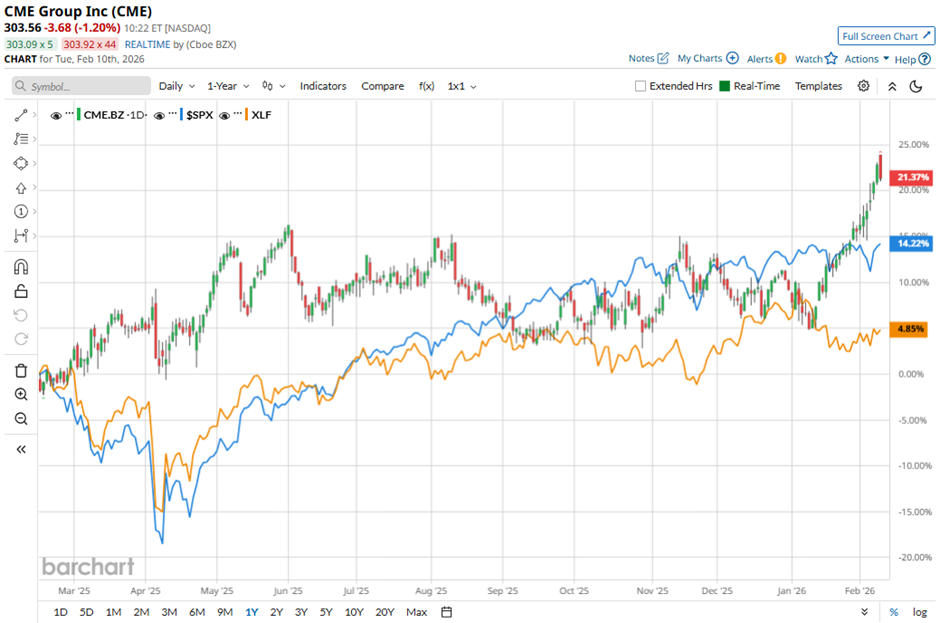

The Chicago, Illinois-based company's shares have outperformed the broader market over the past 52 weeks. CME stock has climbed 27.5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 14.7%. In addition, shares of the company are up 12.9% on a YTD basis, compared to SPX’s 1.7% gain.

Looking closer, CME stock has also outpaced the State Street Financial Select Sector SPDR ETF’s (XLF) 5.5% return over the past 52 weeks.

Shares of CME Group rose marginally on Feb. 4 after the company reported better-than-expected Q4 2025 adjusted EPS of $2.77 and revenue of $1.65 billion. Investor sentiment was further supported by CME posting record full-year 2025 revenue of $6.5 billion, up 6% year-over-year, and highlighting record trading activity with Q4 average daily volume of 27.4 million contracts.

For the fiscal year ending in December 2026, analysts expect CME’s adjusted EPS to grow 4.7% year-over-year to $11.73. The company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

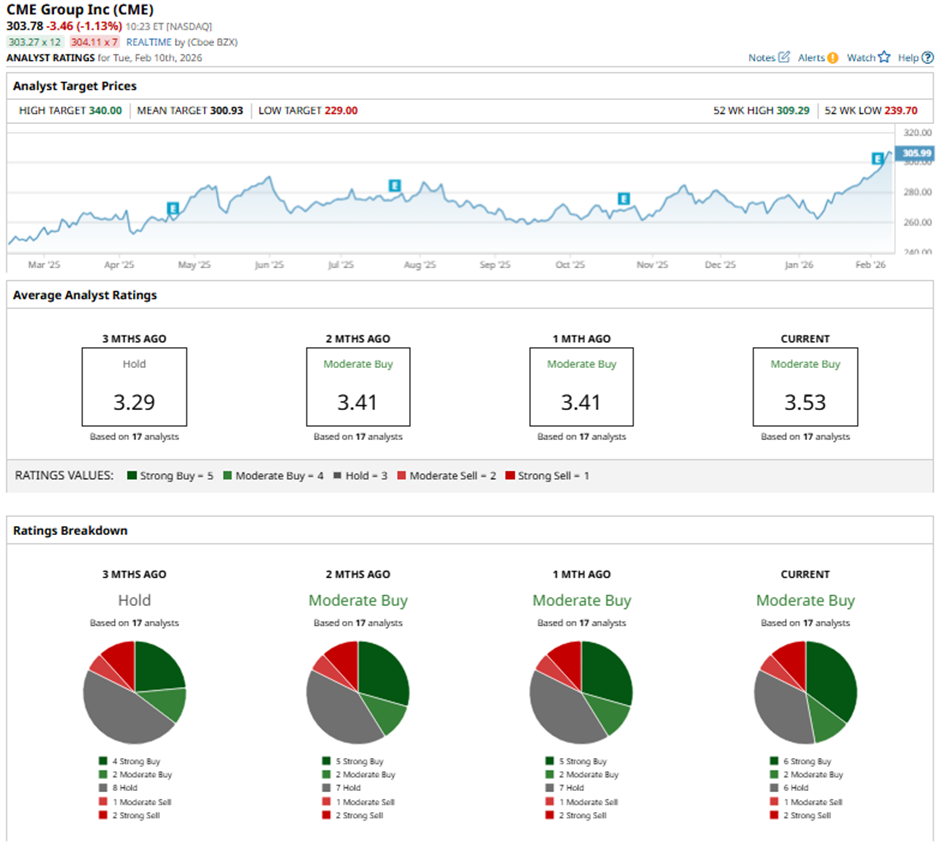

Among the 17 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on six “Strong Buy” ratings, two “Moderate Buys,” six “Holds,” one “Moderate Sell,” and two “Strong Sells.”

On Feb. 6, J.P. Morgan analyst Ken Worthington reiterated a “Sell” rating on CME Group and set a price target of $266.

As of writing, the stock is trading above the mean price target of $300.93. The Street-high price target of $340 implies a potential upside of 11.9% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Stock Will Be Bigger Than Nvidia By the End of 2026

- Covered Call ETF Risks Are on Full Display. Why It Might Get Much Worse.

- Microsoft is Bouncing Back from Its Post-Earnings Price Crash, But Watch This Before You Buy MSFT Stock

- The Bullish Price Surprise That Will Really Surprise You But Shouldn’t