The meteoric rise of covered-call exchange-traded funds (ETFs) — like the JPM Equity Premium Income ETF (JEPI), JPM Nasdaq Equity Premium Income ETF (JEPQ), and GX Nasdaq-100 Covered Call ETF (QYLD) — has been one of the most significant trends the past few years. Total assets in the option-income space now exceed $170 billion. While that is impressive, it is also downright dangerous.

Based on my multi-year immersion into analyzing the space, I suspect a lot of investors are walking around thinking they own something they don’t. And the signs of just how misunderstood these ETFs are is starting to show up. In the form of crashing stock prices on the underlying securities with them.

Investors tend to think that covered-call writing is some form of total return cushion. It is not. And someone needs to wake them up to that fact. I volunteer.

Boomers Watch Their Wealth Go Boom (As in, Up in Smoke)

For many baby boomers entering retirement, these funds appear to be a financial miracle. Double-digit annual yields, delivered monthly, with an expectation of lower volatility. However, beneath the surface of these big payouts is a not-so-hidden tradeoff that may be setting an entire generation up for long-term failure.

The Total Return Mirage

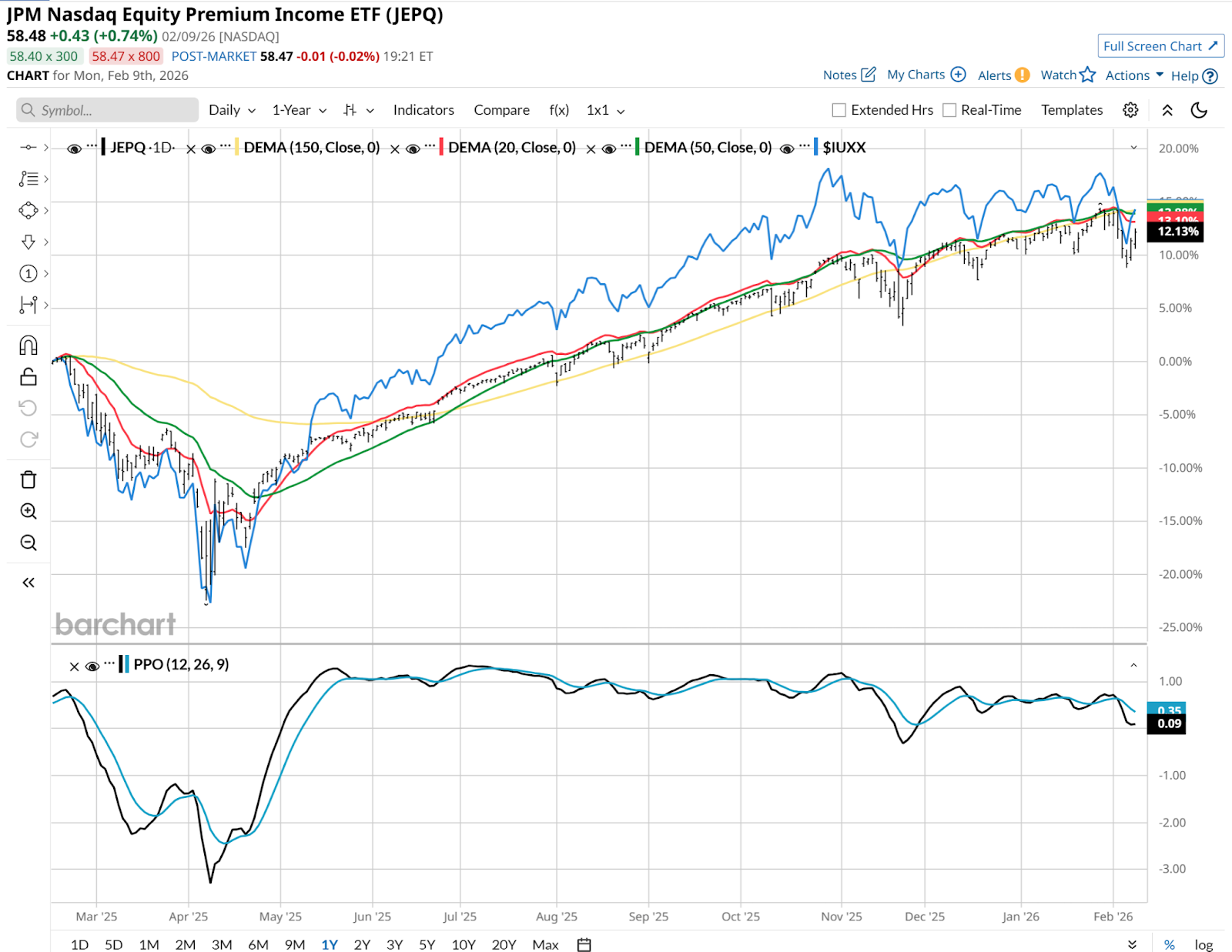

The primary risk of the covered-call strategy is the sacrifice of capital appreciation. These funds work by holding a basket of stocks and selling call options against them to generate premium income. While this provides immediate cash flow, it effectively places a ceiling on the ETF's upside. This picture, with Nasdaq QQQ Invesco ETF (QQQ) in blue in comparison to JEPQ, shows this quite clearly.

But as usual, it is not the upside that concerns me. It is the underestimated risk. With covered-call ETFs, the investor can be forgiven for not being used to the blow dealt by a market that falls and stays down for a while. Because we have not had many of those recently. That only makes the inevitable bear market more of a shock to the system, especially for those of a certain age.

For retirees, this hurts in two ways. First, if your principal does not grow alongside the broader market, you are not building a buffer for the inevitable drawdowns. Even worse, many of these funds suffer from nearly 100% of the downside when the market falls, but capture only 20% to 30% of the upside when it recovers. This asymmetry can lead to a shrinking portfolio that eventually fails to generate the same amount of income, even if the percentage yield remains high.

The Yield-Chase Trap

As of early 2026, the yield on many of these ETFs has fluctuated wildly. For example, investors in popular funds have seen their monthly distributions swing by as much as 30% to 50%, depending on market volatility. This lack of predictability is the exact opposite of what a baby boomer needs for a reliable retirement budget.

Here’s a covered-call ETF, Yieldmax Coin Option Income Strategy ETF (CONY), which tracks Coinbase (COIN) stock. And that’s the problem. It touts a yield of nearly 20%. But that gets erased when the underlying stock falls — such as when COIN’s price was cut in half over the past six months, even after an initial 20% pop higher.

There is also the risk of return of capital. In some cases, when the underlying stocks underperform or the option premiums aren't enough to cover the high distribution targets, the fund may simply pay you back your own money. This reduces the fund's net asset value and further diminishes the future earnings potential of the investment. It is essentially a slow-motion liquidation of your retirement nest egg disguised as a dividend.

This is in the process of becoming a huge issue. Many stocks that have covered-call ETFs issued against them are the high-flyers. And many have run out of jet fuel.

The Bottom Line

Covered-call ETFs are not a magic solution; they are a sophisticated tradeoff, at best. They cap your upside and expose you to nearly full downside. Thus, these funds can lead to a permanent loss of capital that cannot be recovered in a bull market. For baby boomers, the allure of the monthly check may be masking a structural decay that will only become apparent when it is too late to fix.

Rob Isbitts created the ROAR Score, based on his 40+ years of technical analysis experience. ROAR helps DIY investors manage risk and create their own portfolios. His weekly investor letter can be accessed at ETFYourself.com. To copy-trade Rob’s portfolios, check out the new PiTrade app. And, for a change of pace, his new blog on racehorse ownership as an alternative asset is at HorseClaiming.com.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Covered Call ETF Risks Are on Full Display. Why It Might Get Much Worse.

- As Silver Prices Plunge, This CIO Warns That Precious Metals Are Nothing More Than Meme Stocks

- The Best Way To Play Crypto Amid Bitcoin's Stunning Selloff

- As Software Stocks Face a New Apocalypse, Here’s What My Risk and Reward Model Says Comes Next