With a market cap of $146.6 billion, Eaton Corporation plc (ETN) is a global power management company operating across the Americas, Europe, and the Asia Pacific through segments including Electrical, Aerospace, Vehicle, and eMobility. It provides a broad range of electrical, hydraulic, and mechanical solutions serving industrial, aerospace, and automotive markets worldwide.

Shares of the power management company have surpassed the broader market over the past 52 weeks. ETN stock has climbed 23.4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 14.4%. Moreover, shares of the company are up 22.6% on a YTD basis, compared to SPX’s 1.4% gain.

Zooming in further, shares of the Dublin, Ireland-based company have lagged behind the State Street Industrial Select Sector SPDR ETF’s (XLI) 26.5% increase over the past 52 weeks.

Shares of Eaton rose marginally on Feb. 3 after the company reported Q4 2025 results, including record adjusted EPS of $3.33 and sales of $7.1 billion. Investor sentiment was further supported by accelerating demand, with Electrical Americas orders up 16%, Aerospace orders up 11%, and strong backlog growth of 29% in the Electrical segment and 16% in Aerospace, while segment margins hit a Q4 record of 24.9%, above guidance.

For the fiscal year ending in December 2026, analysts expect ETN’s adjusted EPS to grow 10.2% year-over-year to $13.30. The company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

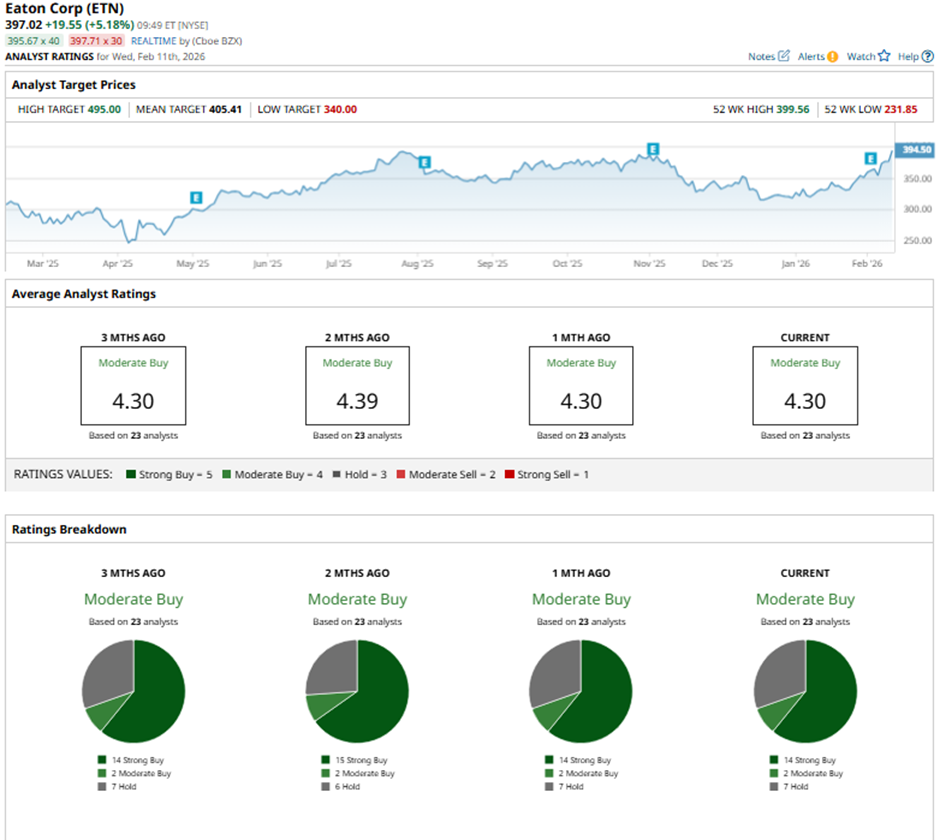

Among the 23 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 14 “Strong Buy” ratings, two “Moderate Buys,” and seven “Holds.”

On Feb. 4, Morgan Stanley raised Eaton’s price target to $425 and maintained an “Overweight” rating.

The mean price target of $405.41 represents a premium of 2.1% to ETN's current levels. The Street-high price target of $495 implies a potential upside of 24.7% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart