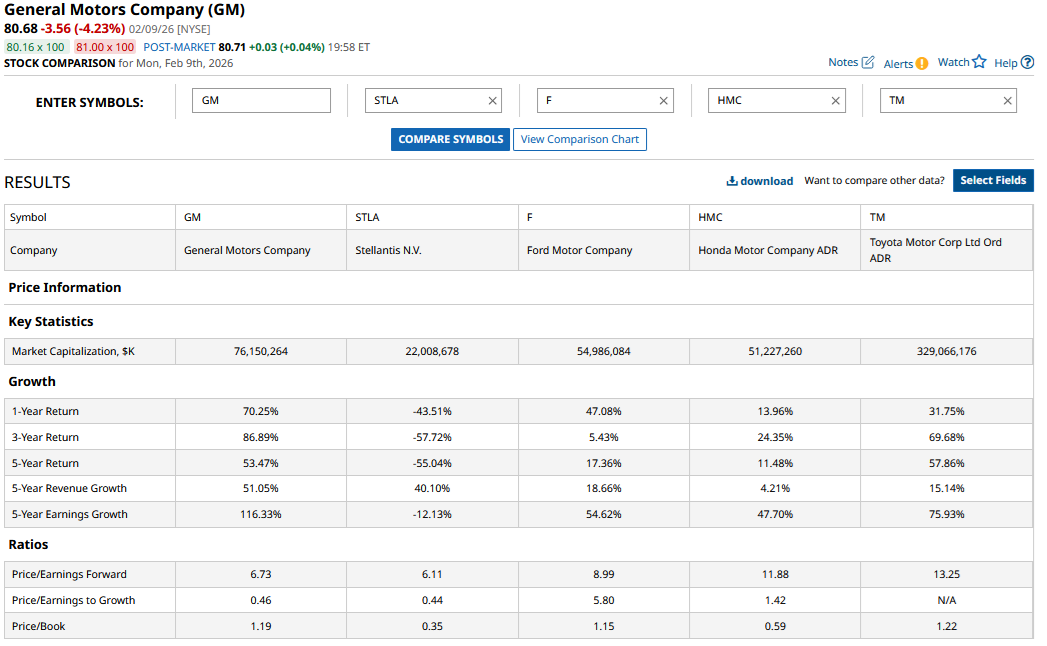

General Motors (GM) stock gained over 50% last year, outperforming the market by a wide margin. The stock has doubled over the last two years, which is well ahead of legacy automakers, including Detroit rivals Stellantis (STLA) and Ford (F). GM’s outperformance becomes all the more noteworthy as it comes amid all the noise over the slowdown in vehicle sales, tariff costs, electric vehicle (EV) losses, and struggles in China, which was once the company's largest market.

GM’s 2025 financial performance was stellar despite all the headwinds, particularly tariff costs, and the company expects its 2026 performance to be even better. The Mary Barra-led company expects its North America adjusted pre-tax margins to be back in the 8% to 10% range this year, which is a major improvement from the previous year. The company expects its adjusted pre-tax earnings to be between $13 billion and $15 billion this year, with the top end of the guidance $2.3 billion higher than in 2025.

GM Is a Free Cash Flow Powerhouse

GM is a free cash flow powerhouse and expects to generate adjusted automotive free cash flows of between $9 billion and $11 billion this year. Notably, while Ford has been spending much of its free cash flows on paying dividends, GM has prioritized buybacks while also investing to ramp up its U.S. production capacity. The increase in U.S. manufacturing made strategic sense for GM, as it is more exposed to President Donald Trump’s tariffs than Ford.

Also, as I have noticed previously, with its shares trading at single-digit price-to-earnings (P/E) multiples, share buybacks have helped GM scoop up its shares at depressed valuations.

GM Increased Its 2026 Dividend By 20%

GM has repurchased $23 billion worth of shares since announcing the accelerated repurchase plan in November 2023, which reduced its outstanding share count by 35%. Last month, the company announced another $6 billion buyback program and increased its dividend by 20%. CFO Paul Jacobson said that the capital return is reflective of the “confidence in our ability to generate strong future cash flows and underscoring our ongoing commitment to returning capital to shareholders.”

GM’s dividend yield has risen to around 0.90% after the hike, and while it is around a fifth of Ford, the stock’s total returns after accounting for the capital gains are well ahead of its Detroit rival. While their differing capital allocation strategies are among the reasons behind the divergence in the price action, with Ford up just about 5% over the last three years, GM has done much better than Ford when it comes to execution, as the Blue Oval continues to be bogged down by recurring warranty and recall issues

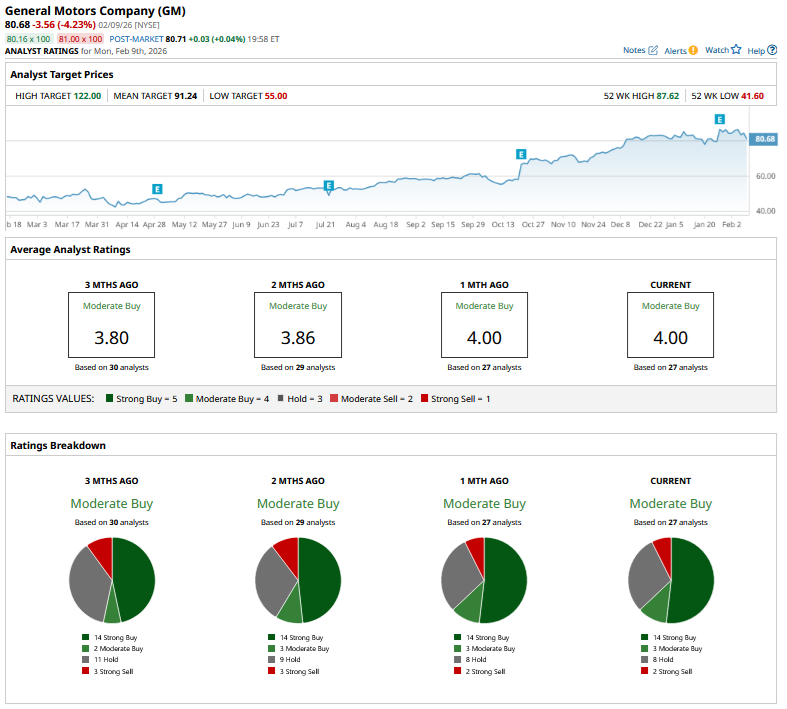

Sell-side analysts have also warmed up to GM, and earlier this year, Piper Sandler upgraded the stock from a “Neutral” to “Overweight” while raising its target price from $66 to $98, which it further increased to $105 following the Q4 earnings last month. In December, Morgan Stanley had also upgraded GM to “Overweight” while nearly doubling its price estimate to $90, which it further bumped to $100 after the Q4 earnings. Among others, the firm’s analyst Andrew Percoco is impressed by GM’s capital discipline.

Several other analysts raised GM’s target price following the Q4 earnings, and its mean target price now sits at $91.24, which is 13% higher than current price levels. As I noted previously, I expect GM shares to rise towards $100 this year, given its tepid valuations with a forward P/E of 6.73x.

Overall, I remain bullish on GM shares as the company’s internal combustion engine (ICE) business continues to do incredibly well, generating tons of free cash flow, which it is using to repurchase its outstanding shares, increasing the per-share earnings in the process. The management has placed the company on the right side of Washington by committing to increasing its U.S. manufacturing footprint. While Ford remains a dividend powerhouse, I believe GM's total returns will surpass Ford's in 2026, just as they did in the last two years.

On the date of publication, Mohit Oberoi had a position in: GM , F . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart