The recent selloff in software stocks has created what many analysts now view as a compelling opportunity for long-term investors, particularly after valuations across the sector took a sharp hit amid rising fears over generative artificial intelligence (AI) disruption. According to Morgan Stanley, the pullback in software multiples, roughly a 33% drop since October 2025, has pushed average valuations back to levels last seen during the peak uncertainty around the public cloud, presenting attractive entry points in high-quality names.

Analyst Keith Weiss argues that fears around AI have been overstated and that investors are underestimating the ability of incumbent software vendors to not just survive but thrive as AI adoption accelerates.

Morgan Stanley spotlighted a few software stocks, including Atlassian Corporation (TEAM), Shopify (SHOP), and Palo Alto Networks (PANW), as some of the most compelling opportunities for investors looking to buy the dip now. Let’s dig deeper.

Software Stock: #1: Atlassian Corporation (TEAM)

Based in Sydney, Australia, Atlassian Corporation is a global enterprise software company best known for its collaboration and productivity tools that help teams plan, track, and manage work, including Jira, Confluence, Trello, and Bitbucket. Atlassian’s market cap sits around $24.5 billion.

TEAM has plunged a whopping 71.2% over the past 52 weeks and 42.7% on a year-to-date (YTD) basis, outpacing the S&P 500 Index’s ($SPX) 14.4% returns over the past year and 1.4% gains this year.

In terms of valuation, the stock trades at 4.6 times, which is higher than the sector median but significantly lower than its own five-year average.

Atlassian released its fiscal second quarter 2026 earnings on Feb. 5, 2026, with results that significantly beat expectations. The company reported revenue of $1.6 billion, representing a year-over-year (YoY) increase of about 23%, and adjusted earnings per share (EPS) of $1.22, well above both the consensus forecasts and the prior year’s figures, where EPS was around $0.96.

Management highlighted strong cloud revenue growth, including its first quarter exceeding $1 billion in cloud revenue, up roughly 26% YoY.

Analysts tracking TEAM project the company’s profit to reach $0.06 per share in 2026, up 107.4% from the prior year.

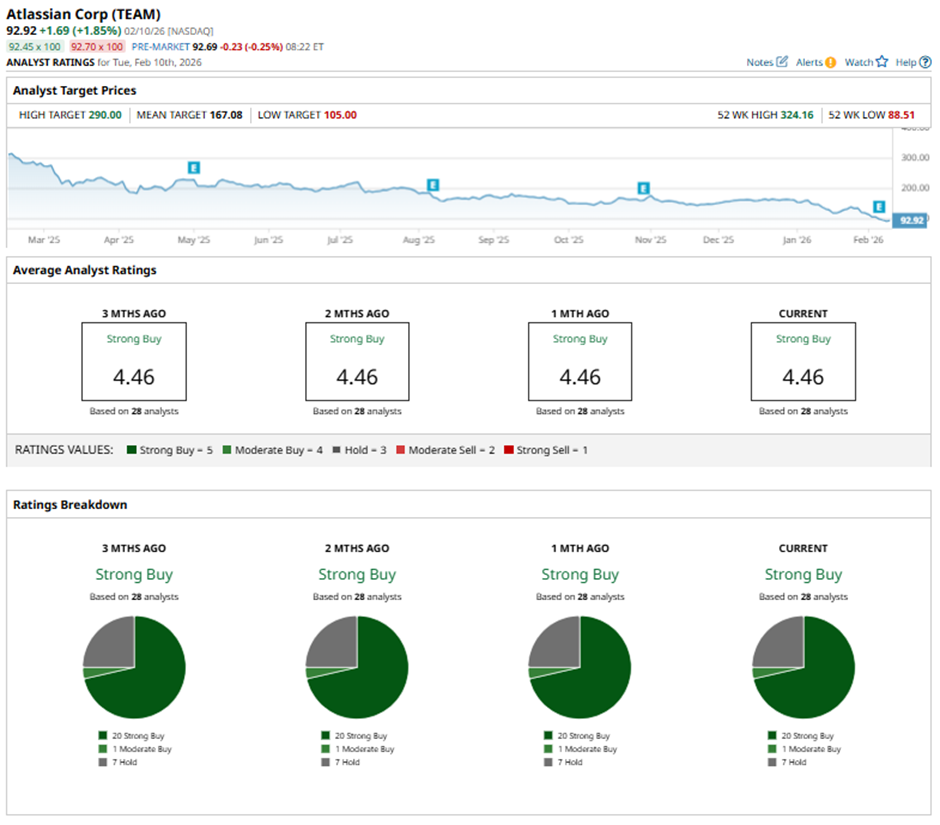

Wall Street’s outlook on the stock is optimistic, with a consensus “Strong Buy” rating overall. Of 28 analysts covering the stock, 20 recommend a “Strong Buy,” one opts for a “Moderate Buy,” and the remaining seven suggest a “Hold.”

The average analyst price target of $167.08 indicates potential upside of nearly 79.8% from the current price levels. The Street-high price target of $290 suggests that TEAM could rally as much as 212.1% from here.

Software Stock #2: Shopify (SHOP)

Shopify is an e-commerce technology company that provides a cloud-based platform enabling businesses of all sizes to create online stores, manage products, process payments, handle shipping, and sell across multiple channels. The company is headquartered in Canada and serves millions of merchants globally. Shopify’s market cap is around $147.9 billion, reflecting its significant position in the global e-commerce and tech landscape.

SHOP stock is up 6.1% over the past 52 weeks but down 21% YTD, lagging the S&P 500 in both time frames.

Priced at 81.59 times forward earnings, the stock trades at a premium to the sector median but a discount to its own five-year average.

Shopify released its Q4 2025 results on Feb. 11, reporting revenue of $3.7 billion, up 31% YoY, and an EPS of about $0.57, beating the consensus estimate, reflecting strong top-line growth and improving profitability.

For Q1 2026, Shopify guided to continued revenue growth in the low-thirties percent range year-over-year and reiterated solid profit trends, signaling confidence in sustained demand and execution in its core e-commerce platform.

Analysts tracking SHOP remain optimistic, projecting an EPS of $1.37 in 2026, up 25.7% YoY.

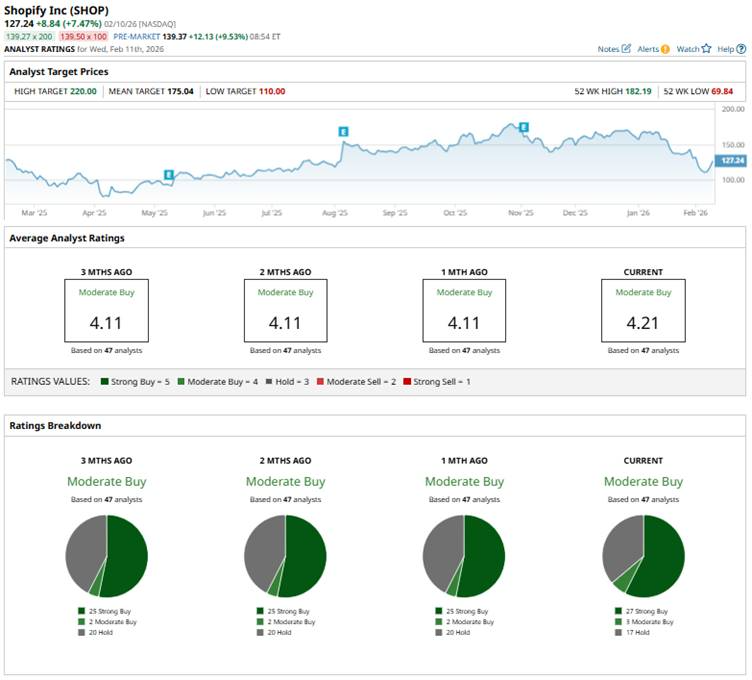

Wall Street is cautiously bullish overall, with a consensus “Moderate Buy” rating for SHOP. Out of the 47 analysts covering the stock, 27 recommend a “Strong Buy,” three advise a “Moderate Buy,” and the remaining 17 analysts are playing it safe with a “Hold.”

The average analyst price target of $175.04 indicates potential upside of 37.6% from the current price, while the Street-high target of $220 suggests that the stock could surge as much as 72.9%.

Software Stock #3: Palo Alto Networks (PANW)

Palo Alto Networks is a leading cybersecurity company headquartered in Santa Clara, California. Founded in 2005, it develops and delivers a comprehensive platform of advanced network security products and cloud-based services designed to protect enterprises and governments worldwide from cyber threats, spanning next-generation firewalls, cloud security, and extended detection and response solutions. Palo Alto Networks has a market cap of around $115.4 billion.

Shares of Palo Alto have declined 14.1% over the past 52 weeks and 8.9% on a YTD basis, underperforming the broader market.

The stock is trading at a premium to the sector median but below its own historical average, at 76.73 times forward earnings.

Palo Alto Networks released its fiscal first quarter 2026 results on Nov. 19, 2025, reporting that total revenue grew 16% YoY to around $2.5 billion, driven by continued demand for its cybersecurity platform and subscription services. The company’s non-GAAP EPS increased to about $0.93, up from around $0.78 in the year-ago quarter and beating expectations.

Alongside these results, Palo Alto Networks provided guidance for the fiscal second quarter of 2026 with expected revenue in the range of $2.57 billion to $2.59 billion and non-GAAP EPS in the range of $0.93 to $0.95.

The company is expected to report its Q2 earnings results on Feb. 17. Analysts expect its profit per share for the quarter to increase 14% YoY to $0.49. Fiscal 2026 profit is expected to be $2.08 per share, up 26.8% YoY, and rise another 15.4% to $2.40 per share in fiscal 2027.

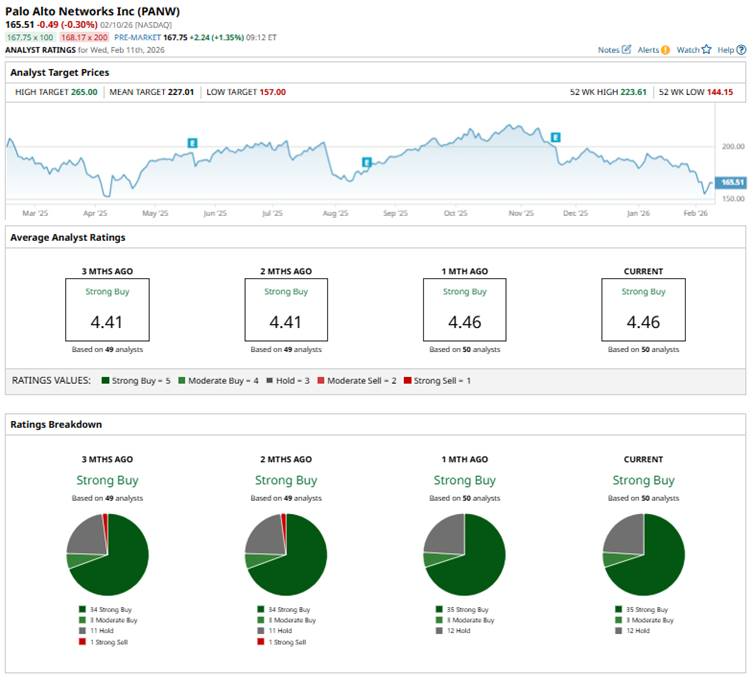

PANW stock has a consensus “Strong Buy” rating overall. Of 50 analysts covering the stock, 35 recommend a “Strong Buy,” three advise a “Moderate Buy,” and the remaining 12 suggest a “Hold.”

The average analyst price target of $227.01 indicates potential upside of nearly 37.2% from the current price levels. The Street-high price target of $265 suggests that the stock could rally as much as 60.1% from here.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart