The Artificial Intelligence driven ETF (Exchange Traded Fund) AMOM (NYSEARCA: AMOM) has released its latest holdings list, making a surprising pivot into some consumer names and equally unexpected rotations out of others. Of course, the largest holding within this fund was NVIDIA (NASDAQ: NVDA), as the company reached a record one trillion dollar market capitalization amid the new rush of interest in its chips, enabling the new wave of generative artificial intelligence technology.

What shocks Monster Beverage (NASDAQ: MNST) shareholders is that the fund sold out of its entire position, which previously represented a mere 2.72% of holdings. Some may have attributed the decision to the recent rallies in the stock, as it reached a current all-time high price of $60.47 per share. However, valuation multiples, accompanied by continued growth in the latest earnings press release, may raise some suspicion about why the fund decided to unload an outperforming stock from its holdings.

Comparable Holdings in the Fund

While in the same sector as Monster Beverage, AMOM ETF held onto its 2.43% weighing of Starbucks (NASDAQ: SBUX). Monster Beverage charts will show that the stock outperformed Starbucks by approximately 6.7% during the past twelve months while also carrying a higher multiple of earnings valuation. A 47.6x P/E ratio for Monster is relative to Starbucks' 31.5x and can be taken as a double-edged sword. A richer multiple may indicate that investors are willing to pay a more significant premium for the company's underlying current - and future - earnings over those relative earnings generated by Starbucks.

This willingness to "overpay" can be attributed to a higher ROA (return on assets), where Monster achieved a 12.3% versus that 10.4% for Starbucks. Monster's first quarter 2023 earnings press release will also showcase margin improvements, as gross margins advanced alongside a contraction in operating expenses as a percentage of sales. These boosts can be attributed to the company implementing core channel development technologies, such as more modern vending machines and distribution centers — hardly any reason to think that A.I. will not have its share of contribution to these margin-boosting advancements.

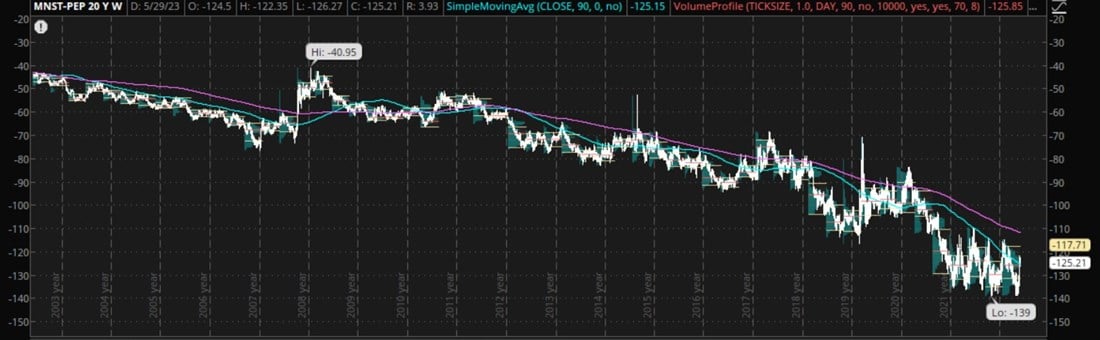

Besides, on comparative performance, it would seem that Monster stock still has room to keep outperforming Starbucks. The above image expresses the 'spread' between the two stock prices, computed as the value of Monster stock minus the value of Starbucks stock over time.

This time series would show that the spread, as it currently stands, has yet to reach its 52-week high or even its three-year high. Testing these highs would imply that Monster stock will continue to rise relative to Starbucks, which may either rise slower than Monster or even decline relative to Monster.

Further Comparisons, Room for Growth

Investors would benefit from further analysis of Monster's relationship to its sector, outside of AMOM ETF's decision to unload the stock. PepsiCo (NASDAQ: PEP) has been on a similar rise, though still underperforming Monster by 21.4% over the past twelve months. Carrying a 38.6x P/E ratio would suggest a similar dynamic in PepsiCo, where investors are placing a higher value on the underlying earnings of Monster in relation. What poses a more interesting perspective for investors is the similar 'spread' comparison between the two companies. From this angle, Monster stock is set to outperform PepsiCo significantly.

Lastly, investors can look to the ultimate business moat in the soft-drink giant Coca-Cola (NYSE: KO), where the previous dynamics take a sharp turn. Although Coca-Cola carries a 26.3x P/E ratio, compared to the higher perceived value in Monster, current market conditions are beginning to turn. Investors prefer predictable cash flows and dividends over aggressive growth, where Coca-Cola reigns in the former and Monster dominates the latter. Monster Energy posted record first-quarter revenues and grew their net income by 21.4% during the past twelve months; these conditions allowed for a $682.8 million share repurchase program to be implemented during 2023. On the other hand, Coca-Cola pays out a handsome 3.8% dividend to cushion any headwinds in industry dynamics.

Considering this relationship, it is unsurprising that Monster also outperformed Coca-Cola by 26.8% during the past twelve months. The 'spread' between these two companies will solidify market viewpoints placing a higher perceived value on the growth of Monster, which by all dynamics is expected to continue to grow, especially after its first quarter 2023 results.