The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Boot Barn (NYSE: BOOT) and the rest of the apparel and footwear retail stocks fared in Q2.

Apparel and footwear was once a category thought to be relatively safe from major e-commerce penetration because of the need to try on, touch, and feel products, but the category is now meaningfully transacted online. Everyone still needs clothes and shoes to go outside unless they want some curious (or horrified) looks. But this ongoing digitization is forcing apparel and footwear retailers–that once only had brick-and-mortar stores–to respond with omnichannel offerings. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stagnate, so the evolution of clothing and shoes sellers marches on.

The 12 apparel and footwear retail stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 0.8% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 6.4% since the latest earnings results.

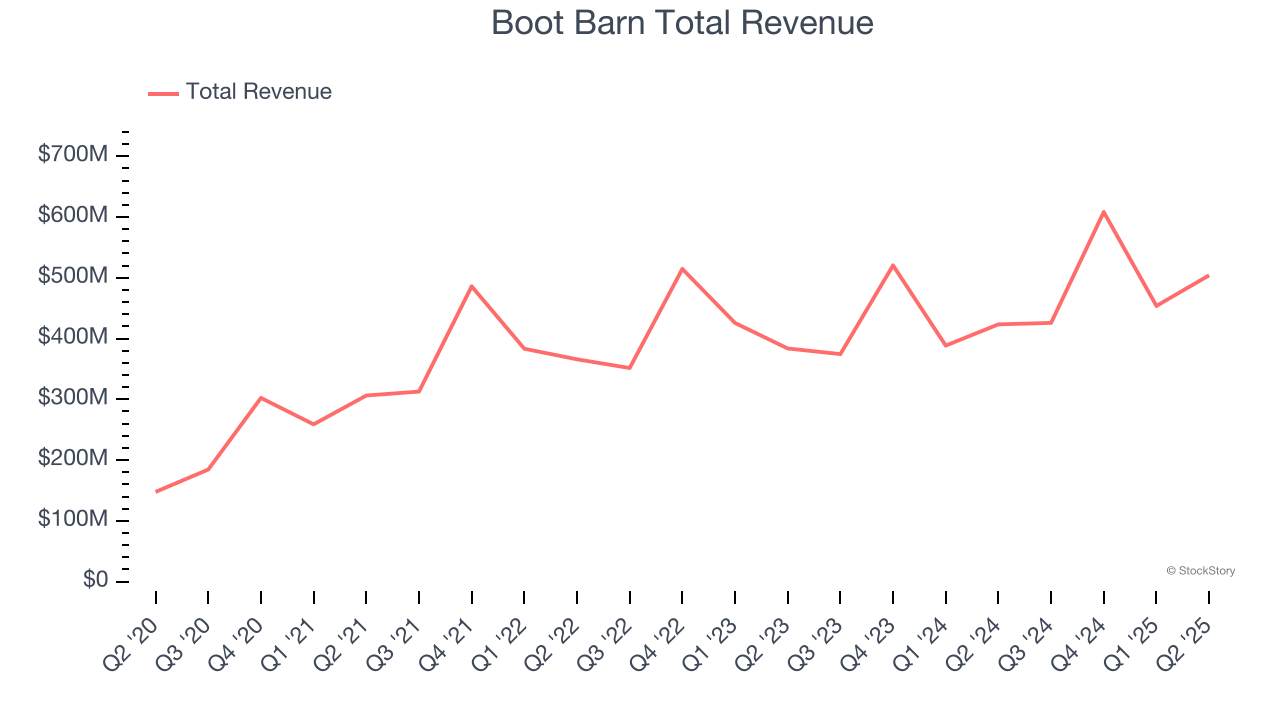

Boot Barn (NYSE: BOOT)

With a strong store presence in Texas, California, Florida, and Oklahoma, Boot Barn (NYSE: BOOT) is a western-inspired apparel and footwear retailer.

Boot Barn reported revenues of $504.1 million, up 19.1% year on year. This print exceeded analysts’ expectations by 1.5%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ EBITDA estimates and EPS guidance for next quarter exceeding analysts’ expectations.

John Hazen, Chief Executive Officer, commented, “We are pleased with our strong start to fiscal 2026, highlighted by high-single digit consolidated same-store sales growth and successful new store openings, which drove 19% overall revenue growth. Demand was broad-based, with strength across all major merchandise categories and geographies. At the same time, we improved gross profit 210 basis points, led by robust merchandise margin expansion which, along with solid expense control, fueled a 38% increase in earnings per diluted share. As a result of our better than expected first quarter performance and the continued strength we have seen as we moved into our second quarter, we are raising our full-year outlook while maintaining our prior guidance for the second half of the year. With our four strategic initiatives delivering consistent results and the opportunity we have to double our store count, we remain confident in our ability to continue generating value for our shareholders over the long term.”

Boot Barn scored the fastest revenue growth but had the weakest full-year guidance update of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 2.2% since reporting and currently trades at $168.

Is now the time to buy Boot Barn? Access our full analysis of the earnings results here, it’s free for active Edge members.

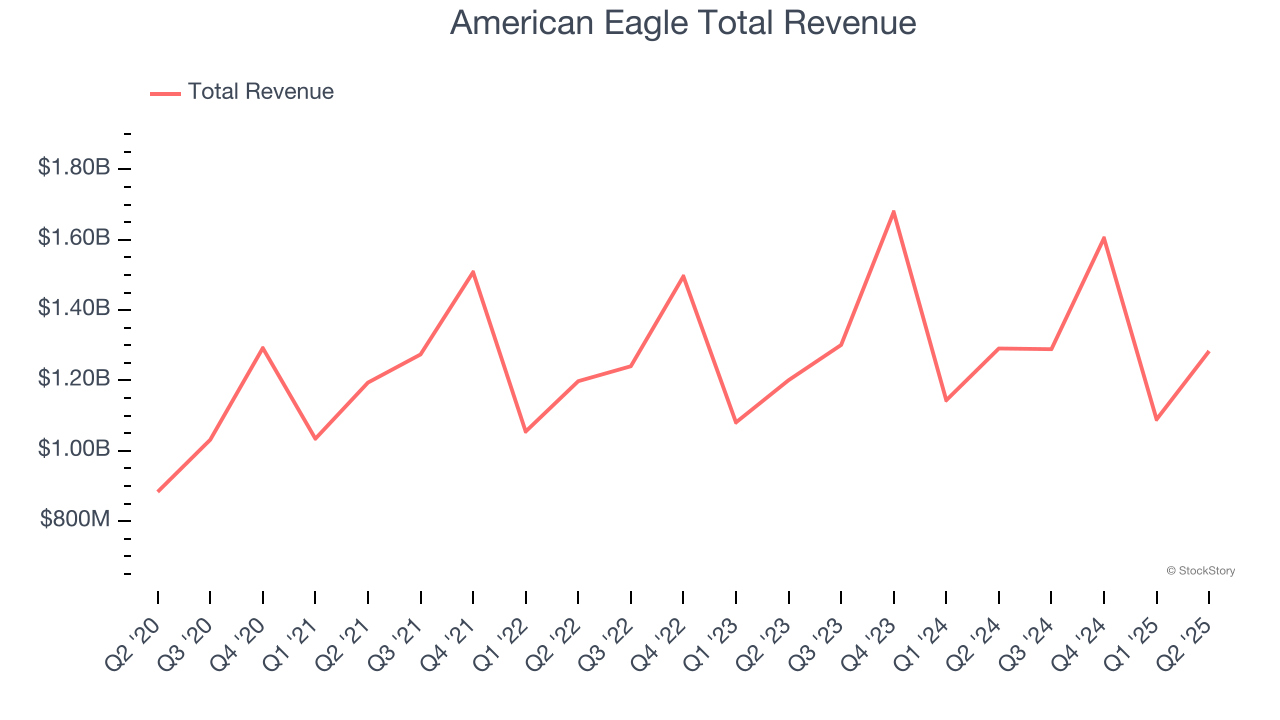

Best Q2: American Eagle (NYSE: AEO)

With a heavy focus on denim, American Eagle Outfitters (NYSE: AEO) is a specialty retailer offering an assortment of apparel and accessories to young adults.

American Eagle reported revenues of $1.28 billion, flat year on year, outperforming analysts’ expectations by 4%. The business had an incredible quarter with a beat of analysts’ EPS and gross margin estimates.

The market seems happy with the results as the stock is up 10.7% since reporting. It currently trades at $15.10.

Is now the time to buy American Eagle? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: Torrid (NYSE: CURV)

Promoting a message of body positivity and inclusiveness, Torrid Holdings (NYSE: CURV) is a plus-size women’s apparel and accessories retailer.

Torrid reported revenues of $262.8 million, down 7.7% year on year, exceeding analysts’ expectations by 0.9%. Still, it was a disappointing quarter as it posted full-year EBITDA guidance missing analysts’ expectations significantly and revenue guidance for next quarter missing analysts’ expectations.

As expected, the stock is down 31.4% since the results and currently trades at $1.64.

Read our full analysis of Torrid’s results here.

Victoria's Secret (NYSE: VSCO)

Spun off from L Brands in 2020, Victoria’s Secret (NYSE: VSCO) is an intimate clothing and beauty retailer that sells its own brands of lingerie, undergarments, and personal fragrances.

Victoria's Secret reported revenues of $1.46 billion, up 3% year on year. This result topped analysts’ expectations by 4%. It was a very strong quarter as it also produced a beat of analysts’ EPS and EBITDA estimates.

Victoria's Secret scored the biggest analyst estimates beat among its peers. The stock is up 31.4% since reporting and currently trades at $29.90.

Read our full, actionable report on Victoria's Secret here, it’s free for active Edge members.

Shoe Carnival (NASDAQ: SCVL)

Known for its playful atmosphere that features carnival elements, Shoe Carnival (NASDAQ: SCVL) is a retailer that sells footwear from mainstream brands for the entire family.

Shoe Carnival reported revenues of $306.4 million, down 7.9% year on year. This print came in 2.5% below analysts' expectations. Aside from that, it was a strong quarter as it put up an impressive beat of analysts’ gross margin estimates and a solid beat of analysts’ EBITDA estimates.

Shoe Carnival had the weakest performance against analyst estimates and slowest revenue growth among its peers. The stock is down 7.7% since reporting and currently trades at $19.85.

Read our full, actionable report on Shoe Carnival here, it’s free for active Edge members.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.