What a fantastic six months it’s been for Goldman Sachs. Shares of the company have skyrocketed 44%, hitting $790.44. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is it too late to buy GS? Find out in our full research report, it’s free for active Edge members.

Why Do Investors Watch Goldman Sachs?

Founded in 1869 as a small commercial paper business in New York City, Goldman Sachs (NYSE: GS) is a global financial institution that provides investment banking, securities, asset management, and consumer banking services to corporations, governments, and individuals.

Three Things to Like:

1. Encouraging Short-Term Revenue Growth

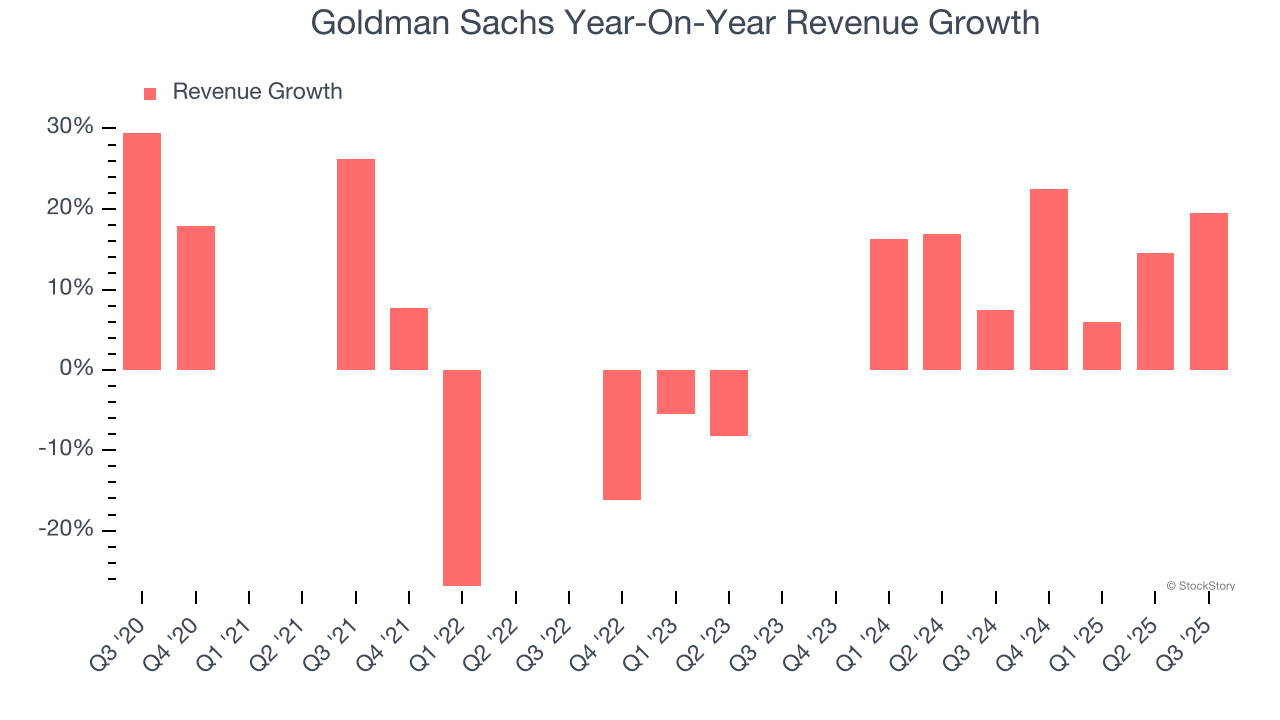

We at StockStory place the most emphasis on long-term growth, but within financials, a stretched historical view may miss recent interest rate changes, market returns, and industry trends. Goldman Sachs’s annualized revenue growth of 13.5% over the last two years is above its five-year trend, suggesting its demand recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

2. EPS Increasing Steadily

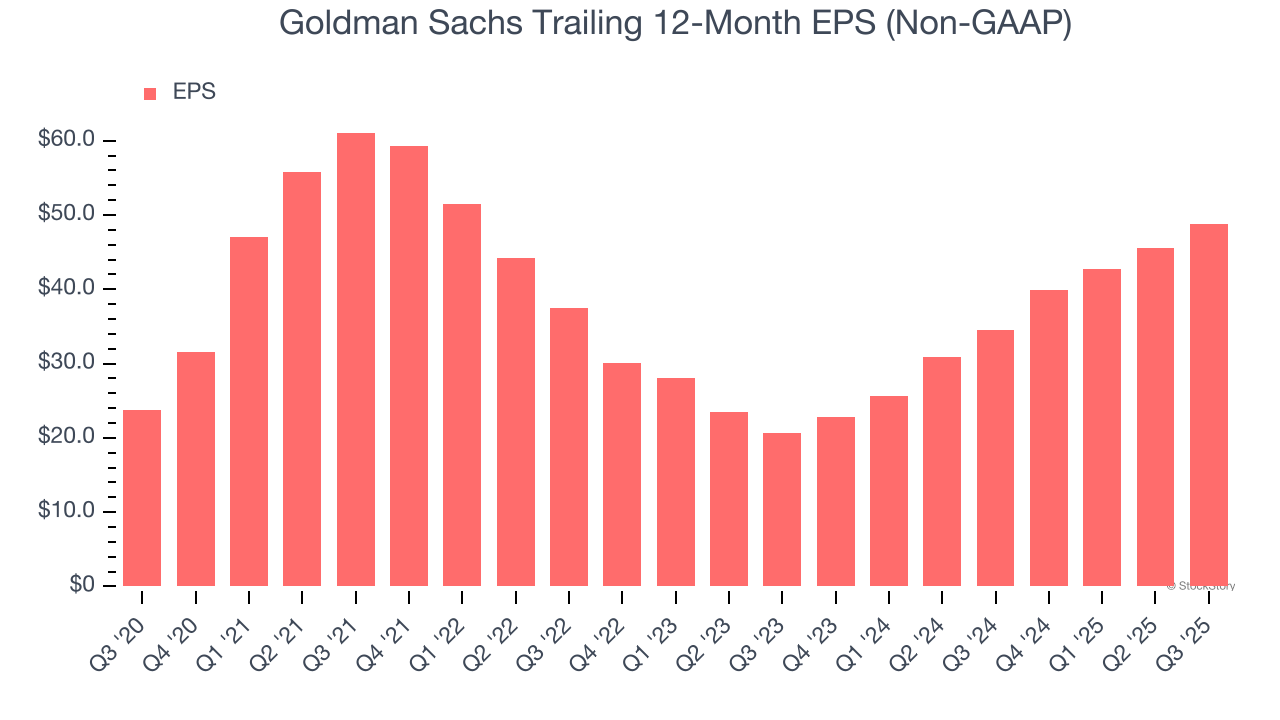

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Goldman Sachs’s EPS grew at a solid 15.5% compounded annual growth rate over the last five years, higher than its 6.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

3. TBVPS Growth Demonstrates Strong Asset Foundation

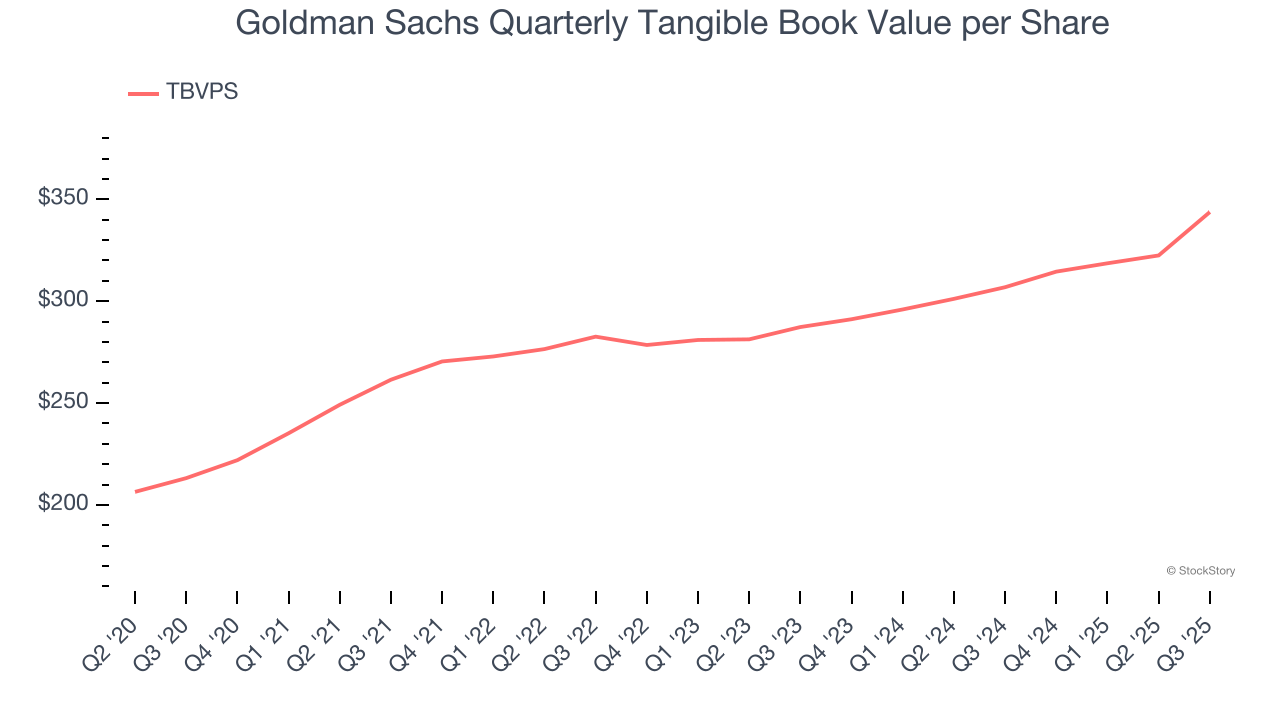

Tangible book value per share (TBVPS) is a crucial metric that measures the actual value of shareholders’ equity, stripping out goodwill and other intangible assets that may not be recoverable in a worst-case scenario.

Goldman Sachs’s TBVPS increased by 10% annually over the last five years, and the past two years show a similar trajectory as TBVPS grew at a decent 9.4% annual clip (from $287.32 to $343.75 per share).

Final Judgment

Goldman Sachs possesses several positive attributes, and with the recent rally, the stock trades at 14.7× forward P/E (or $790.44 per share). Is now a good time to buy despite the apparent froth? See for yourself in our comprehensive research report, it’s free for active Edge members .

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.