Beauty products company Coty (NYSE: COTY) fell short of the market’s revenue expectations in Q1 CY2025, with sales falling 6.2% year on year to $1.30 billion. Its non-GAAP profit of $0.01 per share was 81% below analysts’ consensus estimates.

Is now the time to buy Coty? Find out by accessing our full research report, it’s free.

Coty (COTY) Q1 CY2025 Highlights:

- Revenue: $1.30 billion vs analyst estimates of $1.31 billion (6.2% year-on-year decline, 1% miss)

- Adjusted EPS: $0.01 vs analyst expectations of $0.05 (81% miss)

- Adjusted EBITDA: $204.2 million vs analyst estimates of $188.4 million (15.7% margin, 8.4% beat)

- Operating Margin: 17.4%, up from 5.6% in the same quarter last year

- Free Cash Flow was -$168.4 million compared to -$234.3 million in the same quarter last year

- Organic Revenue was flat year on year

- Market Capitalization: $4.50 billion

"Across economic cycles, beauty has remained resilient for decades. Even in this challenging landscape, we have significantly strengthened our strategic, operational, and financial fundamentals, driving margin expansion, stronger cash flow generation, and substantial deleveraging over the past four years,” said Sue Nabi, Coty's CEO.

Company Overview

With a portfolio boasting many household brands, Coty (NYSE: COTY) is a beauty products powerhouse spanning cosmetics, fragrances, and skincare.

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $6.00 billion in revenue over the past 12 months, Coty carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

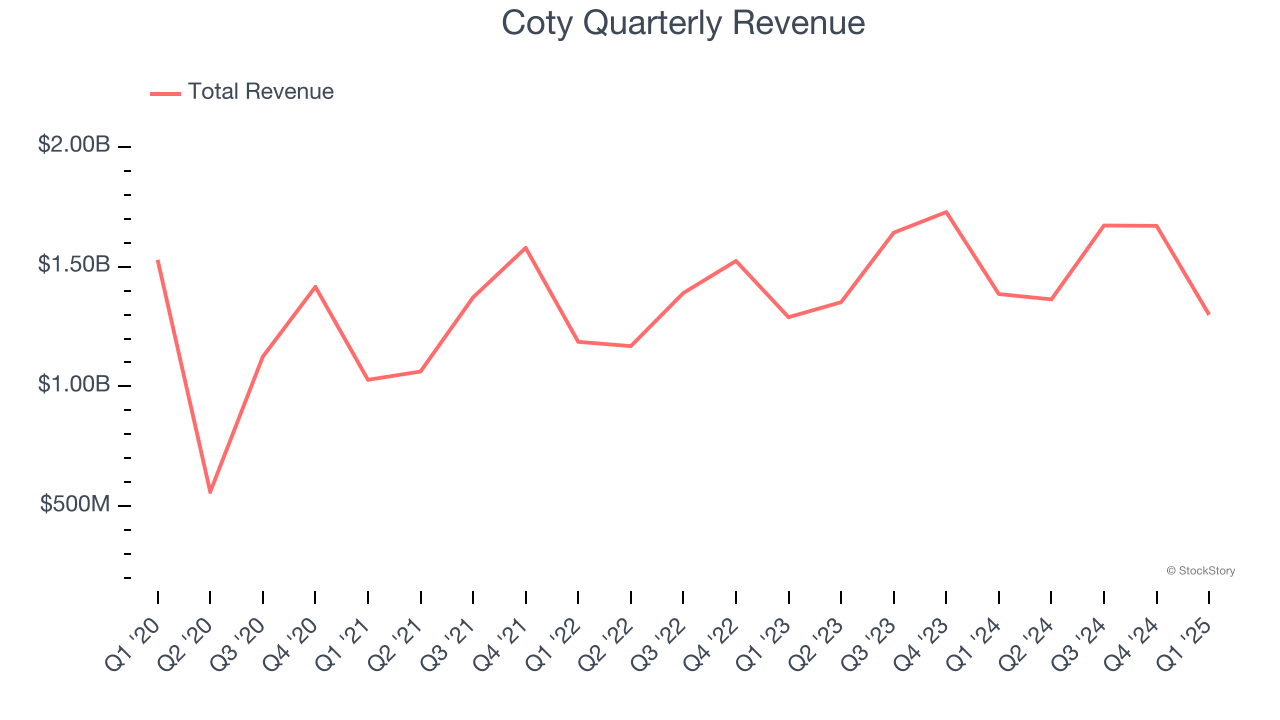

As you can see below, Coty’s 4.9% annualized revenue growth over the last three years was tepid. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

This quarter, Coty missed Wall Street’s estimates and reported a rather uninspiring 6.2% year-on-year revenue decline, generating $1.30 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 1.6% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and indicates its products will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

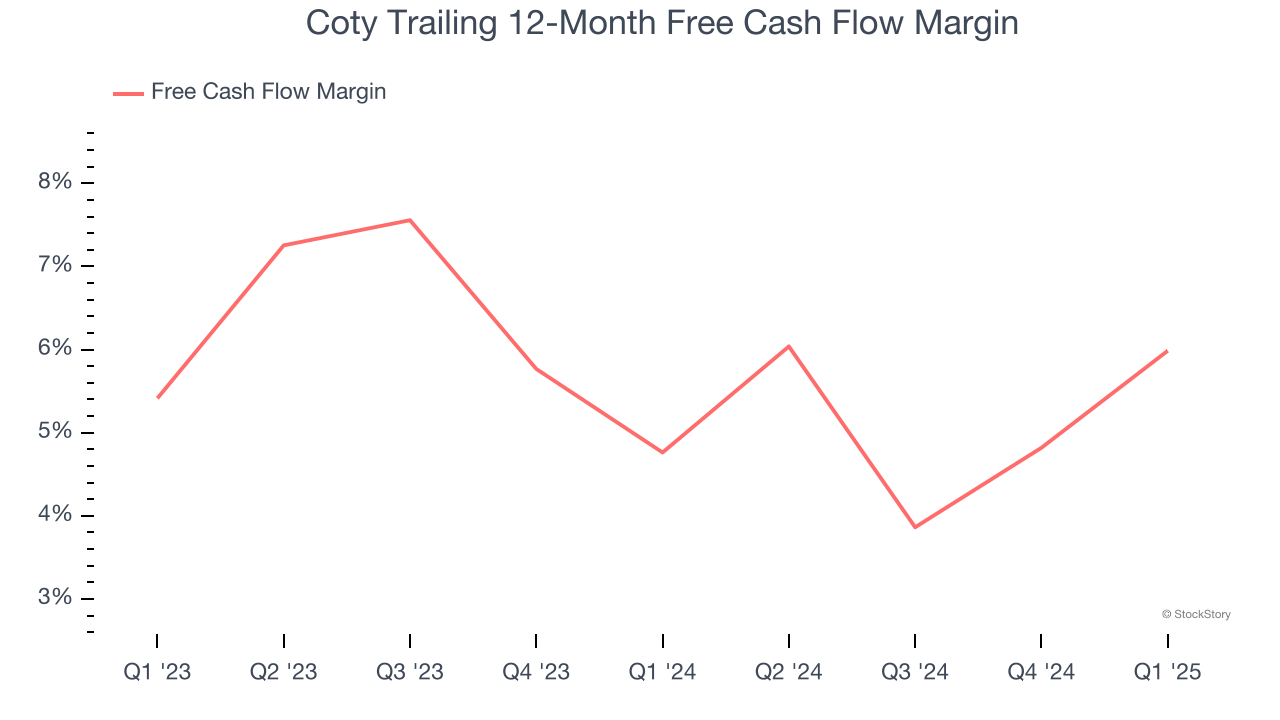

Coty has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 5.4% over the last two years, slightly better than the broader consumer staples sector.

Taking a step back, we can see that Coty’s margin expanded by 1.2 percentage points over the last year. This is encouraging because it gives the company more optionality.

Coty burned through $168.4 million of cash in Q1, equivalent to a negative 13% margin. The company’s cash burn slowed from $234.3 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, indicating it is a seasonal business that must build up inventory during certain quarters.

Key Takeaways from Coty’s Q1 Results

We were impressed by how significantly Coty blew past analysts’ EBITDA expectations this quarter. On the other hand, its revenue and EPS missed (though its organic revenue beat). Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The areas below expectations seem to be driving the move, and the stock traded down 2.6% to $5.03 immediately following the results.

So do we think Coty is an attractive buy at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.