The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Oshkosh (NYSE: OSK) and the rest of the heavy transportation equipment stocks fared in Q2.

Heavy transportation equipment companies are investing in automated vehicles that increase efficiencies and connected machinery that collects actionable data. Some are also developing electric vehicles and mobility solutions to address customers’ concerns about carbon emissions, creating new sales opportunities. Additionally, they are increasingly offering automated equipment that increases efficiencies and connected machinery that collects actionable data. On the other hand, heavy transportation equipment companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the construction and transport volumes that drive demand for these companies’ offerings.

The 12 heavy transportation equipment stocks we track reported a very strong Q2. As a group, revenues beat analysts’ consensus estimates by 2.4%.

Thankfully, share prices of the companies have been resilient as they are up 7.9% on average since the latest earnings results.

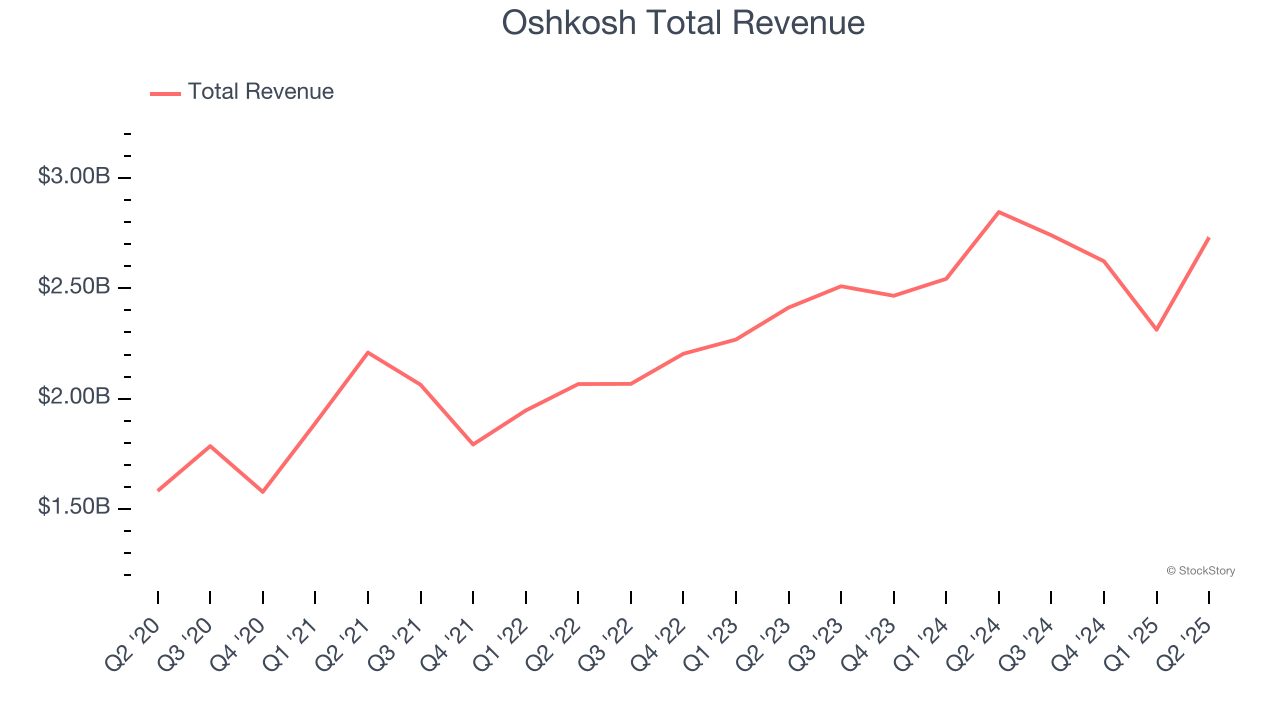

Oshkosh (NYSE: OSK)

Oshkosh (NYSE: OSK) manufactures specialty vehicles for the defense, fire, emergency, and commercial industry, operating various brand subsidiaries within each industry.

Oshkosh reported revenues of $2.73 billion, down 4% year on year. This print exceeded analysts’ expectations by 0.7%. Overall, it was a stunning quarter for the company with a solid beat of analysts’ backlog estimates and an impressive beat of analysts’ EBITDA estimates.

“We delivered a strong second quarter, with adjusted earnings per share of $3.41, up 2.1 percent from the prior year, reflecting disciplined execution and broad-based strength across our portfolio,” said John Pfeifer, president and chief executive officer of Oshkosh Corporation.

Interestingly, the stock is up 9.6% since reporting and currently trades at $138.76.

Is now the time to buy Oshkosh? Access our full analysis of the earnings results here, it’s free.

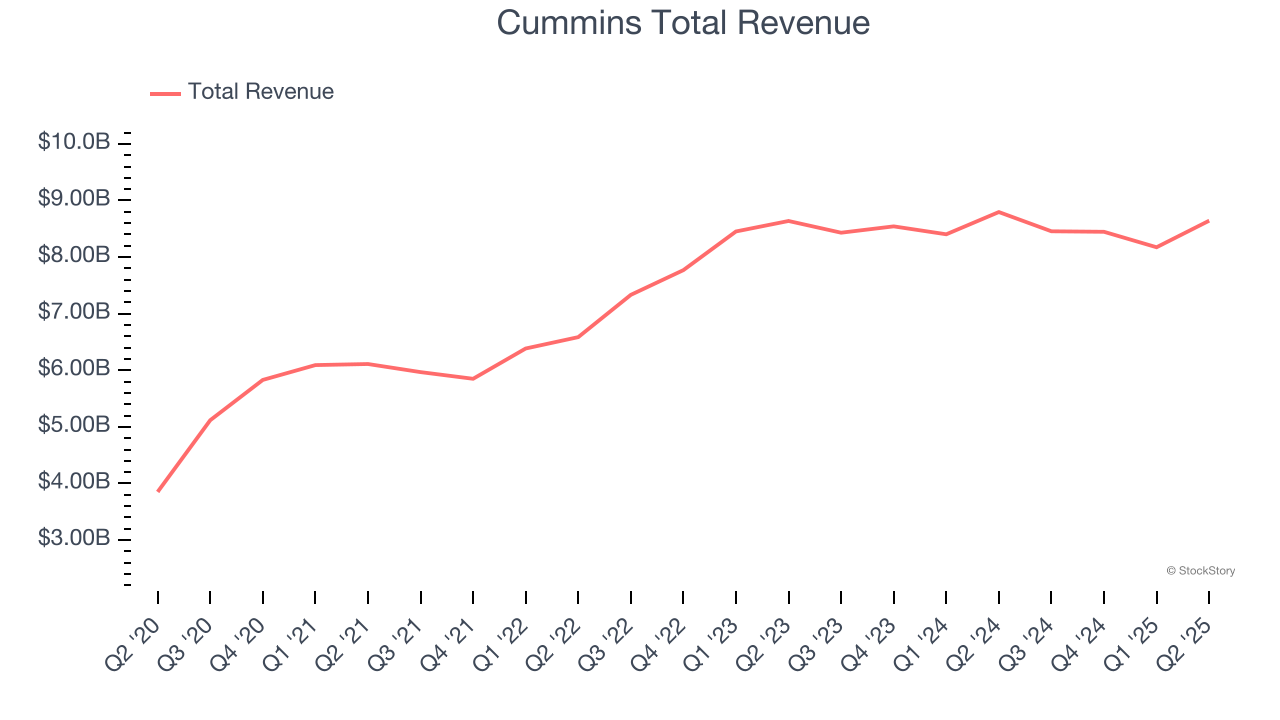

Best Q2: Cummins (NYSE: CMI)

With more than half of the heavy-duty truck market using its engines at one point, Cummins (NYSE: CMI) offers engines and power systems.

Cummins reported revenues of $8.64 billion, down 1.7% year on year, outperforming analysts’ expectations by 3.4%. The business had an incredible quarter with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ adjusted operating income estimates.

The market seems happy with the results as the stock is up 10.3% since reporting. It currently trades at $399.

Is now the time to buy Cummins? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Trinity (NYSE: TRN)

Operating under the trade name TrinityRail, Trinity (NYSE: TRN) is a provider of railcar products and services in North America.

Trinity reported revenues of $506.2 million, down 39.8% year on year, falling short of analysts’ expectations by 13.3%. It was a slower quarter as it posted a significant miss of analysts’ EPS estimates and a miss of analysts’ EBITDA estimates.

Trinity delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 14.8% since the results and currently trades at $28.69.

Read our full analysis of Trinity’s results here.

PACCAR (NASDAQ: PCAR)

Founded more than a century ago, PACCAR (NASDAQ: PCAR) designs and manufactures commercial trucks of various weights and sizes for the commercial trucking industry.

PACCAR reported revenues of $6.96 billion, down 15.7% year on year. This result topped analysts’ expectations by 2.6%. It was an exceptional quarter as it also produced an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ adjusted operating income estimates.

The stock is up 6.5% since reporting and currently trades at $98.92.

Read our full, actionable report on PACCAR here, it’s free.

Douglas Dynamics (NYSE: PLOW)

Once manufacturing snowplows designed for the iconic jeep vehicle precursor, Douglas Dynamics (NYSE: PLOW) offers snow and ice equipment for the roads and sidewalks.

Douglas Dynamics reported revenues of $194.3 million, down 2.8% year on year. This print beat analysts’ expectations by 6.3%. Overall, it was an exceptional quarter as it also logged a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Douglas Dynamics scored the highest full-year guidance raise among its peers. The stock is up 11.6% since reporting and currently trades at $31.57.

Read our full, actionable report on Douglas Dynamics here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.