Since August 2020, the S&P 500 has delivered a total return of 88.4%. But one standout stock has more than doubled the market - over the past five years, Booking has surged 208% to $5,452 per share. Its momentum hasn’t stopped as it’s also gained 11% in the last six months thanks to its solid quarterly results, beating the S&P by 6.4%.

Following the strength, is BKNG a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Does BKNG Stock Spark Debate?

Formerly known as The Priceline Group, Booking Holdings (NASDAQ: BKNG) is the world’s largest online travel agency.

Two Positive Attributes:

1. Room Nights Booked Drive Additional Growth Opportunities

As an online travel company, Booking generates revenue growth by increasing both the number of stays (or experiences) booked and the commission charged on those bookings.

Over the last two years, Booking’s room nights booked, a key performance metric for the company, increased by 9.5% annually to 309 million in the latest quarter. This growth rate is solid for a consumer internet business and indicates people are excited about its offerings.

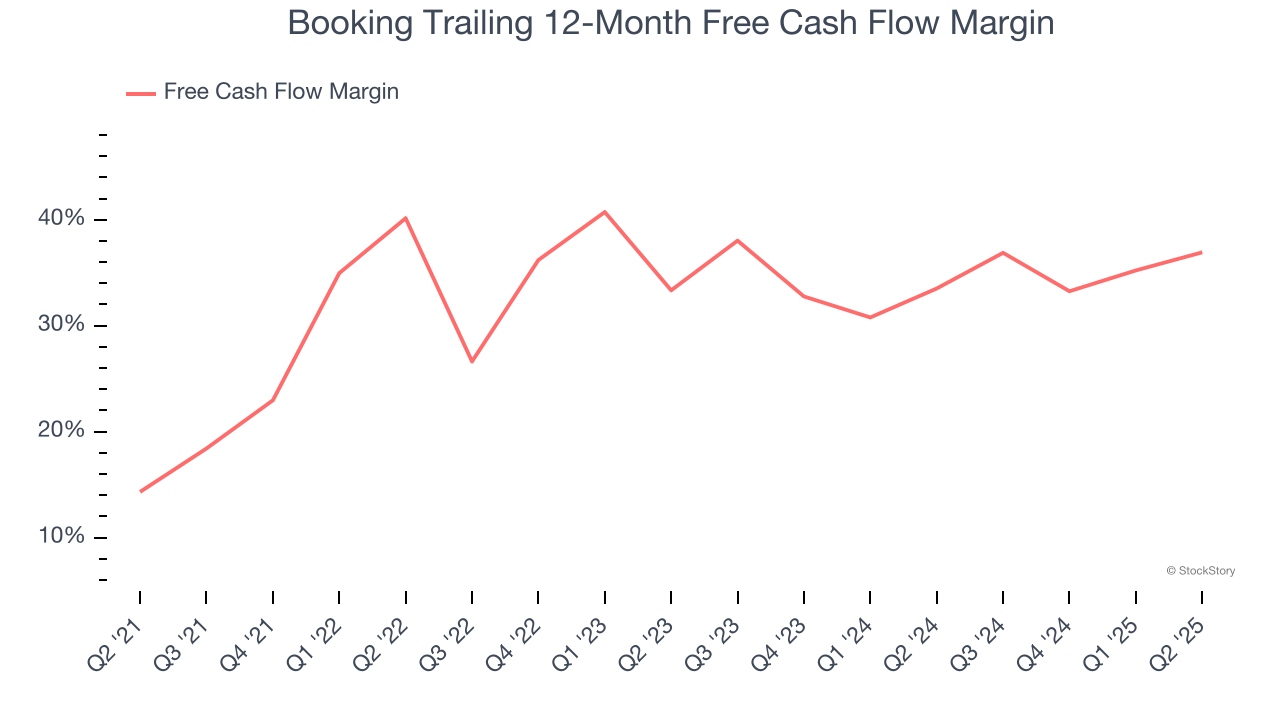

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Booking has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the consumer internet sector, averaging an eye-popping 35.3% over the last two years.

One Reason to be Careful:

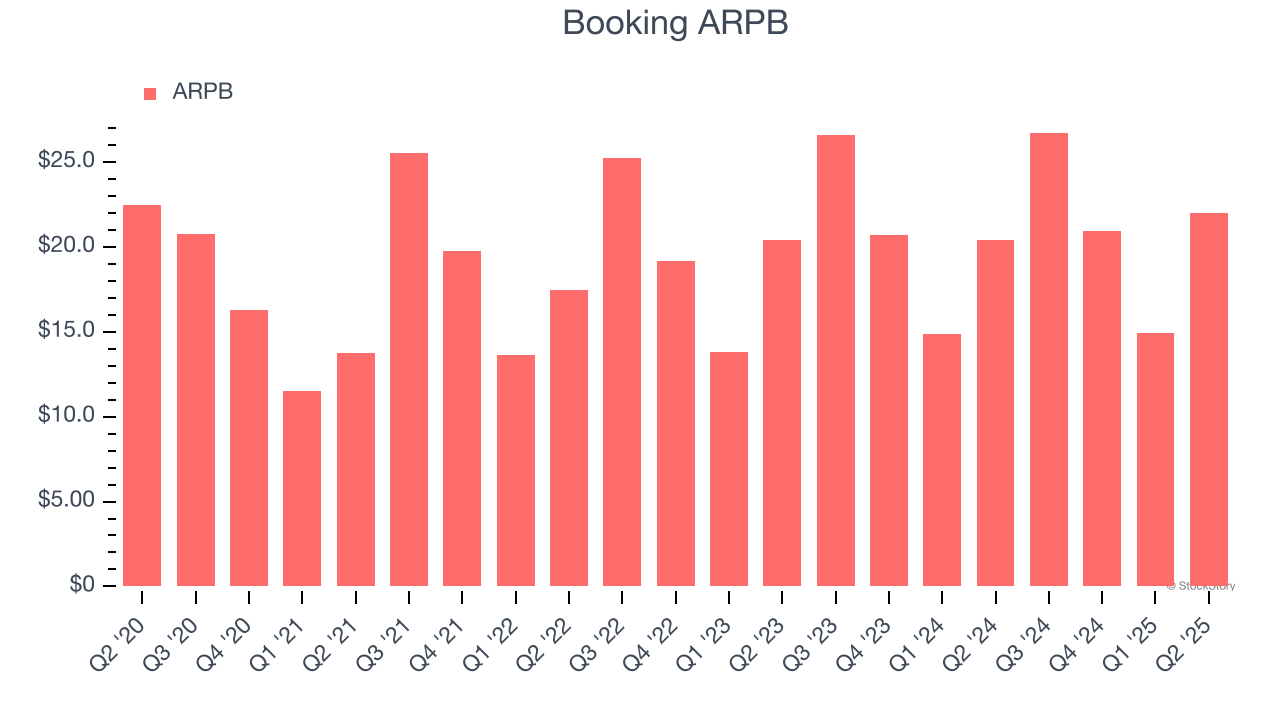

Growth in Customer Spending Lags Peers

Average revenue per booking (ARPB) is a critical metric to track because it not only measures how much users book on its platform but also the commission that Booking can charge.

Booking’s ARPB growth has been mediocre over the last two years, averaging 3.9%. This isn’t great, but the increase in room nights booked is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Booking tries boosting ARPB by taking a more aggressive approach to monetization, it’s unclear whether bookings can continue growing at the current pace.

Final Judgment

Booking’s merits more than compensate for its flaws, and with its shares topping the market in recent months, the stock trades at 18.1× forward EV/EBITDA (or $5,452 per share). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Booking

Trump’s April 2024 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.