Since February 2021, the S&P 500 has delivered a total return of 77.6%. But one standout stock has more than doubled the market - over the past five years, AZZ has surged 175% to $135.47 per share. Its momentum hasn’t stopped as it’s also gained 21.4% in the last six months thanks to its solid quarterly results, beating the S&P by 12.3%.

Is now still a good time to buy AZZ? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Is AZZ a Good Business?

Responsible for projects like nuclear facilities, AZZ (NYSE: AZZ) is a provider of metal coating and power infrastructure solutions.

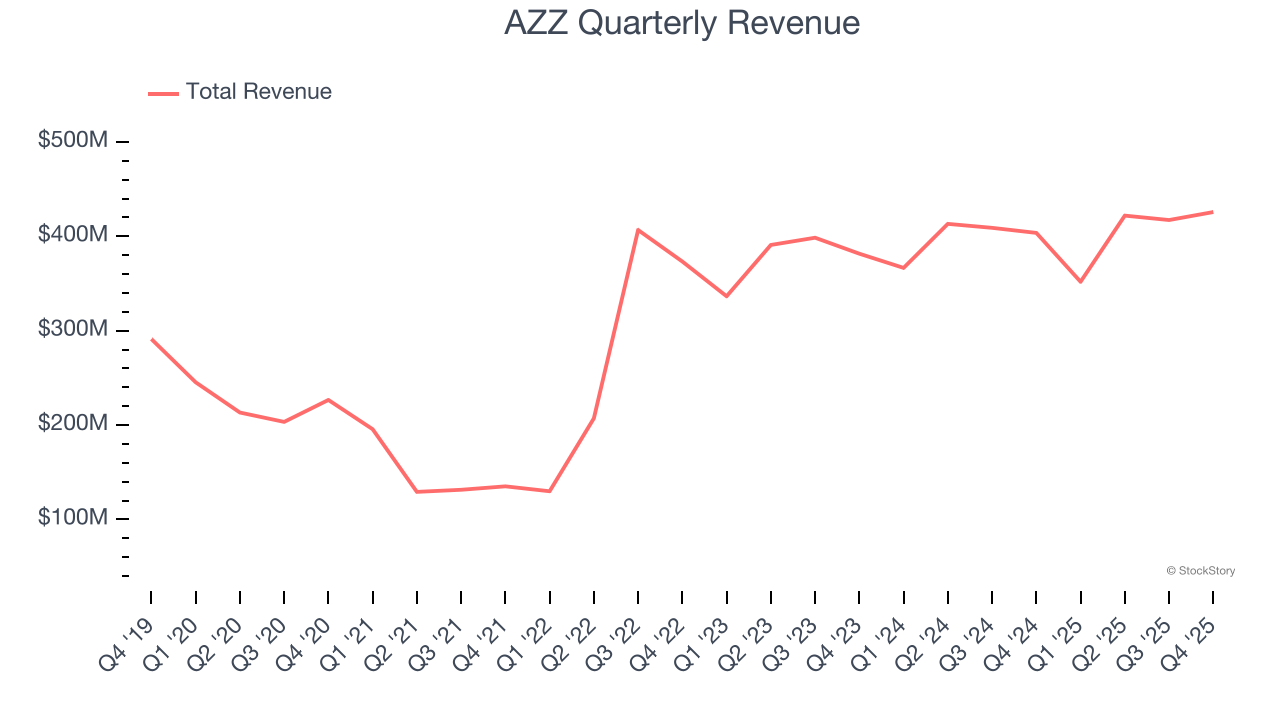

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, AZZ’s sales grew at an excellent 12.7% compounded annual growth rate over the last five years. Its growth surpassed the average industrials company and shows its offerings resonate with customers.

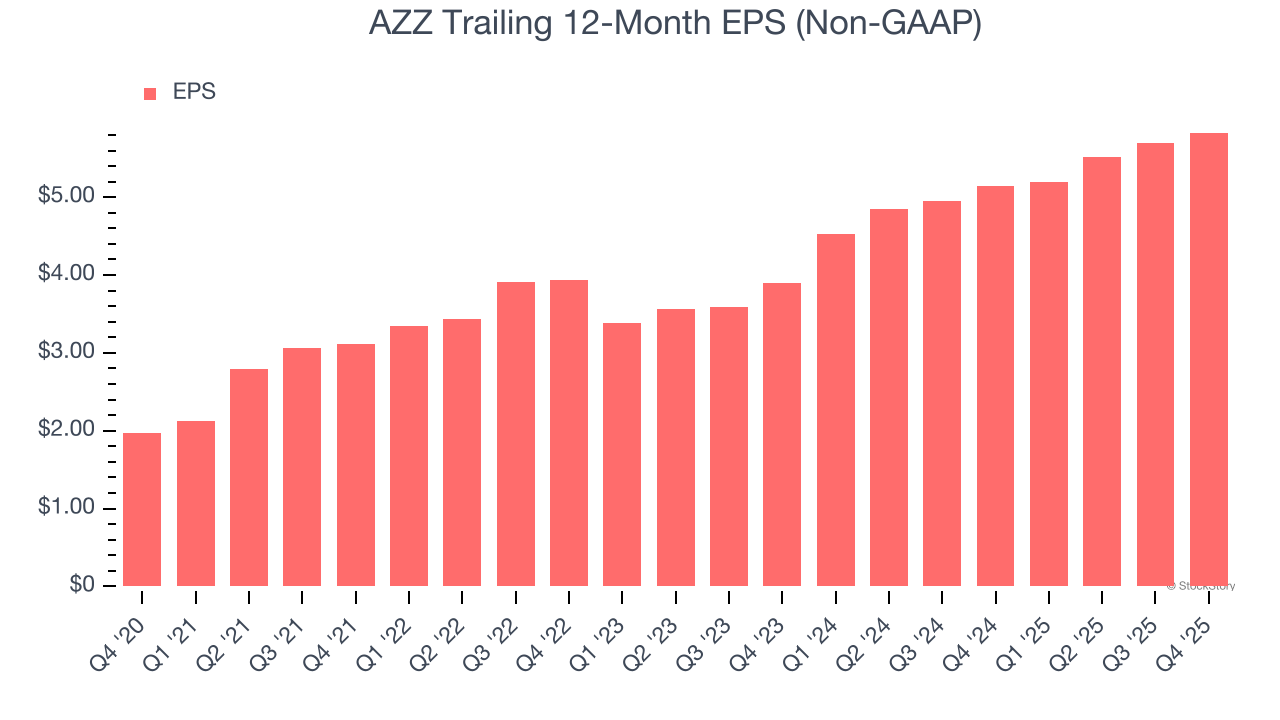

2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

AZZ’s EPS grew at an astounding 24.2% compounded annual growth rate over the last five years, higher than its 12.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

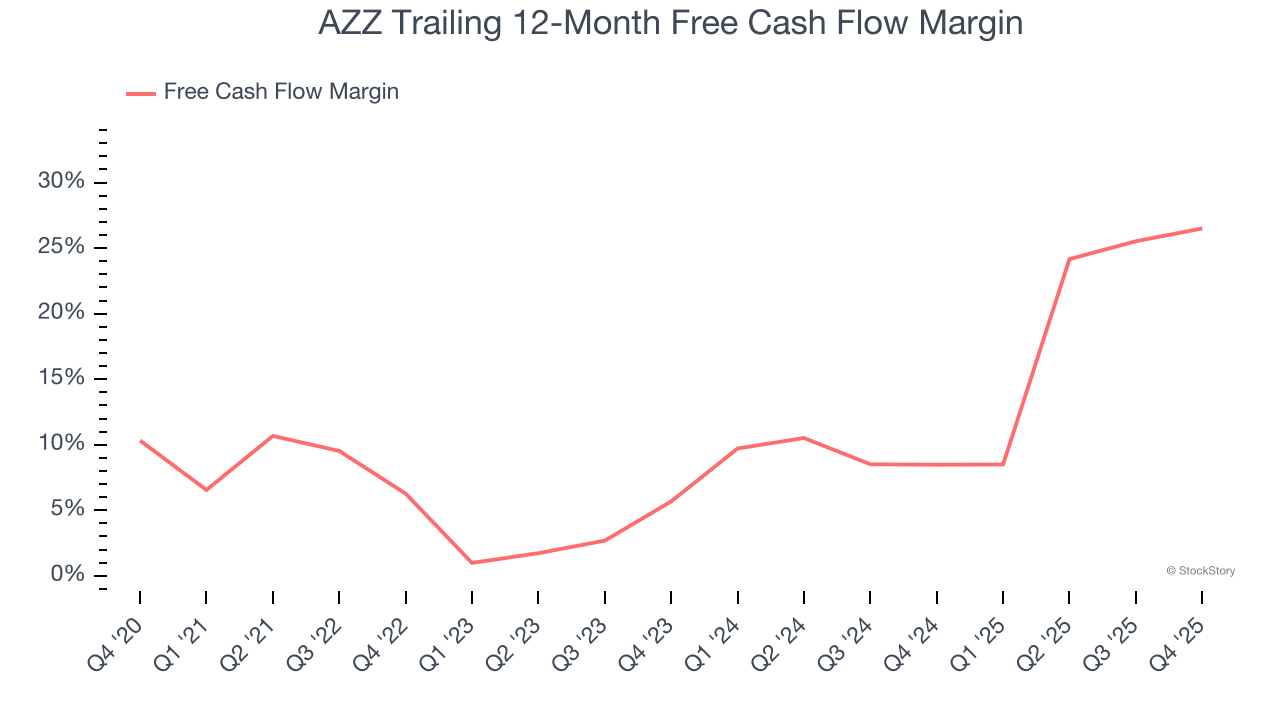

3. Increasing Free Cash Flow Margin Juices Financials

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, AZZ’s margin expanded by 25.1 percentage points over the last five years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability. AZZ’s free cash flow margin for the trailing 12 months was 26.5%.

Final Judgment

These are just a few reasons AZZ is a high-quality business worth owning, and with its shares outperforming the market lately, the stock trades at 20.2× forward P/E (or $135.47 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than AZZ

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.