Commercial real estate firm CBRE (NYSE: CBRE) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 11.8% year on year to $11.63 billion. Its non-GAAP profit of $2.73 per share was 2% above analysts’ consensus estimates.

Is now the time to buy CBRE? Find out by accessing our full research report, it’s free.

CBRE (CBRE) Q4 CY2025 Highlights:

- Revenue: $11.63 billion vs analyst estimates of $11.66 billion (11.8% year-on-year growth, in line)

- Adjusted EPS: $2.73 vs analyst estimates of $2.68 (2% beat)

- Adjusted EBITDA: $1.29 billion vs analyst estimates of $1.23 billion (11.1% margin, 4.7% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $7.45 at the midpoint, missing analyst estimates by 0.6%

- Operating Margin: 5.4%, in line with the same quarter last year

- Free Cash Flow Margin: 11.7%, similar to the same quarter last year

- Market Capitalization: $43.82 billion

“We had a strong end to 2025, with fourth-quarter revenue and core earnings-per-share rising by double digits and both reaching their highest levels ever for CBRE,” said Bob Sulentic, CBRE’s chair and chief executive officer.

Company Overview

Established in 1906, CBRE (NYSE: CBRE) is one of the largest commercial real estate services firms in the world.

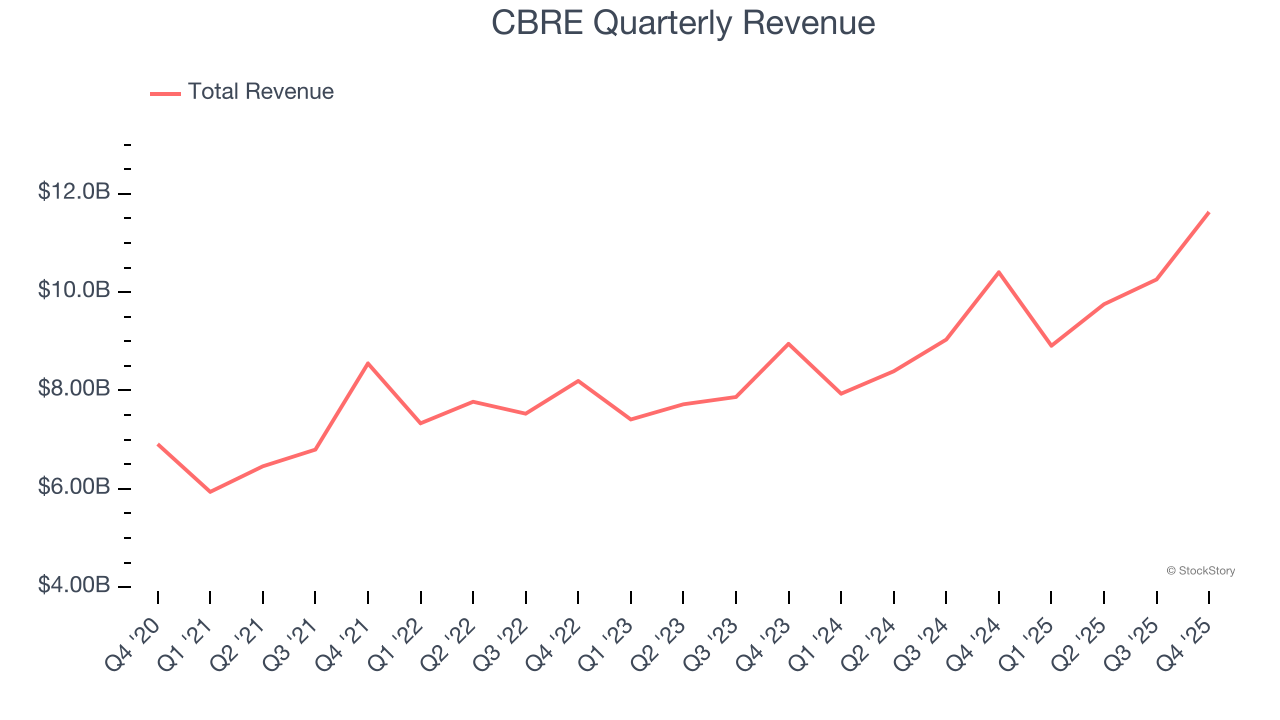

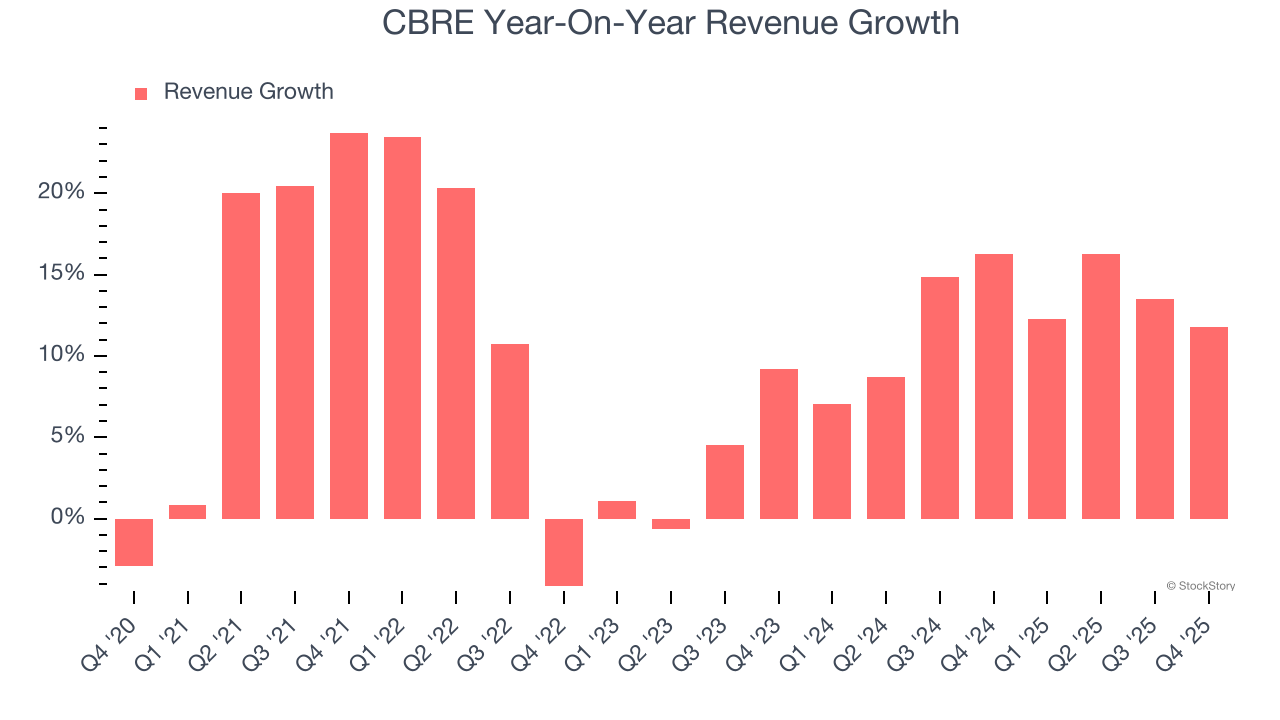

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, CBRE grew its sales at a 11.2% compounded annual growth rate. Though this growth is acceptable on an absolute basis, we need to see more than just topline growth for the consumer discretionary sector, which can display significant earnings volatility. This means our bar for the sector is particularly high, reflecting the non-essential and hit-driven nature of the products and services offered. Additionally, five-year CAGR starts around Covid, when revenue was depressed then rebounded.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. CBRE’s annualized revenue growth of 12.7% over the last two years is above its five-year trend, which is encouraging.

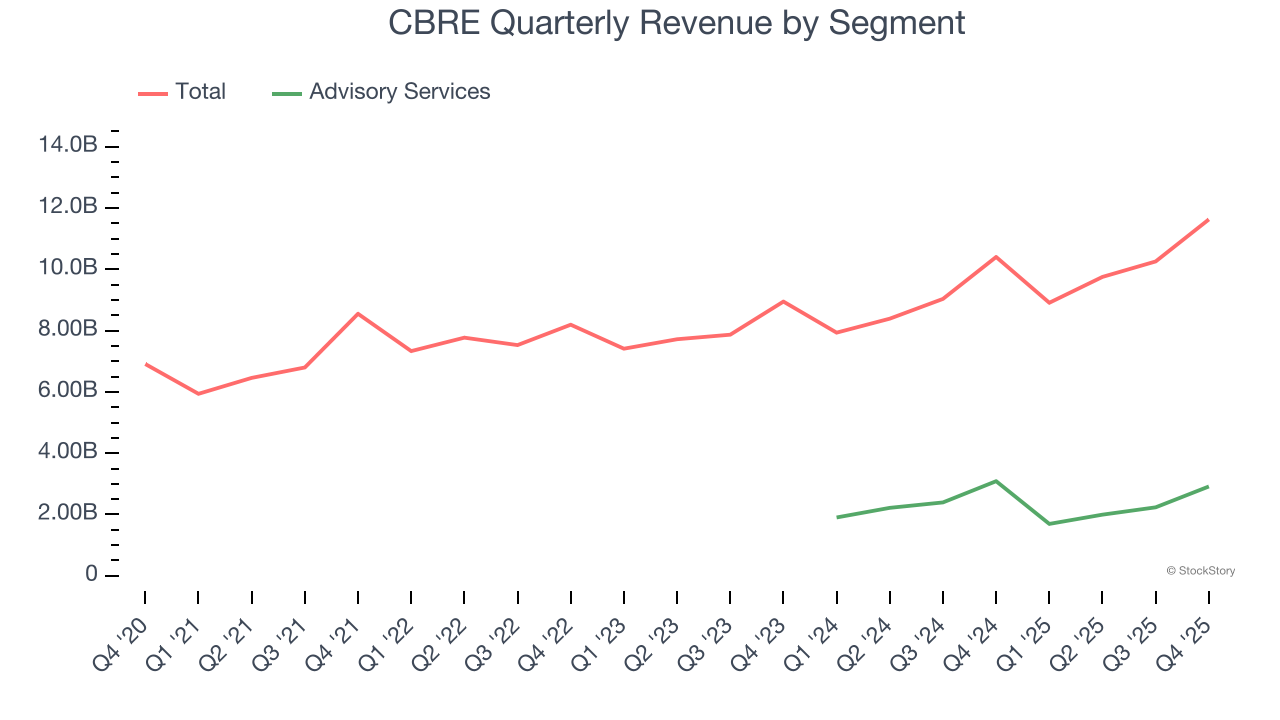

We can better understand the company’s revenue dynamics by analyzing its most important segment, Advisory Services. Over the last two years, CBRE’s Advisory Services revenue (leasing, capital markets) averaged 8.3% year-on-year declines. This segment has lagged the company’s overall sales.

This quarter, CBRE’s year-on-year revenue growth was 11.8%, and its $11.63 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 11.4% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and indicates its products and services will see some demand headwinds.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

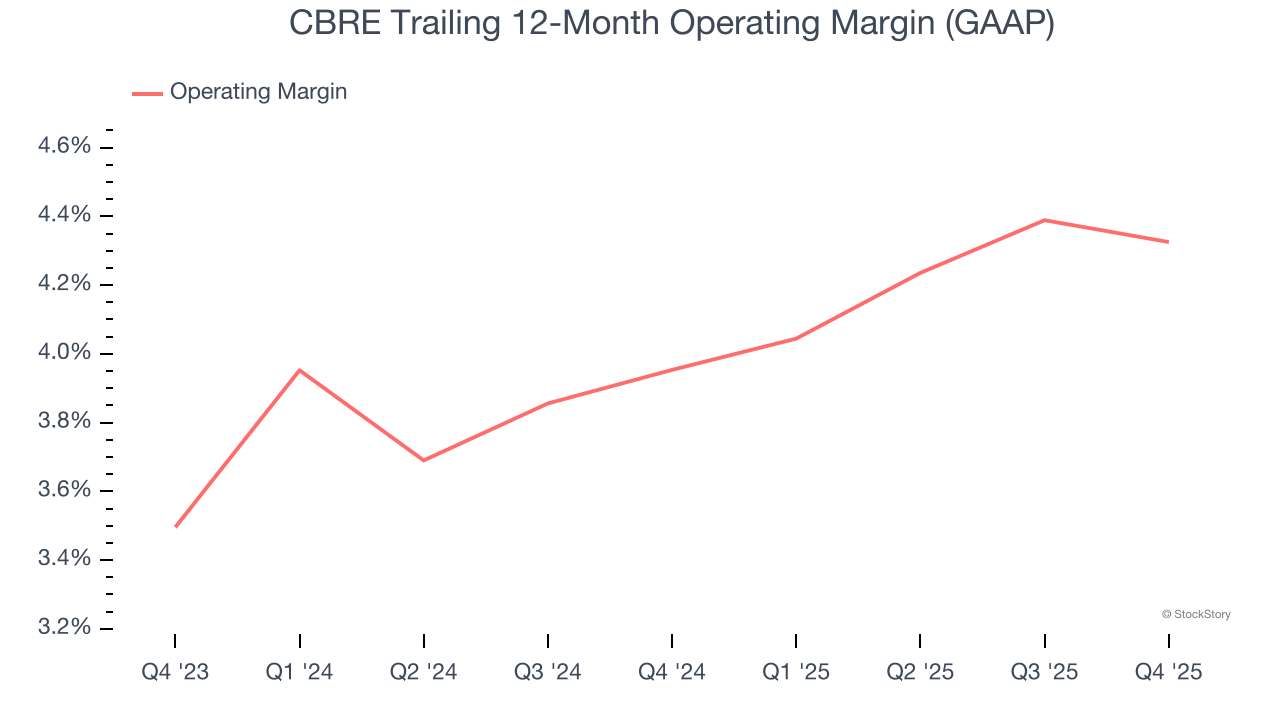

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

CBRE’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 4.2% over the last two years. This profitability was inadequate for a consumer discretionary business and caused by its suboptimal cost structure.

In Q4, CBRE generated an operating margin profit margin of 5.4%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

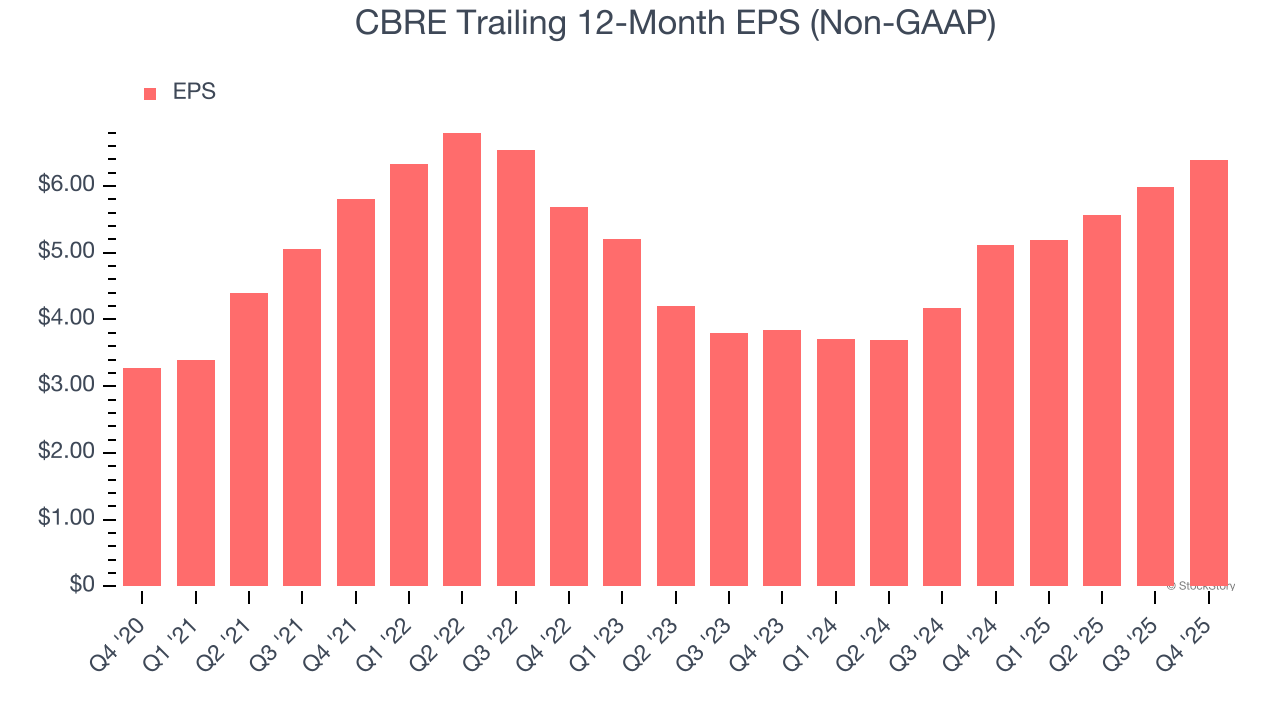

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

CBRE’s EPS grew at a weak 14.3% compounded annual growth rate over the last five years. This performance was better than its flat revenue but doesn’t tell us much about its business quality because its operating margin didn’t improve.

In Q4, CBRE reported adjusted EPS of $2.73, up from $2.32 in the same quarter last year. This print beat analysts’ estimates by 2%. Over the next 12 months, Wall Street expects CBRE’s full-year EPS of $6.39 to grow 14.8%.

Key Takeaways from CBRE’s Q4 Results

It was encouraging to see CBRE beat analysts’ EPS expectations this quarter on in-line revenue. On the other hand, EPS guidance missed. Zooming out, we think this was a mixed quarter. The stock traded up 2.1% to $152.60 immediately after reporting.

Is CBRE an attractive investment opportunity at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).