With a market cap of $22.7 billion, Ulta Beauty, Inc. (ULTA) is the largest specialty beauty retailer in the United States, offering over 25,000 products from around 500 established and emerging brands. The company operates stores with full-service salons and sells products through its website and mobile applications.

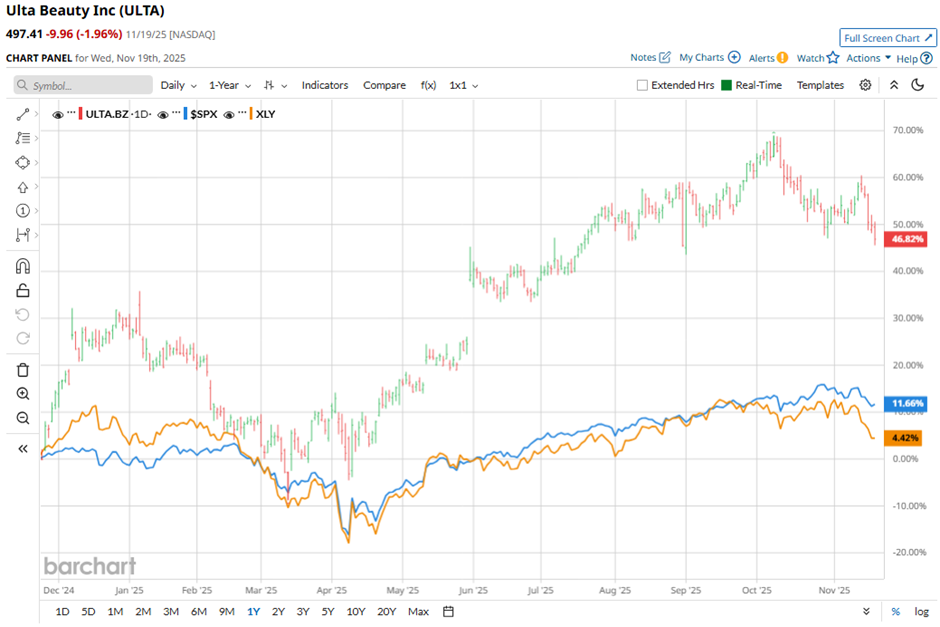

Shares of the beauty products retailer have outperformed the broader market over the past 52 weeks. ULTA stock has surged 45.4% over this time frame, while the broader S&P 500 Index ($SPX) has gained 12.3%. Moreover, shares of the company are up 14.4% on a YTD basis, compared to SPX’s 12.9% increase.

Narrowing the focus, shares of the Bolingbrook, Illinois-based company have outpaced the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 4.2% rise over the past 52 weeks.

Despite reporting better-than-expected Q2 2025 profit of $5.78 per share and revenue of $2.79 billion on Aug. 28, shares of ULTA tumbled 7.1% the next day as the company’s operating margin fell to 12.4%, SG&A expenses jumped 15.0% to $741.7 million, and inventories surged 20.5% to $2.4 billion while the company also added $289.1 million in short-term debt to fund the Space NK acquisition. In addition, management warned of uncertain consumer demand in the second half of the year, while raising full-year EPS guidance to $23.85–$24.30.

For the fiscal year ending in January 2026, analysts expect ULTA’s EPS to decrease 3.8% year-over-year to $24.37. However, the company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

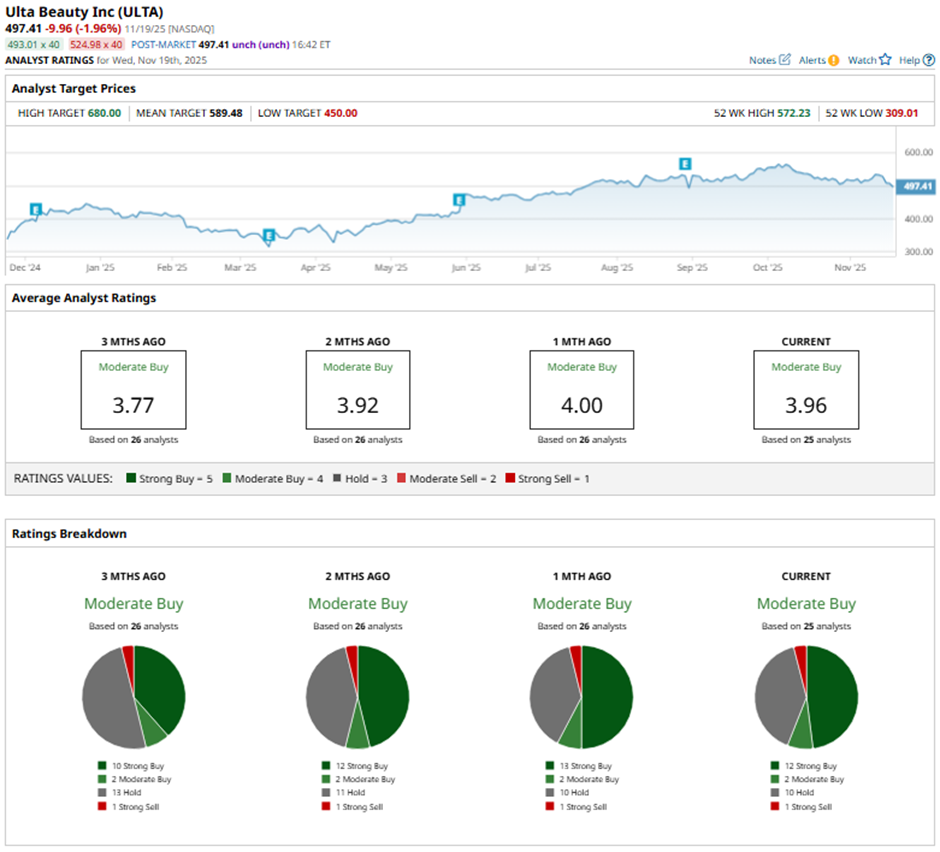

Among the 25 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, two “Moderate Buys,” 10 “Holds,” and one “Strong Sell.”

This configuration is more bullish than three months ago, with 10 “Strong Buy” ratings on the stock.

On Aug. 29, UBS analyst Michael Lasser maintained a “Buy” rating on Ulta Beauty and raised the price target to $680.

The mean price target of $589.48 represents an 18.5% premium to ULTA’s current price levels. The Street-high price target of $680 suggests a 36.7% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Jensen Huang Says ‘Blackwell Sales Are Off the Charts, and Cloud GPUs Are Sold Out’ as Nvidia Crushes Q3 Earnings and Beats Analyst Expectations

- Stocks Rally Before the Open on Upbeat Nvidia Earnings, U.S. Jobs Report in Focus

- Pfizer Is Giving Up on BioNTech. Should You Ditch BNTX Stock Now Too?

- This Silver Stock Just Raised Its Dividend 16%. Should You Buy Shares Now?