Over the past six months, FB Financial’s stock price fell to $49.50. Shareholders have lost 6.3% of their capital, which is disappointing considering the S&P 500 has climbed by 5.4%. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Following the pullback, is now an opportune time to buy FBK? Find out in our full research report, it’s free.

Why Does FB Financial Spark Debate?

Founded in 1906 and operating through more than a century of economic cycles, FB Financial (NYSE: FBK) operates FirstBank, providing commercial and consumer banking services across Tennessee, Kentucky, Alabama, and North Georgia.

Two Things to Like:

1. Net Interest Income Skyrockets, Fueling Growth Opportunities

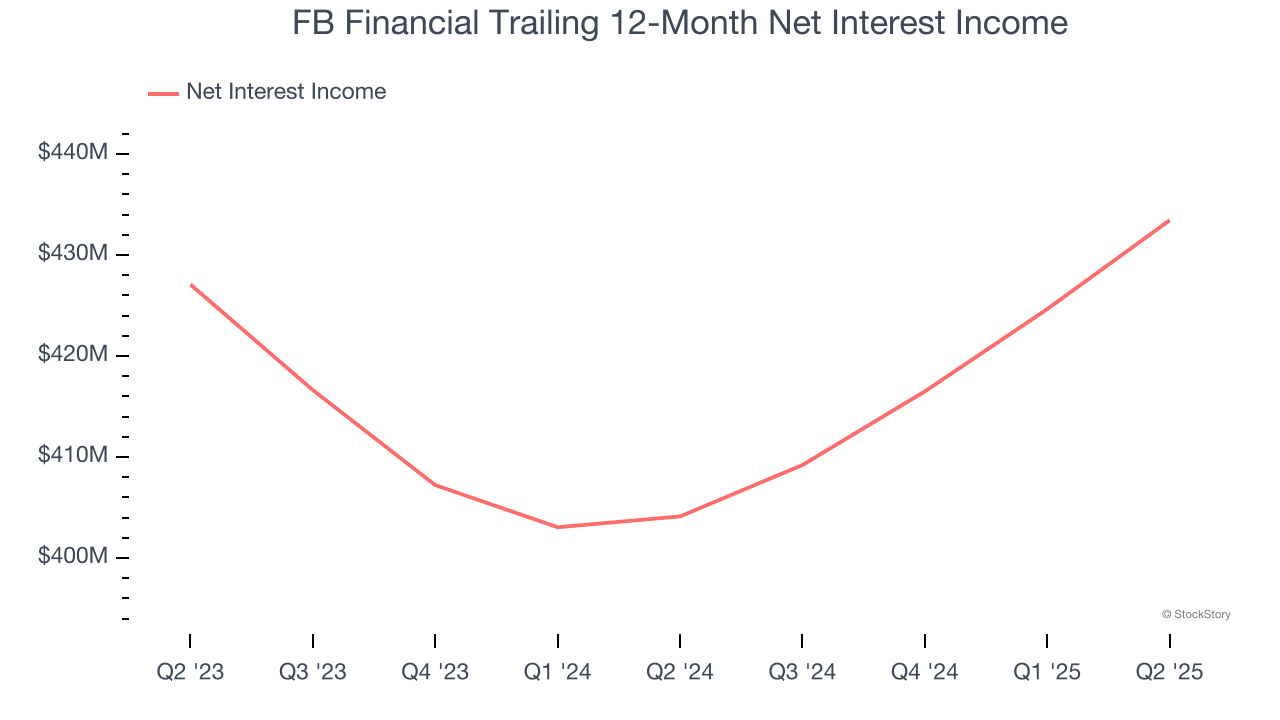

Net interest income commands greater market attention due to its reliability and consistency, whereas one-time fees are often seen as lower-quality revenue that lacks the same dependable characteristics.

FB Financial’s net interest income has grown at a 14.4% annualized rate over the last five years, better than the broader bank industry and faster than its total revenue. Its growth was driven by an increase in its net interest margin, which represents how much a bank earns in relation to its outstanding loans, as its loan book shrank throughout that period.

2. Outstanding Long-Term EPS Growth

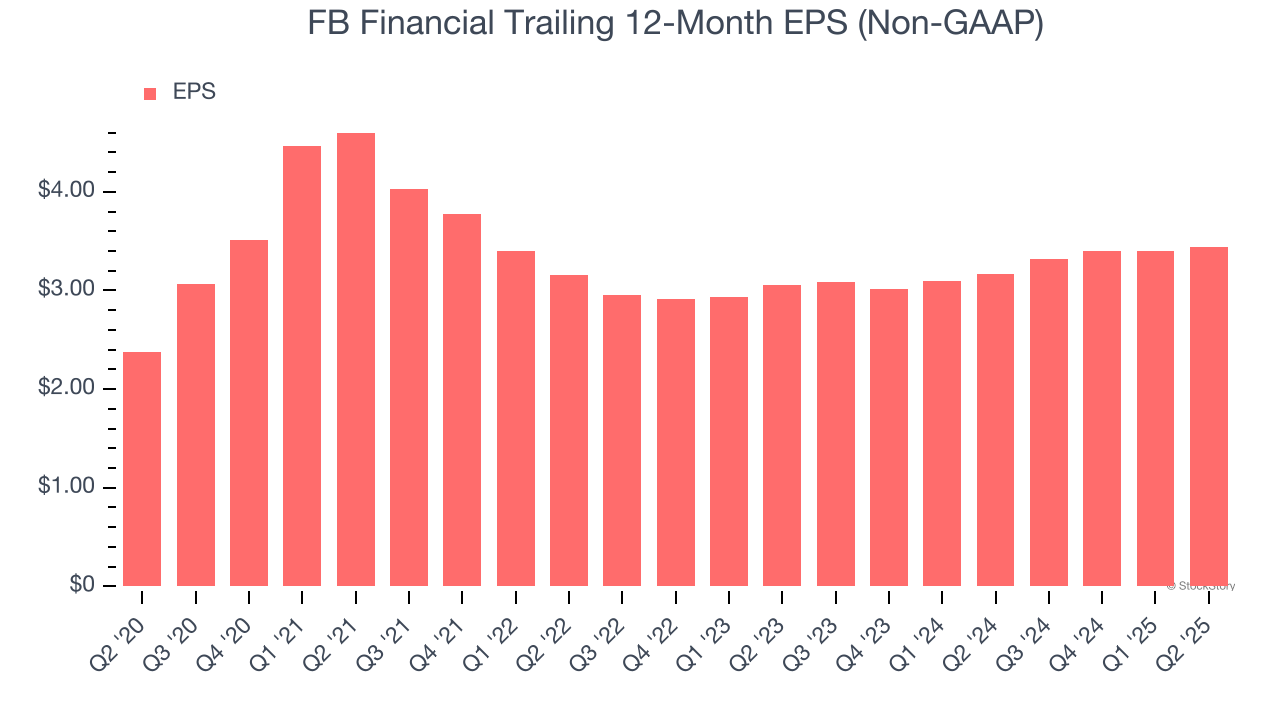

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

FB Financial’s EPS grew at a remarkable 7.6% compounded annual growth rate over the last five years, higher than its flat revenue. This tells us management responded to softer demand by adapting its cost structure.

One Reason to be Careful:

Long-Term Revenue Growth Flatter Than a Pancake

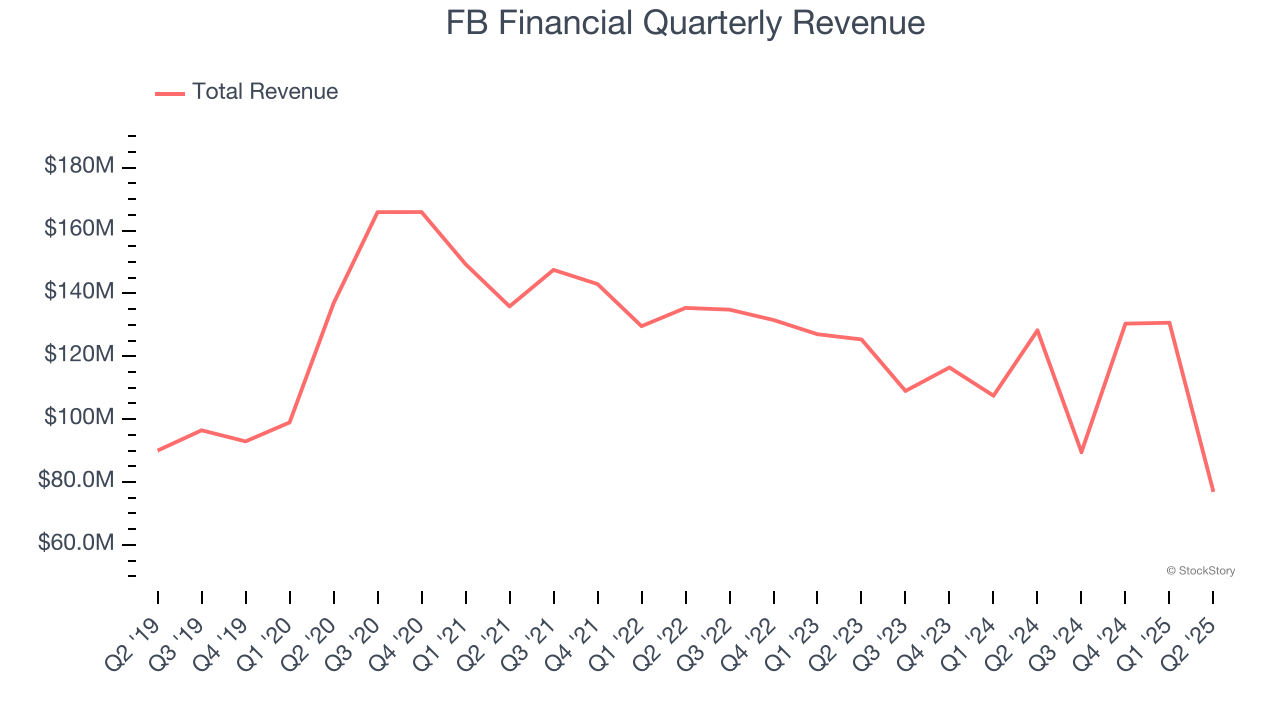

From lending activities to service fees, most banks build their revenue model around two income sources. Interest rate spreads between loans and deposits create the first stream, with the second coming from charges on everything from basic bank accounts to complex investment banking transactions.

Unfortunately, FB Financial struggled to consistently increase demand as its $427.4 million of revenue for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result, but there are still things to like about FB Financial.

Final Judgment

FB Financial has huge potential even though it has some open questions. With the recent decline, the stock trades at 1.3× forward P/B (or $49.50 per share). Is now the right time to buy? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

Trump’s April 2024 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.