With a market cap of $63.8 billion, Autodesk, Inc. (ADSK) is a leading software company specializing in design, engineering, and digital content creation tools. Best known for products like AutoCAD, Revit, Fusion 360, and Maya, the San Francisco-based company serves industries such as architecture, construction, manufacturing, product design, and media/entertainment.

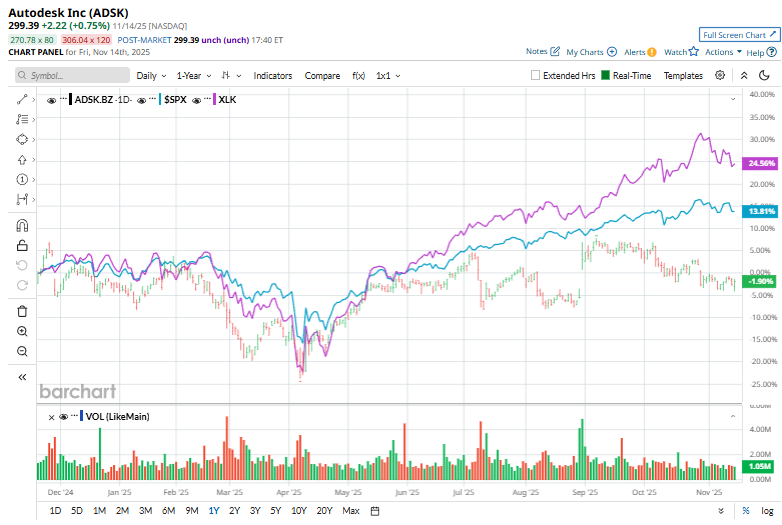

Shares of the company have lagged behind the broader market over the past 52 weeks. ADSK stock has increased 2.4% over this time frame, while the broader S&P 500 Index ($SPX) has risen 13.2%. Moreover, shares of the company are up 1.3% on a YTD basis, lagging behind SPX's 14.5% gain.

In addition, shares of the design software company have trailed the Technology Select Sector SPDR Fund's (XLK) 22.9% return over the past 52 weeks.

Autodesk shares have lagged the broader market over the past year primarily due to concerns around profitability, capital efficiency, and strategic uncertainty. The company has faced margin pressure, slower-than-expected ARR growth, and critiques over high customer acquisition costs, all of which have raised questions about its operating efficiency. Investor sentiment has also been weighed down by activist pressure from Starboard Value, which has challenged Autodesk’s spending discipline and governance.

For the fiscal year ending in January 2026, analysts expect ADSK's EPS to grow 17.8% year-over-year to $6.90. The company's earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

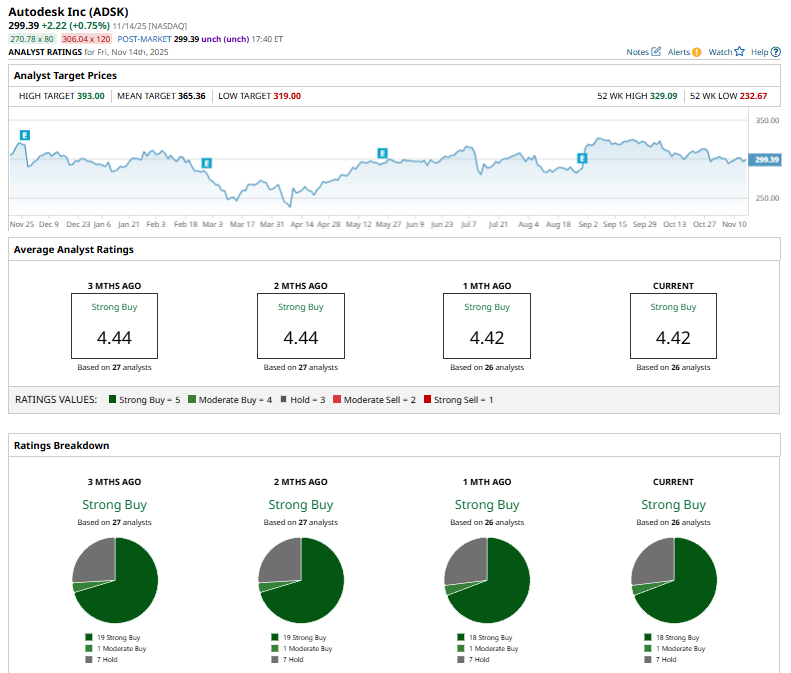

Among the 26 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 18 “Strong Buy” ratings, one “Moderate Buy,” and seven “Holds.”

This configuration is bearish than two months ago, with 19 “Strong Buy” ratings on the stock.

On Oct. 8, RBC Capital analyst Matthew Hedberg reaffirmed his “Buy” rating on Autodesk.

The mean price target of $365.36 represents a 17.7% premium to ADSK’s current price levels. The Street-high price target of $393 suggests a 30.3% potential upside.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart