Key Takeaways:

• Customer satisfaction is flat and that's a warning sign. The national ACSI score remains where it was close to a decade ago, signaling long-term weakening of buyer utility even as companies report strong profits.

• A wave of "pent-up customer defection" is building. Stagnant satisfaction, rising complaints, and higher switching costs are creating a stockpile of latent churn that can release suddenly when barriers drop.

• Market concentration is masking real economic fragility. With fewer competitors and greater pricing power, firms can raise prices without improving the customer experience — a pattern that historically precedes slower GDP growth and rising inflation.

The U.S. economy faces a witches' brew of destructive macro and microeconomic problems: increasing customer switching costs and complaints, with stagnating satisfaction. Paradoxically, customer defections are down — not up. These are not signs of a healthy economy.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20260210746258/en/

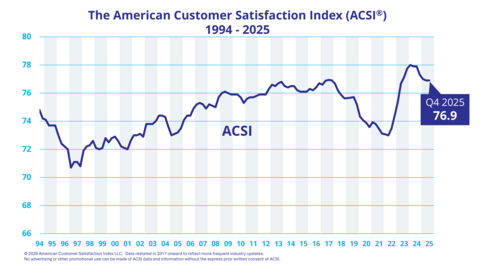

ACSI 1994-2025

Over the past six months, the American Customer Satisfaction Index (ACSI®) has remained unchanged — even at the first decimal. From a sample of about 200,000 customers, the national ACSI score holds at 76.9 (out of 100) for the fourth quarter of 2025. On an annual basis, the Index fell by 0.5% and has not materially increased since 2017.

At the macro level, compounding market concentration, increasing seller pricing power, and higher buyer switching costs are major causes for the lack of improvement. At the micro level, irrelevant performance metrics and data-discordant analytics have made resource allocation for strengthening customer relationships next to impossible.

"In well-functioning markets, buyer satisfaction and seller profits move together," said Claes Fornell, founder of the ACSI and the Distinguished Donald C. Cook Professor (Emeritus) of Business Administration at the University of Michigan. "When seller profits increase without a corresponding rise in buyer utility, it is an indicator of market inefficiency. Decoupling seller profit from buyer satisfaction impedes economic growth and slows innovation. Buyer surplus stagnates and inflation accelerates. Escalating M&A activity, without a corresponding increase in antitrust enforcement, has compounded the problem. Tariffs have had a similar effect by discouraging international competition."

The 1946-1948 World War II aftermath, the 2007-2009 Great Recession, and the COVID-19 pandemic's shock to supply chains provide warnings, some of which apply today. Sellers took advantage of limited competition and raised prices.

During COVID-19, profit margins soared while customer satisfaction fell. The Great Recession of 2007-2009 was similar in some respects — it separated quantity of economic output (GDP) from quality of economic output (ACSI). Subsequently, cumulative GDP growth (post-2007) slowed by 13.5% — about $5 trillion in today's money. Profits began to account for more of national income and increased more than consumer spending did.

As to microeconomic consequences and corporate management concerns, pent-up customer defection is of increasing concern for managers as well as shareholders. It represents the unrealized customer churn that accumulates over time and is preceded by weak or stagnant customer satisfaction, increasing customer complaints, and higher customer switching costs. It is facilitated by contracts, lock-ins, market concentration, subscriptions, a lack of substitutes, and consumer risk aversion.

Pent-up customer defection is a stock of covert risk — it is not a flow — and when released, it moves rapidly. It might be avoided, or its effect may be tamed, if corporations include more financial, accounting, and analytical expertise in building strong customer relationships. Strong customer relationships are important, albeit intangible, financial assets in a competitive marketplace and would benefit if managed as such. History is clear as to what will happen to firms that do not create strong customer relationships based on profit for the seller and satisfaction and utility for the buyer. They tend to occupy the bottom of the ACSI roster.

Strong customer relationships in competitive markets are critical for customer retention. Higher retention, in turn, has compounding multiplicative effects — and at high levels of retention, exponentially increasing effects — on revenue growth and profit, while simultaneously reducing uncertainty and cash flow instability.

Claes Fornell, the Donald C. Cook Distinguished Professor of Business (Emeritus) at the University of Michigan, is the primary author of this press release. He led the development of the American Customer Satisfaction Index with assistance from Eugene W. Anderson, University of Pittsburgh; Michael D. Johnson, Cornell University; Birger Wernerfelt, M.I.T.; and David F. Larcker, Stanford University.

According to Google Scholar, Professor Fornell is the most cited person in the world on customer satisfaction and one of the most cited econometricians/statisticians with respect to structural equation models with unobservable variables and measurement error. He holds honorary doctorates from several universities.

For more, follow the American Customer Satisfaction Index on LinkedIn and X at @theACSI or visit www.theacsi.org.

No advertising or other promotional use can be made of the data and information in this release without the express prior written consent of ACSI LLC.

About the ACSI

The American Customer Satisfaction Index (ACSI®) is a national economic indicator and a leading provider of customer analytics products that help organizations build lasting customer relationships and prove ROI on experience investments. ACSI's AI-enhanced platform delivers intuitive dashboards and cause-and-effect analytics that pinpoint the quality drivers most predictive of customer allegiance, retention, price tolerance, and financial performance. ACSI data has been shown to correlate strongly with key micro and macroeconomic indicators, including consumer spending, GDP growth, earnings, and stock returns.

Founded in 1994 at the University of Michigan's Ross School of Business, the ACSI measures customer satisfaction with more than 400 companies in over 40 industries, including federal government services, based on approximately 200,000 annual interviews. Learn more at https://www.theacsi.org.

ACSI and its logo are Registered Marks of American Customer Satisfaction Index LLC.

View source version on businesswire.com: https://www.businesswire.com/news/home/20260210746258/en/

Contacts

Christian Rizzo

crizzo@gregoryagency.com