Environmental solutions provider CECO Environmental (NASDAQ: CECO) reported revenue ahead of Wall Street’s expectations in Q3 CY2025, with sales up 45.8% year on year to $197.6 million. On the other hand, the company’s full-year revenue guidance of $750 million at the midpoint came in 1.1% below analysts’ estimates. Its non-GAAP profit of $0.26 per share was 4% above analysts’ consensus estimates.

Is now the time to buy CECO Environmental? Find out by accessing our full research report, it’s free for active Edge members.

CECO Environmental (CECO) Q3 CY2025 Highlights:

- Revenue: $197.6 million vs analyst estimates of $190.6 million (45.8% year-on-year growth, 3.6% beat)

- Adjusted EPS: $0.26 vs analyst estimates of $0.25 (4% beat)

- Adjusted EBITDA: $23.2 million vs analyst estimates of $23.59 million (11.7% margin, 1.7% miss)

- The company reconfirmed its revenue guidance for the full year of $750 million at the midpoint

- EBITDA guidance for the full year is $95 million at the midpoint, above analyst estimates of $91.35 million

- Initiated full year 2026 guidance that was above for revenue and EBITDA

- Operating Margin: 4.8%, in line with the same quarter last year

- Free Cash Flow Margin: 9.6%, up from 8.2% in the same quarter last year

- Market Capitalization: $1.88 billion

Todd Gleason, CECO's Chief Executive Officer commented, “We delivered another quarter with outstanding growth and multiple financial records, highlighted by another new backlog record, which we achieved along with our highest ever quarterly revenues. Impressively, through three quarters of this year, we already produced more revenue than we did in the entire year 2024, which had previously been a record year. Over the past four quarters, we booked over $950 million in new orders – a testament to our well-positioned and highly diversified portfolio of leading environmental solutions for industrial air, industrial water and energy transition markets. We expect to maintain our consistent growth trajectory as our sales pipeline now exceeds $5.8 billion – which is balanced across our business segments and geographic profile.”

Company Overview

With roots dating back to 1869 and a focus on creating cleaner industrial operations, CECO Environmental (NASDAQ: CECO) provides technology and expertise that helps industrial companies reduce emissions, treat water, and improve energy efficiency across various sectors.

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $718.3 million in revenue over the past 12 months, CECO Environmental is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

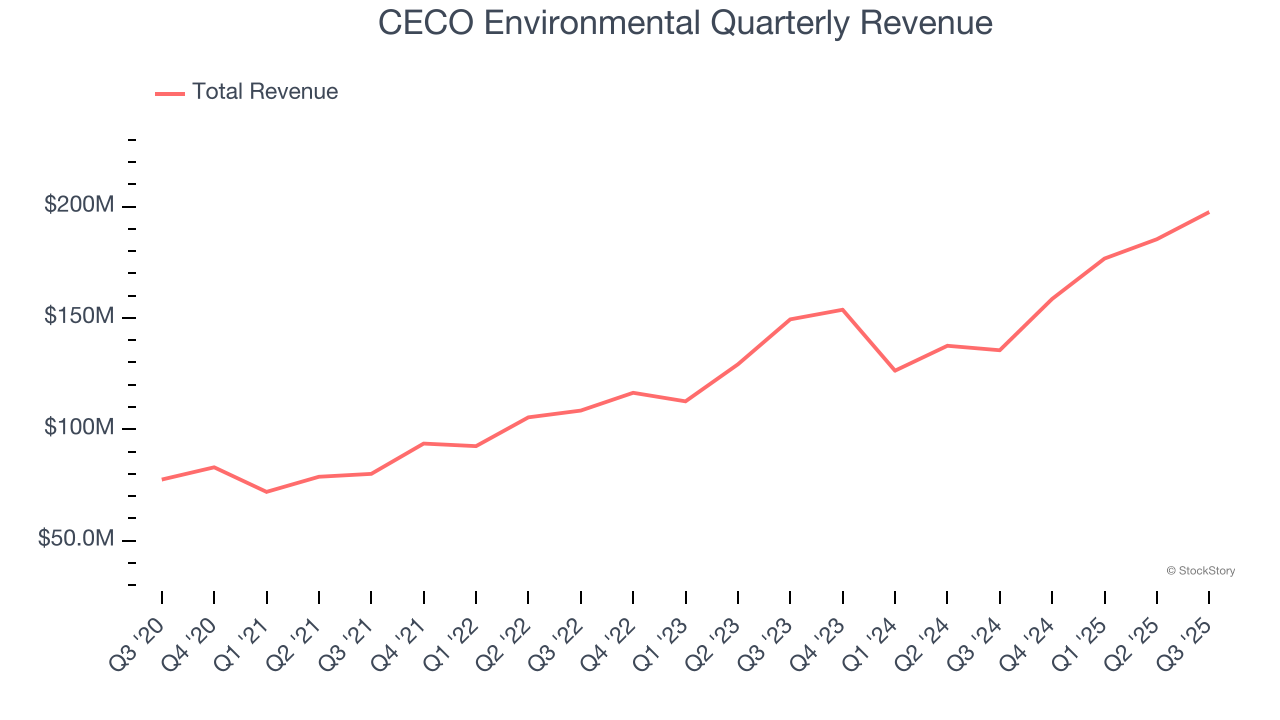

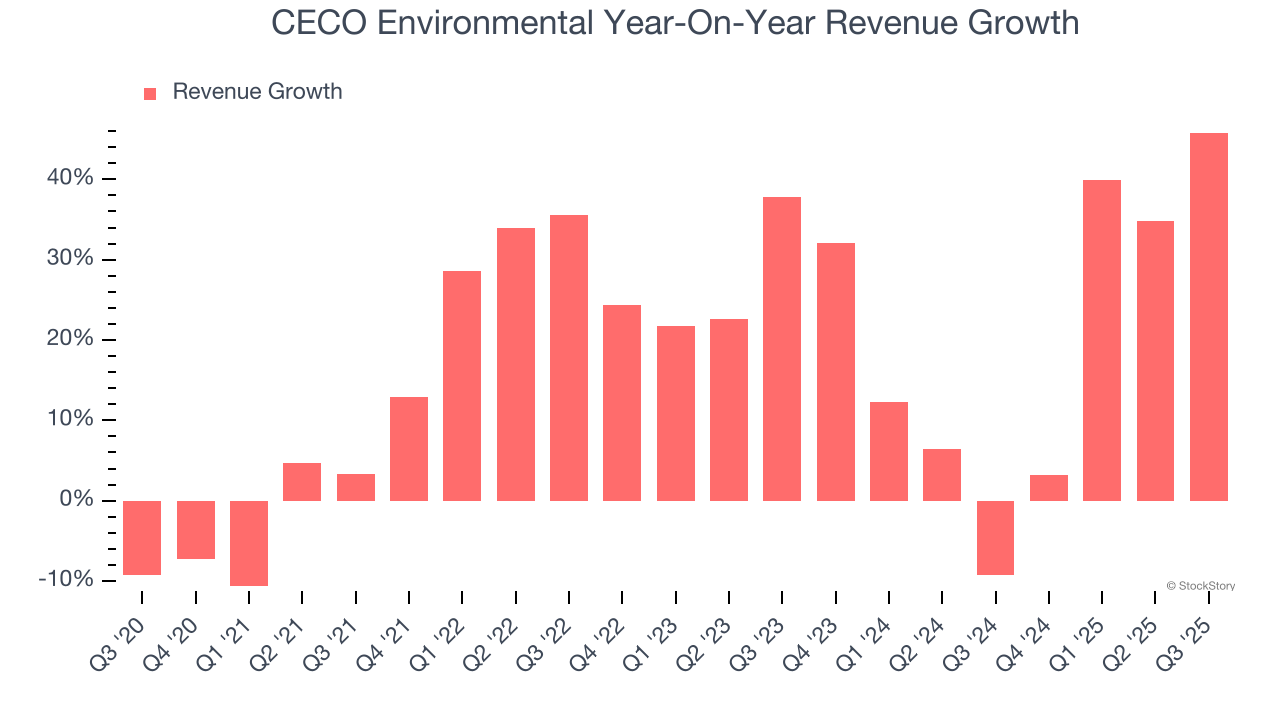

As you can see below, CECO Environmental grew its sales at an incredible 17.4% compounded annual growth rate over the last five years. This is a great starting point for our analysis because it shows CECO Environmental’s demand was higher than many business services companies.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. CECO Environmental’s annualized revenue growth of 19% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, CECO Environmental reported magnificent year-on-year revenue growth of 45.8%, and its $197.6 million of revenue beat Wall Street’s estimates by 3.6%.

Looking ahead, sell-side analysts expect revenue to grow 14.6% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is noteworthy and implies the market sees success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

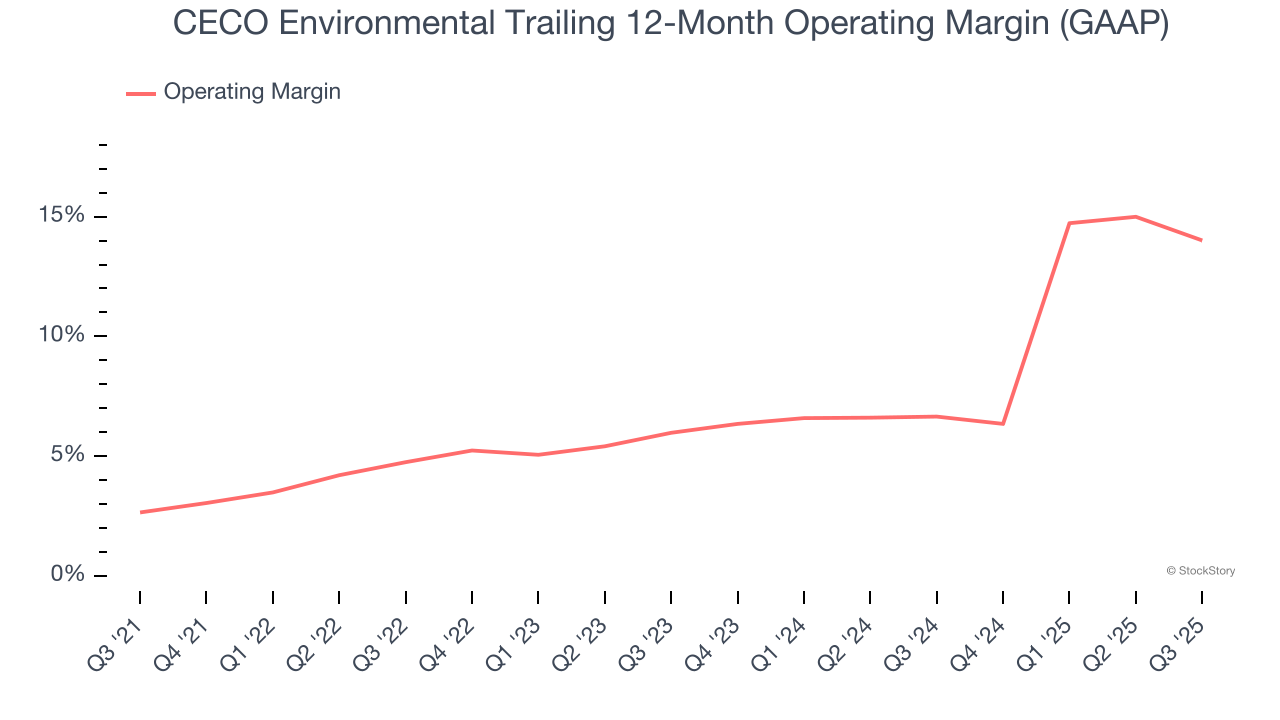

CECO Environmental was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.8% was weak for a business services business.

On the plus side, CECO Environmental’s operating margin rose by 11.4 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q3, CECO Environmental generated an operating margin profit margin of 4.8%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

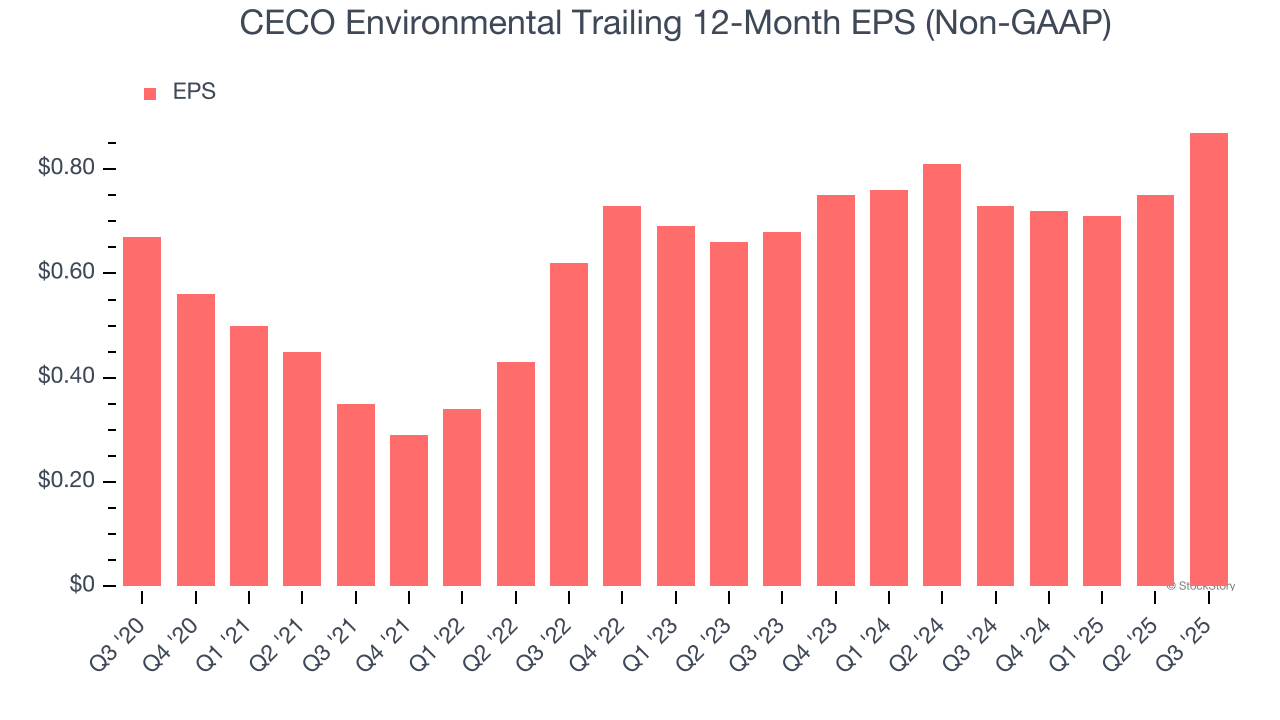

CECO Environmental’s EPS grew at an unimpressive 5.4% compounded annual growth rate over the last five years, lower than its 17.4% annualized revenue growth. However, its operating margin actually improved during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

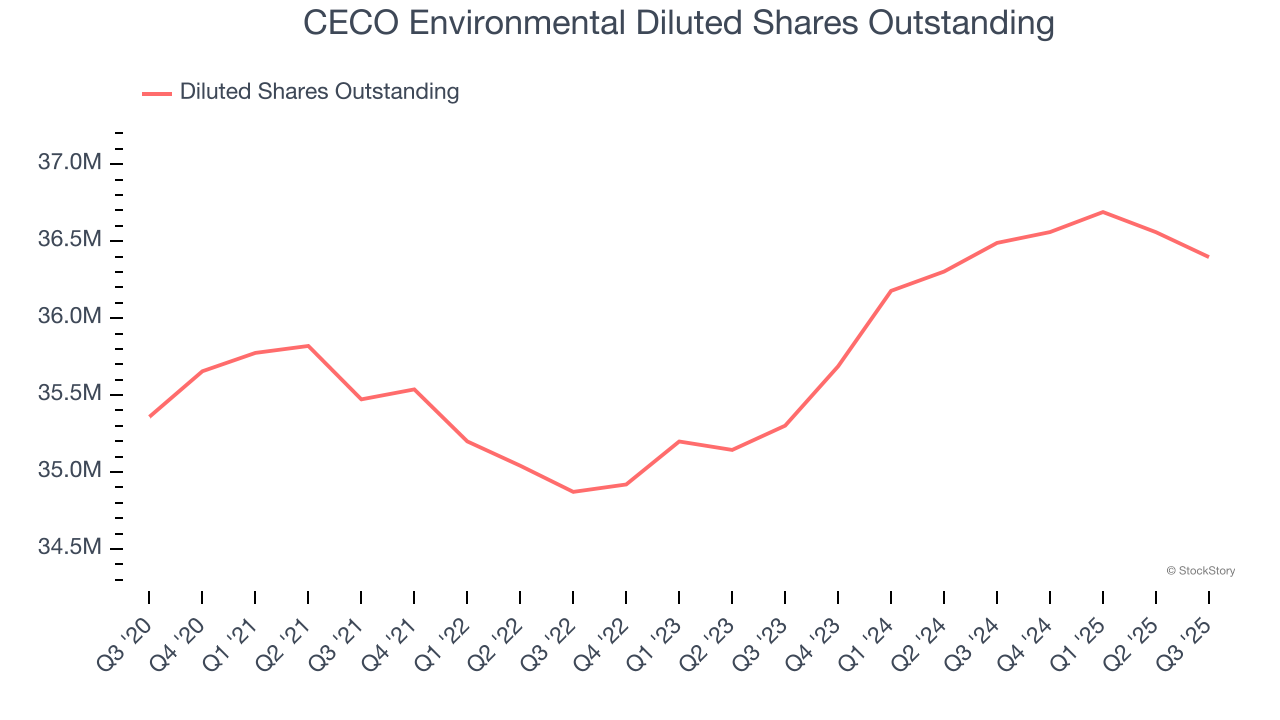

We can take a deeper look into CECO Environmental’s earnings to better understand the drivers of its performance. A five-year view shows CECO Environmental has diluted its shareholders, growing its share count by 2.9%. This dilution overshadowed its increased operational efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For CECO Environmental, its two-year annual EPS growth of 13.1% was higher than its five-year trend. This acceleration made it one of the faster-growing business services companies in recent history.

In Q3, CECO Environmental reported adjusted EPS of $0.26, up from $0.14 in the same quarter last year. This print beat analysts’ estimates by 4%. Over the next 12 months, Wall Street expects CECO Environmental’s full-year EPS of $0.87 to grow 58%.

Key Takeaways from CECO Environmental’s Q3 Results

We enjoyed seeing CECO Environmental beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its full-year 2025 revenue guidance slightly missed. The market seemed to be hoping for more, and the stock traded down 7.2% to $49.51 immediately following the results.

So do we think CECO Environmental is an attractive buy at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.