Over the past six months, AMD has been a great trade, beating the S&P 500 by 15.1%. Its stock price has climbed to $213.97, representing a healthy 24.2% increase. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is it too late to buy AMD? Find out in our full research report, it’s free.

Why Is AMD a Good Business?

Founded in 1969 by a group of former Fairchild semiconductor executives led by Jerry Sanders, Advanced Micro Devices (NASDAQ: AMD) is one of the leading designers of computer processors and graphics chips used in PCs and data centers.

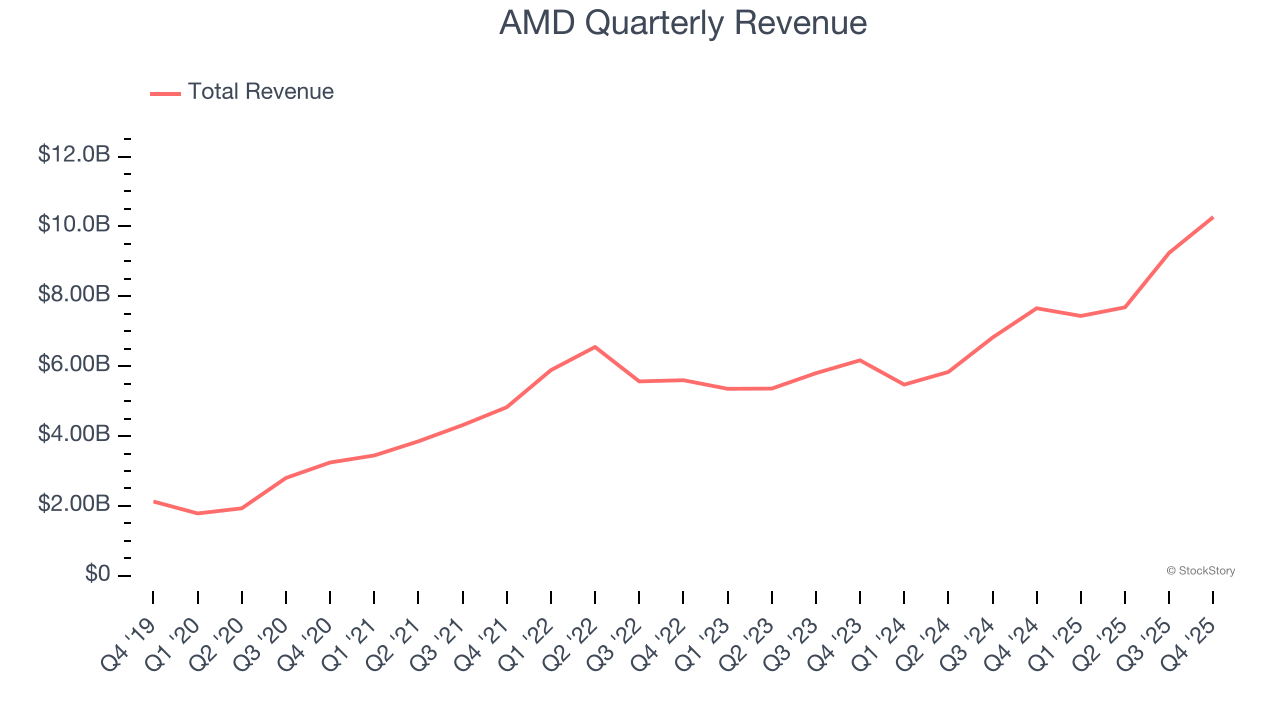

1. Skyrocketing Revenue Shows Strong Momentum

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, AMD’s 28.8% annualized revenue growth over the last five years was incredible. Its growth surpassed the average semiconductor company and shows its offerings resonate with customers. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

2. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect AMD’s revenue to rise by 34.5%, an improvement versus its 28.8% annualized growth for the past five years. This projection is eye-popping for a company of its scale and suggests its newer products and services will spur better top-line performance.

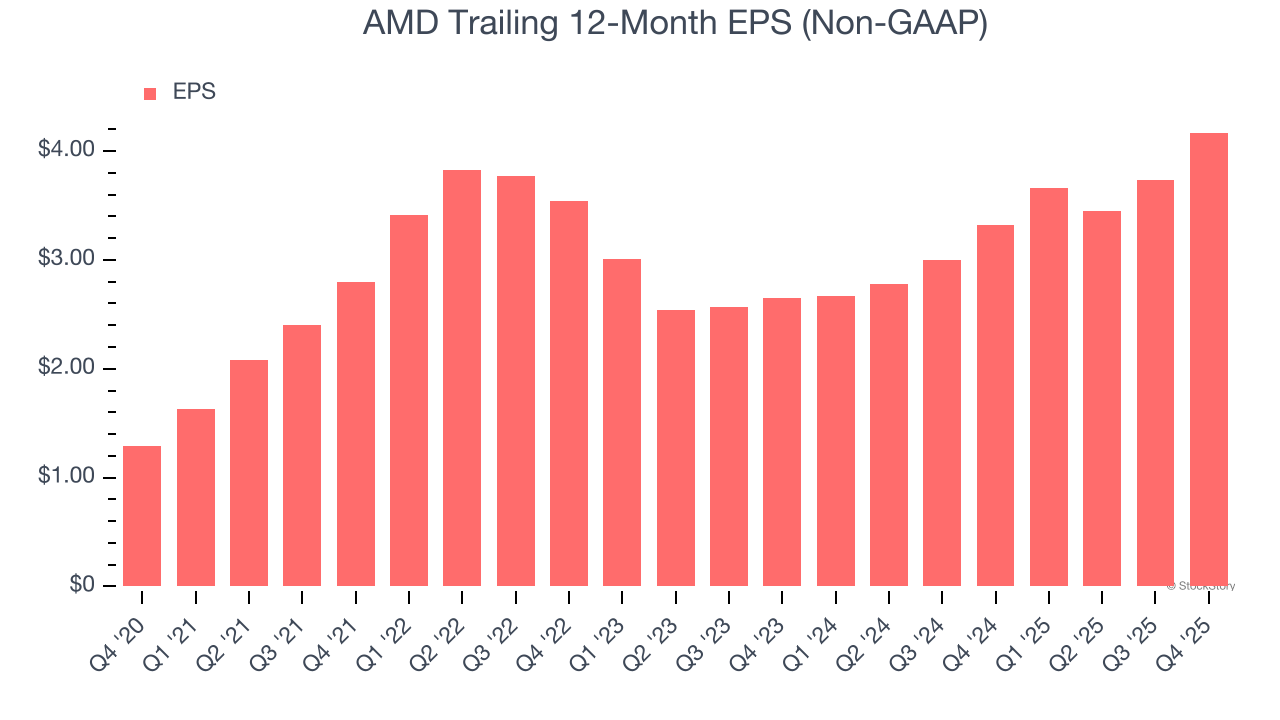

3. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

AMD’s EPS grew at a spectacular 26.4% compounded annual growth rate over the last five years. This performance was better than most semiconductor businesses.

Final Judgment

These are just a few reasons why we think AMD is a high-quality business, and with its shares topping the market in recent months, the stock trades at 32.3× forward P/E (or $213.97 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than AMD

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.