With a market cap of $16.7 billion, Hologic, Inc. (HOLX) is a global medical technology company focused on improving women’s health through the early detection and treatment of disease. It develops and supplies diagnostic assays, medical imaging systems, and surgical solutions across its Diagnostics, Breast Health, GYN Surgical, and Skeletal Health segments.

Shares of the Marlborough, Massachusetts-based company have slightly outperformed the broader market over the past 52 weeks. HOLX stock has increased 16.2% over this time frame, while the broader S&P 500 Index ($SPX) has gained 15.6%. However, the stock has risen marginally on a YTD basis, slightly lagging behind SPX's 1.7% return.

Looking closer, shares of the medical device maker have outpaced the State Street Health Care Select Sector SPDR ETF's (XLV) 6.8% return over the past 52 weeks.

Shares of Hologic fell marginally following its Q1 2026 results on Jan. 29. Adjusted EPS came in at $1.04 and revenue totaled $1.05 billion, both below expectations. Investor sentiment was further pressured by weakness in Diagnostics revenue, margin compression from $15.3 million in tariff-related costs, and the company’s decision not to provide forward guidance due to its pending acquisition by Blackstone and TPG.

For the fiscal year ending in September 2026, analysts expect HOLX’s adjusted EPS to grow 4.9% year-over-year to $4.47. The company's earnings surprise history is mixed. It topped the consensus estimates in three of the last four quarters while missing on another occasion.

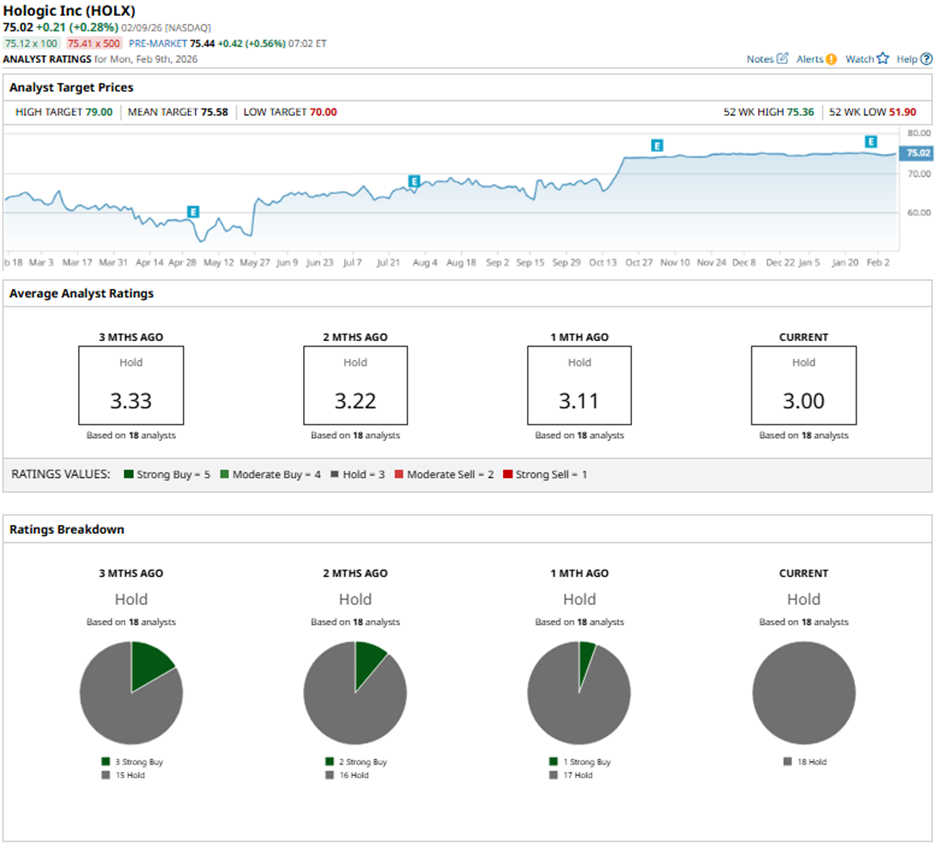

Among the 18 analysts covering the stock, the consensus rating is a “Hold.”

The mean price target of $75.58 represents a marginal premium to HOLX's current price. The Street-high price target of $79 suggests a 5.3% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Hims & Hers Gets Hit With Major Wegovy Loss, Should You Buy the Dip in Deeply Oversold HIMS Stock?

- Can Amazon Stock Defy the Bears and Rise to $300?

- Hungry for Consumer Data? 3 Critical Stocks to Watch Ahead of Earnings on February 11.

- This 1 Little-Known Stock Could Be the Real Winner from the SpaceX-xAI Merger